At the time Buffett began investing in the company, the shares were trading at just a few dollars a share.

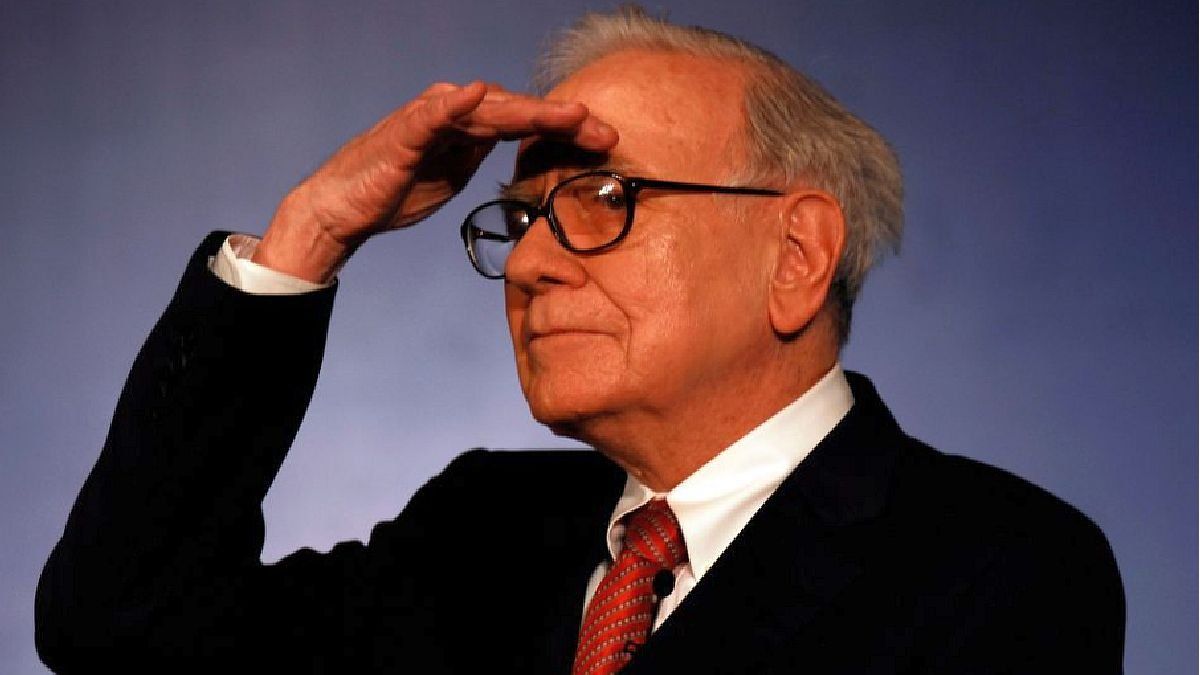

Warren Buffettexecutive director of Berkshire Hathaway, is one of the great investment gurus worldwide. Among the different investment strategies that he took, one of the oldest but still valid is the decision to buy shares of Coca Cola.

The content you want to access is exclusive to subscribers.

Buffett’s investments in the famous soft drink company began in 1988 and since then he has not discontinued his possession of said shares. Berkshire Hathaway currently owns 400 million shares of Coca-Cola.which are valued at US$22 billion and constitute around 8% of the company.

Warren Buffett.jpg

inc.

By the time Buffett began investing in the company, shares were trading just a few dollars a share so at that point, Berkshire Hathaway ended up getting massive gains for that investment. In addition, Coca-Cola issues a dividend worth 44 cents per quarter, thanks to which the company led by Buffett earns almost $1 billion more per year.

Why does Warren Buffett choose these types of stocks?

With the passing of the years and the great growth that the important soft drink company went through, they shed light on the success of having carried out this investment. However, it is unlikely that these actions will give the performance type who took advantage Berkshire Hathaway due to the size of the company today.

markets-shares-finance-investments-alive

But it is possible to deduce what type of investments Buffett chooses. He likes Coca-Cola stocks because, at the time, they had a good price with an interesting competitive advantage. Coca-Cola has almost 50% of the soft drink market in the United States, so as long as they continue to drink soft drinks, the company will continue to do well.

But the second interesting feature is that Coca-Cola creates value, that is, Buffett leans towards “productive assets”, in the sense that they make a product. That trend can be seen in the famed investor’s decision to stay away from cryptocurrencies.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.