Before starting, the investor must know himself. You must identify what type of investor you are and your risk tolerance. You have to define your objective, which, along with the timeframe, are important factors in choosing which types of assets to choose. From your own analysis you will be able to determine if he is conservative, moderate or aggressive and based on that, build a portfolio accordingly.

But you also have to analyze the context and some macroeconomic variables. It is not necessary to be an expert and surely you already consider them when making decisions in daily life. We summarize the most important:

rates in pesos

We are familiar with the 78% rate paid by fixed terms, but the capital market offers other superior alternatives: the LEDES. Discount bills are securities issued by the National Treasury to finance public spending that yield between 83 and 90%, depending on the term.

Why do they pay so much? Precisely, since they are issued by the government and with the fear of a new default or reprofiling present, it must offer a rate high enough to tempt investors. It could be interpreted that this difference over the fixed term is a risk premium.

We believe that for the moment a breach would not be advisable, this being an electoral year. In addition, the Treasury recently managed to defer much of its debt for the next few years (the next term is who has the problem).

clipboard01.jpg

Inflation

Inflation is the sustained and widespread increase in prices for some time in any economy. We know that its main effect is that it corrodes purchasing power. Hence arises the need for any investor to seek alternatives that at least match inflation.

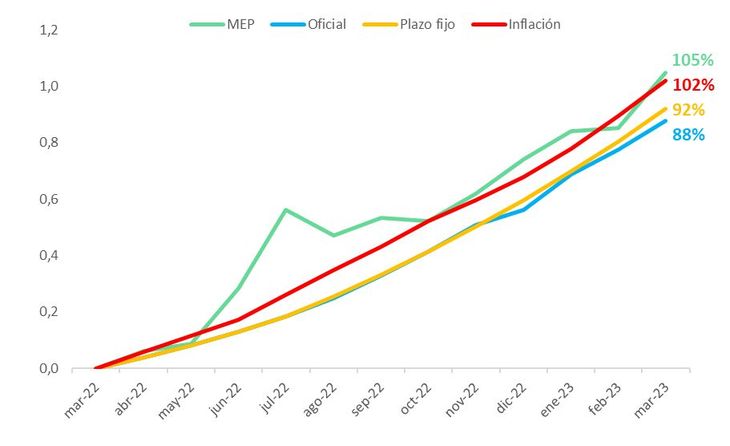

As we can see in the graph, in the last 12 months inflation (red line) was higher than the fixed term rate (yellow line), despite rate increases by the government every time the monthly inflation data came out “bad”.

clipboard02.jpg

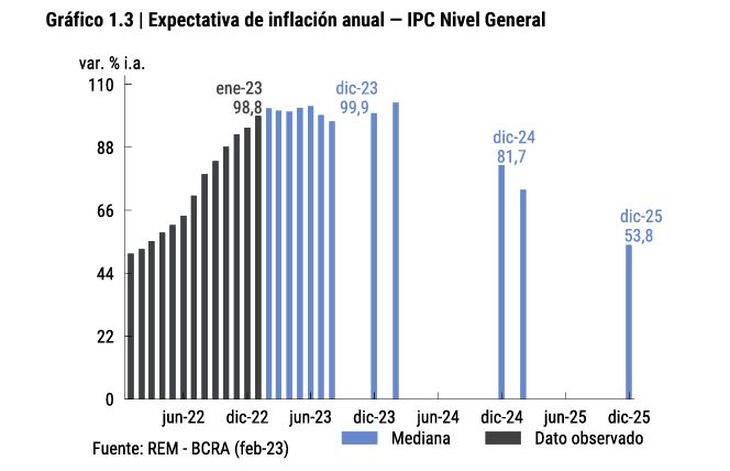

But the past no longer matters, but what comes. The expectations of the investor himself and his heartbeat play an important role. We can see what the market expects taking as a reference the survey of market expectations (REM), which is published monthly by the BCRA. High inflation is expected for the next few months (just falling in 2024). Will the BCRA continue raising the rate in pesos?

clipboard01.jpg

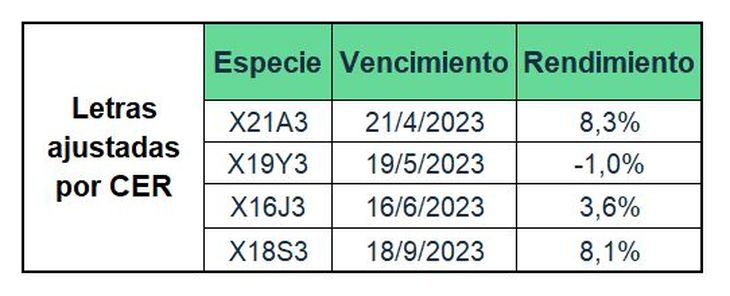

There are alternatives in the market that offer coverage against inflation: LECER and CER and dual bonds, also issued by the government, as well as FCI inflation linked. The first two instruments update capital by the CER coefficient (which measures inflation), therefore, it does not matter how much this variable is. The latter pays inflation or devaluation, whichever is higher.

It is worth clarifying that, given the current context of high inflation, they are in high demand and yield little. They are practically bought as a hedge, without even demanding a premium from the instrument. For example, the Lecer to June pays inflation + 3.6% (in annual terms), while the short ones, for example, to May, yield rates -1%. That is, they are only sued for coverage against inflation, even resigning performance.

clipboard02.jpg

Dollar

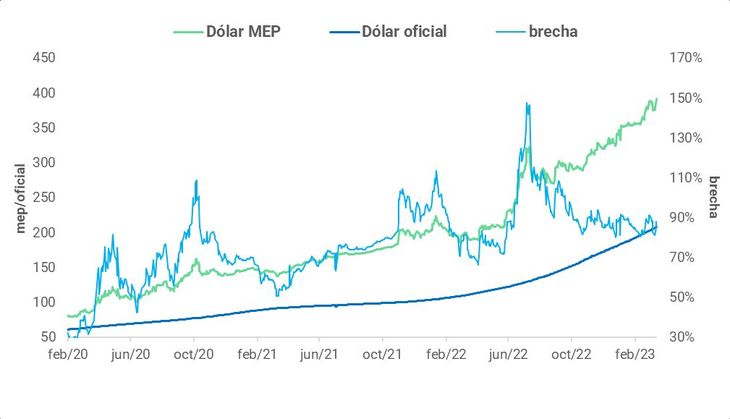

We must distinguish the official dollar from the stock dollar. Most people cannot access to buy the solidarity, while the bag is free, without restrictions or taxes, only parking must be met. Worth $385.

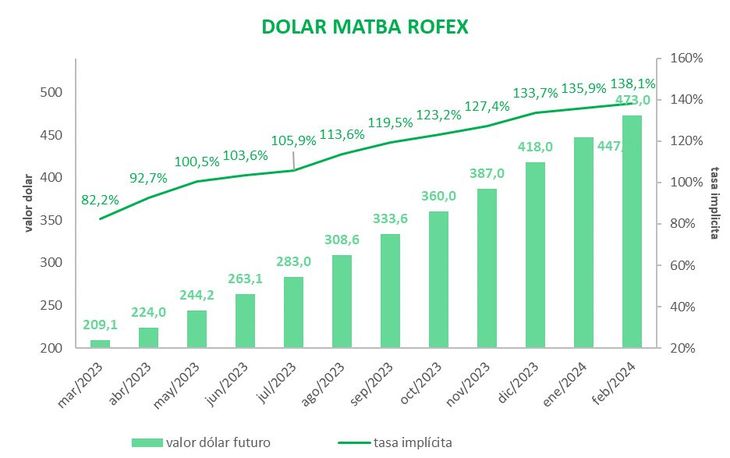

As can be seen in the previous graph, in the last year the MEP rose more than the official one. But again, what is expected? The implicit devaluation rates in dollar futures show that the rate of devaluation for the coming months will increase, with a possible jump in December. Regarding the stock market, many analysts estimate it between $400 and $450, when they consider the monetary base.

clipboard03.jpg

Another way to analyze whether it is expensive or cheap can be by looking at the gap between the official and the MEP (or CCL). Today this gap is at 88%, a level at which the government has stated that it feels comfortable (between 80 and 90%). Currently, the MEP is sustained at these levels by government interventions in the bond market, although it tries to escape daily.

clipboard04.jpg

financial adviser

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.