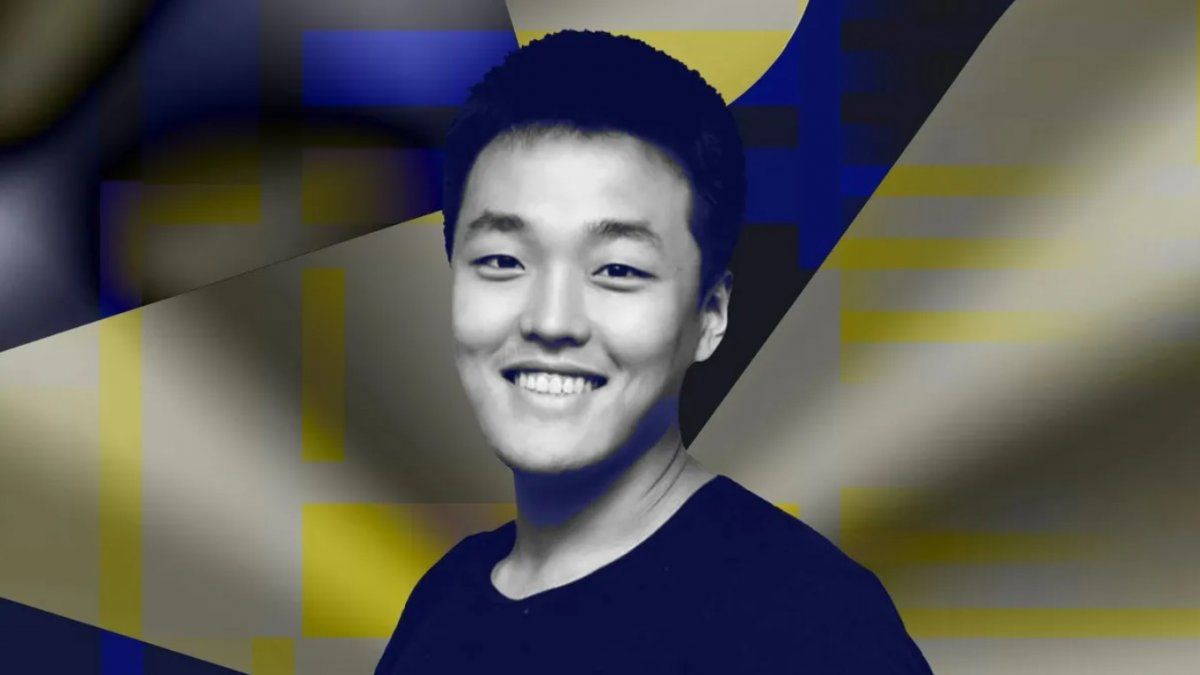

Terraform Labs co-founder, Do Know, faces more than 40 years in prison in South Korea for the financial crimes committed that led to the collapse of the Terra ecosystem and its Terra USD and Luna tokens in May 2022.

In an interview with ‘The Wall Street Journal’, Dan Sung-Han, the main prosecutor in the case, explained that investors would have more options to obtain justice if Kwon is brought to trial in South Korea. According to the prosecutorMost of the evidence and Do Kwon’s main accomplices are related to Terraform Labs and live in the Asian country, where most of the allegedly criminal activities took place.

“Given the nature of this incident, we thought that investigating the case in South Korea would be the most effective way to bring justice. We have obtained a large amount of evidence pertaining to the TerraUSD case, much of which could not have been easily obtained in the United States. Ultimately, it’s about which venue is most effective and which is the best way to deliver justice, and I think the United States is willing to cooperate,” Sung-Han said.

Also, Sung-Han stressed that South Korean prosecutors are committed to locating and securing more assets owned by Kwon and his team so that they can be used to compensate victims. His team has already frozen some 246.8 billion won (about $186.5 million) in South Korean-based assets, including some owned by Kwon.

TERRA.jpg

It should be noted that K.won has been detained in Montenegro since late March, where he faces charges of traveling using forged documents. The crypto entrepreneur’s extradition process will have to wait until the Montenegrin authorities complete their judicial process. Some experts believe it is easier for South Korea to obtain an extradition order for Kwon.

According to the chief prosecutor, Terra’s collapse is a “systemic crime” and has accused Kwon and other partners of making false claims about cryptocurrencies, launching them despite knowing that the algorithms they were based on were not viable and of using “trading bots” to generate false TerraUSD transactions in order to generate false demand for the cryptocurrency and maintain its price levels, among other charges.

Last week, South Korean prosecutors charged seven people, including Terraform co-founder Daniel Shin, with fraud and violation of capital markets laws and regulations on electronic financial transactions and fundraising. Two other people were charged with breach of trust and illegal acceptance of bribes. Shin has alleged that he left Terraform Labs in 2020 and was therefore not involved in Terra’s collapse.

It should be noted that both the Department of Justice and the US Securities and Exchange Commission sued Kwon.

what happened to earth

TerraUSD was an algorithmic stablecoin that worked with its sister coin, Luna, through financial engineering to maintain a value of $1. It lost its peg to the dollar in May 2022 and collapsed along with Luna, triggering a crash that wiped out the savings of thousands of investors around the world.. Terra’s collapse was the first in a long series of bankruptcies of high-profile companies in the ‘crypto’ space such as FTX, Celsius and Three Arrows Capital.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.