The company is offering a bonus to investors who submit bids before the Jan. 19 deadline.

YPF, Argentina’s main energy company that has the State as its main shareholder, issued an offer to buy back some of its dollar bonds due later this year in an attempt to reduce the short-term debt.

The content you want to access is exclusive to subscribers.

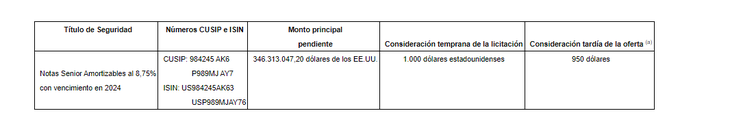

YPF SA, the country’s largest oil producer, said it will pay in cash the $346 million outstanding on bonds that mature in April. The company offers a bonus to investors who submit offers before the January 19 deadline.

ypf1.PNG

The YPF dollar bonds they generated a 30% return last year, the best performance for corporate debt in Latin America after the airline Avianca, according to a Bloomberg index. Bonds maturing in April are trading at around 99.5 cents on the dollar, based on indicative prices compiled by Bloomberg.

The firm hired Citigroup, JPMorgan, Santander, Banco Santander Argentina and Banco Galicia to complete the transaction. Offer expires February 5.

The news was known last Friday where it was also reported that they will issue $1 billion of a guaranteed bond in 2031 with a coupon of 8.75%. In this sense, Adcap Grupo Financiero highlights that “the market expectations are reasonable since YPFDAR 26 with a similar structure had a excellent performance.”

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.