Currently, there are many options available, in pesos and dollars. We will focus on foreign currency issues. We have available papers from different sectors: real estate, energy, oil, consumption, field, telecommunications.

Some pay in MEP dollars, while others in cable dollars (which can later be transferred abroad). We have titles with local and foreign legislation. They generally pay good annual interest and this payment can be quarterly or semi-annually. The capital can be returned at maturity or in installments. They can be bought with pesos or with dollars.

The implicit risk in the ONs is that the BCRA adjusts the stocks and no longer gives companies the necessary dollars to pay their maturities. Currently, companies have access to the MULC for up to 40% of the maturities, having to restructure the remaining 60%. At the moment, this is not a problem for the investing public, since through this refinancing they obtain another paper with similar characteristics (similar term, annual coupon, etc.).

It is always better to build a diversified portfolio to reduce risk. In this case, it is suggested to invest in several companies from different sectors, so that the risks are offset. Among the most interesting alternatives we have:

download.png

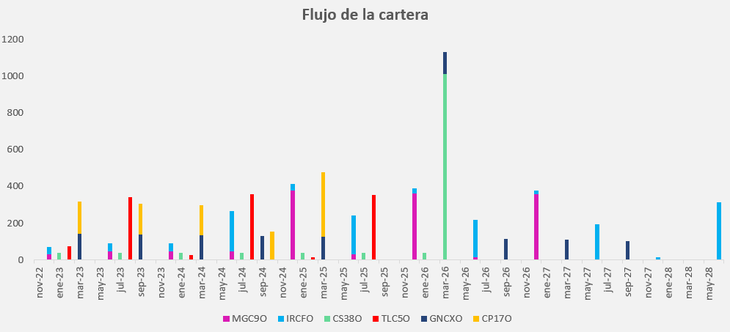

Assuming that we put together a portfolio with 1,000 nominals of each one (assuming an initial investment of USD 6,200), we will have the following projected cash flow:

download (1).png

A diversified portfolio can also be achieved through mutual funds. They are more appropriate for the retail investor, since the minimum investment amounts are very low. And in this group we find various types, local corporate, Latam corporate. The advantage of the FCIs is that they are managed by professionals, who seek the highest performance, so that the active management of the portfolio is delegated. The downside, for some, is that the investor does not receive the dollars from the ONs’ coupons, since they are received by the FCI, who reinvests them. Another difference with respect to ONs: in an FCI we do not know the performance in advance, since it depends on the difference between the subscription price and the redemption price of the shares.

Finally, and for those who take more risk, we have the Cedears, which operate in pesos and dollars. They are certificates of deposits of foreign companies. Like all variable income, its return is uncertain and will depend on the sale price versus the purchase price. The advantage of Cedears is that they allow access to leading US companies, avoiding or reducing Argentine risk, since it is betting on international markets. Many Cedears usually pay dividends (in cable dollars). We prefer value stocks or those that pay high dividends.

It is worth clarifying that in the local market all the instruments are quoted at the stock market dollar, with which, whoever wants to be covered can invest in any option (bonds, shares, cedears, ONs). For reasons of space, we limit ourselves to the three alternatives mentioned for investors with a moderate risk profile.

Financial advisor.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.