The prices of the American bonds are suffering falls for fear of inflation. The flip side of this is that implicit rates started to rise.

Let’s look at the chart of the 10-year US rate:

tasas bogiano.jpg

In the midst of the Covid crisis, the rate approached 0 and now the situation seems to be changing. In early 2021 it climbed sharply and, after a recent slowdown, resumed its bullish path.

Federal Reserve

The Federal Reserve is closely monitoring economic indicators to see when it could begin to tighten monetary policy.

It is known that in November the call will begin tapering (the progressive slowdown in monetary injection). The Fed currently purchases bonds for u $ s120,000 million per month and this figure will be reduced, although it is not yet known in how long.

The market, which seeks to anticipate, is already in bond seller mode, knowing that on the other side of the counter, the most important player will slowly disappear. This effect is the seasoning for the rate to prepare for a considerable escalation. What we saw these days may just be the beginning.

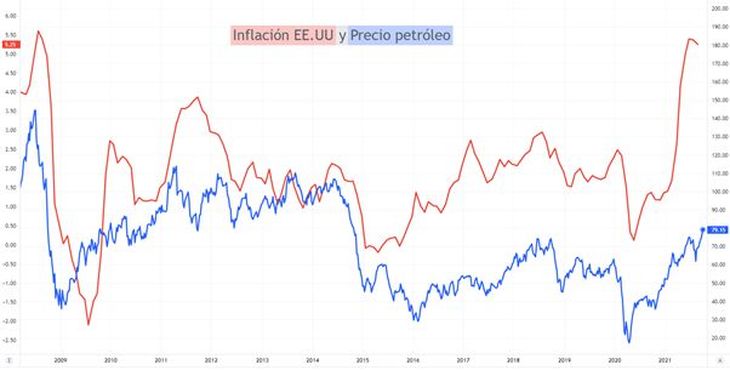

Oil and inflation

Nor can the Fed ignore the energy crisis the world is going through. Begin to stop being “dovish”(lax policy, low rates) to get into mode “hawkish” (restrictive policy, rate hike) is a major challenge in the midst of this conflict.

This is due to the effects generated by the rise in oil on the economy, which has gone from US $ 62 to US $ 79 in just over two months. Why does this rise affect? Because Oil is a fundamental input in the economy and, if it increases, costs become more expensive and puts upward pressure on inflation.

Look at the correlation between US inflation (left axis) and oil price (right axis):

tasas bogiano 2.jpg

So the Fed is at a difficult exit crossroads. As long as inflation continues to rise, the pressures for a rate hike will not cease. AND This rise could aggravate the situation, making economic recovery even more difficult.

It is known that a rate hike It is not friendly to the stock market, especially the technological ones. Why is this happening?

Companies are valued not by what they generate or generated, but by their future expectation. That is why future flows are projected and discounted to arrive at a certain price. By raising the rate, the discount is greater, so it has a negative influence on the price.

This effect is most clearly seen in growth companies (growth), since its main value derives from future flows. Different is the case of value companies (value), which would suffer to a lesser extent from a rate hike.

Another factor to take into account when evaluating the possible consequences of actions is the attractive that they begin to have the bonuses. These, when suffering falls, begin to have higher yields, so it is a disincentive to continue betting on stocks.

If the interest rate reaches the levels of 2018, where it reached 3%, the situation would be very different from the current one. And those values are not at all unreasonable considering inflation in the US (the highest in the last 13 years) and tapering. Returns of 3% would dump investors into the bond market (safe market), getting out of risk equity (uncertain market).

conclusion

The injection of liquidity was the one that caused the big rise in the stock market, although now the situation is totally different.

The rise in inflation is not to underestimate and we will have to be attentive to the position taken by the Fed regarding stimuli and the rate.

The bond market is already anticipating what may happen. That is why stock investors have to be very cautious.

At this time It is high risk to be positioned in technology stocks and especially in bonds. I have spoken countless times about risk in the global debt market. Having bonds in an investment portfolio today is of maximum risk and could suffer, in the future, very large losses.

To finish, I want to invite you to download a free report that I prepared so that you can face the next crisis and know how to beat the market. I honestly think that it will serve you a lot, it does not have waste. You can download it at this link of Financial Letter.