Boggiano 1.jpg

As you can see, the slowdown in recent months has slowed and the jump was abrupt. It is worth clarifying that, despite the fact that it had been going down, the numbers were not pleasant at all.

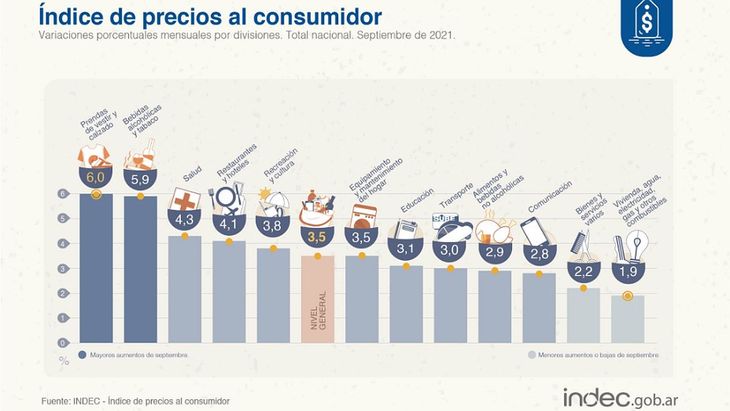

The main increases were in the clothing, alcoholic beverages and health sectors, as can be seen below:

Boggiano 2.jpg

I do not want to fail to mention the context in which such a rise occurs. Bear in mind that we are with regulated rates, price freezes and an infernal exchange rate delay.

The ball of monetary issue and frozen prices that is being generated is extremely dangerous and the repressed inflation is not to be underestimated.

Government measures

Faced with these numbers, the government took action on the matter and summoned the main supermarkets to determine the list of items they will seek to freeze.

Roberto Feletti, the new Secretary of Commerce, drew up a list with more than 1000 products that will be frozen. More premium brands were included compared to other occasions, in which the cheaper ones had a greater preponderance.

This news was not well received by the businessmen, who will also seek to reach an agreement, despite criticism of the initiative. Feletti, for his part, warned that, in the event of not reaching an agreement, he will apply the supply and maximum prices law.

As is known, this “solution” will be a new patch that will not solve the scourge of inflation. The government continues to be wrapped up in the same old recipes and they hold the entrepreneurs responsible for the advance in prices, ignoring the nature of the problem. To top it all, the monetary issue will not take any break.

Dollar

Although the Central Bank had a positive week and was able to buy more than USD 300M, the “free” dollar has accelerated its rise and it is feared that the worst has not yet begun.

This acceleration took place after the new regulations they imposed were known, in which they further limited the operation with local legislation bonds. That is why the dollar Counted with Settlement of local bonds has a reduced price (and accessible to a few), close to $ 178.

On the other hand, the truly free dollar, using the bonds of foreign legislation (or Galician shares) is at $ 194.

As is known, each new regulation generates new distortions, new gaps and fewer incentives to develop the local market. And in addition, they are patches that do not attack the main problem, so the dollar, in the long term, will continue to rise.

Blue, another of the “free” dollars, although from an unregulated market, also continued its bullish trend and is already trading at $ 187 per unit.

High inflation and the rise of the dollar are hot topics that will always be present in our day to day.

These scourges are not born from a cabbage nor are they the responsibility of the private sector, as the government seems to want to demonstrate. They are nothing more than a reflection of the Argentine economic reality: abysmal and eternal deficit, financed with monetary issuance, added to restrictions on imports, stocks and unpayable taxes.

Finally, I want to invite you to download a free report that I prepared so you can face the next crisis and know how to beat the market. I honestly think that it will serve you a lot, it does not have waste. You can download it at this link: https://cartafinanciera.clickfunnels.com/landing-funnel-duplicar-capital-cash?utm_medium=referral&utm_source=ambito&utm_campaign=funnel-duplicar-crash&utm_term=dolar_18_10_21&dolarm_content_18_10_21&dolarm_content_18_10_21&dolarm_content_18_10_21

CEO of Carta Financiera