The challenge for the market remains to understand how the inflation rate may evolve, what will happen with the supply and demand of dollars and, based on this data, when progress can be made towards exchange rate unification, the last pending stage of the economic program.

The reduction of 10 points in the tax rate Country Tax It should be analyzed in this light. It seeks to lower the price of imported products, but in the meantime the opportunity arose to make the announcement in advance. This helped to postpone the impact of the fiscal cost of the measure and at the same time helped the BCRA to recover reserves in a period in which it was facing the sale of foreign currency.

image.png

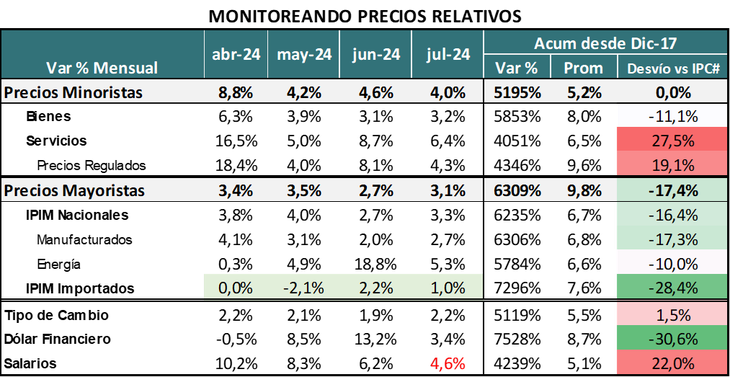

The diagnosis is clear: The prices of imported products, affected by difficulties in accessing the foreign exchange market, deferred payment and a 17.5% country tax rate, have been evolving in recent years clearly above the average level of the rest of the prices. If we take as a basis the prices of December 2017 (prior to the start of exchange rate volatility), the average price of imported products is 27% above the evolution of the official dollar (adjusted by tax rate) and aligned with the evolution of the financial dollar (CCL).

It is within this framework that the official decision to move forward with the reduction of the tax must be understood, even though it is known to have a high fiscal cost and that it lowers the implicit real exchange rate of imported products, making them cheaper.

It is a process of readjustment of relative prices in which efforts are being made to lower the prices that are more “advanced.”

image.png

The other price that appears to be ahead with this approach is the financial dollar. On the other hand, the “lagging” prices are mainly seen in wages and services.

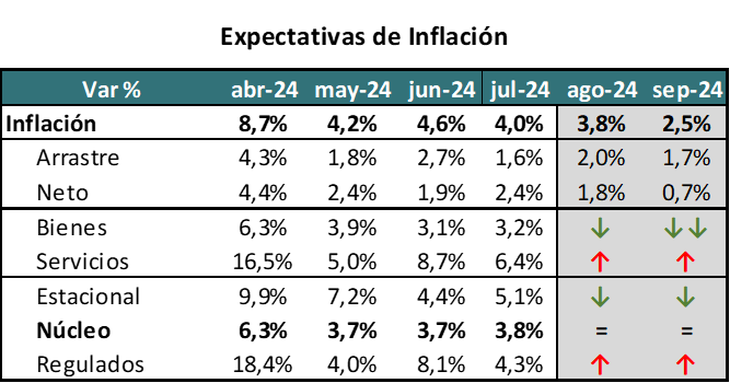

What to expect from inflation in August-September?

Core inflation has been at a minimum level of 3.7%/3.8% per month for the past three months and has been struggling to break through. In August and September, two relevant data points have been added that may have an influence and help break through this minimum level.

The first is the aforementioned effect of the reduction in the rate of the country tax. This will take effect in September, but it has been present in the price formation process since the end of June. It hardly implies a shock impact on prices, but it certainly lowers the expectation of an increase in items with a high impact on expectations such as household appliances, cars, motorcycles, telephones, etc.

The second factor is equally important and is the positive side of a negative shock. The fall in commodity prices strongly affects the supply of foreign currency, but takes pressure off food prices. Since it affects soybeans, wheat and corn, it should generate falls in prices such as flour, baked goods, oils and meats (due to the cost of fattening). In the last 4 months, the average price of grains (soybeans-corn-wheat) fell 12%.

Taking these factors into account, we are expecting inflation figures of just under 4% for August, but a price increase for September that, with these variables, could be below 3% per month for the first time.

image.png

How does it impact the market?

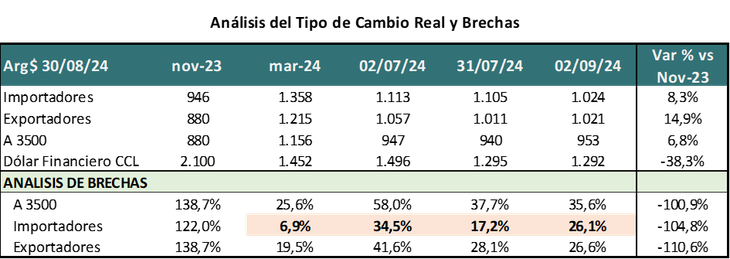

In short, the reduction of the country tax is a measure designed to reduce inflationary pressure on certain products and may be successful in that objective. But this success will depend largely on how it impacts the market, especially on the level of the exchange rate gap, the other factor that has had a negative impact on the process of setting prices for imported products.

If progress continues to be made in increasing access to the exchange market for importers, the impact of the financial dollar must decrease, but for that to happen the gap must remain contained.

This is where incentives for exporters and importers come into play. With the new country tax rate, exporters will operate with a higher effective exchange rate (Blend) than importers.And the gap between the official exchange rate and the financial dollar for importers is moving away from its lowest levels, returning to the 25/30% range.

image.png

This implies that the extra cost of paying for imports in financial dollars increases and therefore the incentive to pay in the official dollar (now in 60 days) and not in financial dollars increases. Therefore, It is a measure that generates more pressure on the official dollar and relieves it on the financial dollar. In this case, the challenge is to prevent this from leading to reserve losses on the part of the BCRA, and the key here is to find the factors that can help offset this flow. This list includes income from money laundering and investments that may begin to enter via RIGI. In any case, the net impact of this process is difficult to quantify.

The last point that comes into play is the elasticity of the price of imports. That is, given the lower price (due to lower taxes), how much will the quantities demanded increase?

In short, we are faced with a measure that seeks to lower the prices of imported products, which are currently the most expensive in relative terms to other goods and services. If successful, it may attenuate the demand for dollars in the financial market, but this implies that more imports are paid for in official dollars.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.