Hardly anyone in Martorell is thinking of Seat these days, because in the brand headquarters half an hour away from Barcelona, the art brand Cupra has long played the first violin with its models worth seeing. This is truer than ever if Cupra goes fully electric by 2030.

The Volkswagen Group is fully committed to electromobility. The individual brands feel this in their own ways. Seat is particularly hard hit, because the traditional Spanish manufacturer has long since been overtaken by the once sporty Cupra offshoot. The question remains whether Seat will still exist in the long term or whether Cupra alone should mime the Spanish conqueror in the medium term. The best way to see it is with the first electric model. The compact Born was originally planned as a Seat. But when the much more stylish twin of the VW ID.3 rolls over the road, the Cupra signet adorns the radiator grille and other design elements. Cupra was once only known to die-hard car fans, because those vehicles were no less than sports versions of the otherwise tame northern Spaniards. On the other hand, corner chasers like the Seat Leon Cupra or Ibiza Cupra put everyone in a good mood and had a lot of steam for it. In the meantime, the northern Spanish GTI counterpart has risen with the benevolence of the Wolfsburg group managers to become an independent electric brand. When a Seat is awarded a plug, there’s also the new logo, reminiscent of tennis star Rafael Nadal’s Nike sports collection. But the Spanish serial winner has not been under contract with Seat for years, but with the Korean competitor Kia.

But that’s not why Seat in the Volkswagen Group has been in a stiff wind for a long time. The group management under Herbert Diess would have liked to have sold Seat years ago, but since there were no tasty offers from abroad and no worthwhile inquiries came from China in particular, one had to deal with unsatisfactory figures. Since the art brand Cupra was created under the former CEO Luca de Meo, the traditional Spanish manufacturer, which officially operates under the name Seat SA, has been concerned with nothing less than bare survival. The future seems to belong solely to the Cupra brand, because as soon as a new model rolls onto the market, it’s called Cupra and not Seat. “The sustainable future viability of our company is very closely related to the growth of Cupra,” Wayne Griffiths, Chairman of the Board of SEAT SA and CEO of Cupra, makes no secret of his preference, “we see our new brand as a lever to increase profitability, and we we have to use all our skills to keep it growing.”

The past year 2021 was difficult compared to many competitors. Impacted by the ongoing pandemic and the semiconductor crisis, Seat SA sold 470,500 vehicles worldwide – an increase of 10.3 percent compared to 2020. In addition, sales of electric and plug-in hybrid vehicles quadrupled last year from 14,700 to 60,600 cars. Cupra even tripled its sales, reaching a volume of 79,300 vehicles thanks in particular to the Formentor. More than 40 percent of Cupra sales were electrified vehicles, but hardly any electric models because the launch of the former Seat El Born was delayed several times. The shortage of semiconductors led to a massive drop in production volume and had a negative impact on both sales and the operating result, so after a minus of 418 million euros in 2020 there was another minus of 371 million euros. “2021 was not the year we had hoped for,” recalls Wayne Griffiths, “after stubbornly fighting the effects of the Covid-19 crisis, our work was severely affected by the semiconductor shortage. Demand for Seat and Cupra products has returned to pre-pandemic levels, so the shortage of semiconductors is causing frustration among our customers due to long delivery times.”

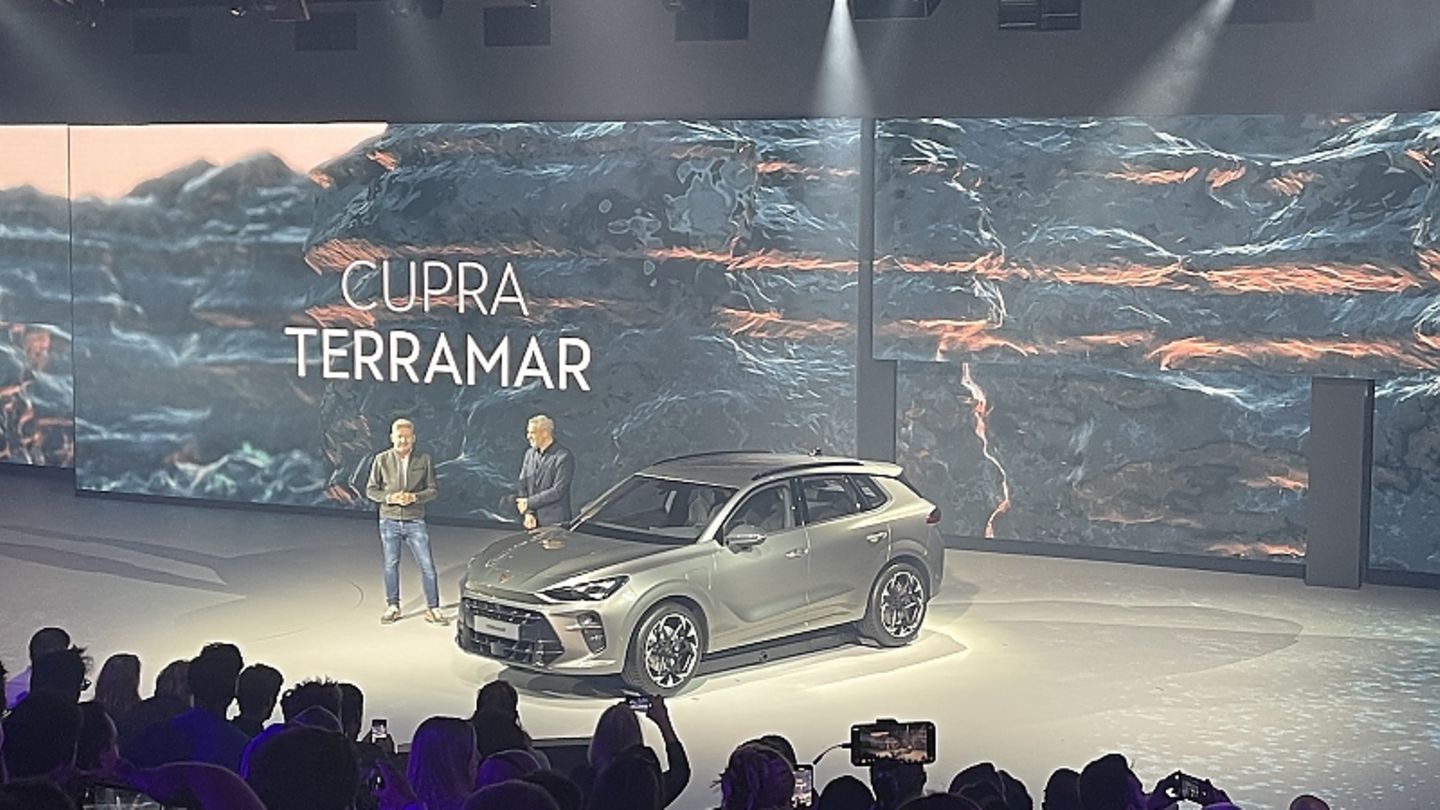

And it will still be some time before a new Cupra model, the Terramar, will come onto the market in 2024: an electrified 4.50 meter SUV with a mild and plug-in hybrid drive that is to be produced in Györ, Hungary. With an electric range of 100 kilometers, it should make people want plug-in hybrid vehicles if it’s not too late by then due to canceled subsidies. The crossover is one of four new models that are intended to expand the Cupra portfolio in terms of volume and earnings. The Tavascan, as a dynamic twin of the VW ID.4 / ID.5, should also be exciting at the end of 2024.

An electric city model called Urban Rebel is to follow in 2025 – again as a 4.03 meter long Cupra and on the new electric platform with front-wheel drive. The sports version has an output of 166 kW / 226 hp and should be limited to 180 km/h. Depending on the battery pack, the electric range is between 320 and 440 kilometers. This year Cupra wants to double its sales, its sales network and its turnover to five billion euros. But unlike Seat, which has been selling most of its vehicles in Germany, Spain and the former euro state Great Britain for years, the Cupra offshoot has bigger things in mind – including expansion to Australia. “Australia is a young market and a young brand like Cupra fits in perfectly. Consumers in Australia are looking for new brands and the disposable income of the middle class is relatively high. We are convinced that Cupra can be successful here,” Griffiths said hopefully. Years ago, a short-term market launch by Seat in China had become a non-starter despite hopeful forecasts. Since then, the Spaniards have concentrated on Europe – including England. In addition to models from Seat and Cupra, the main plant in Martorell also currently produces the Audi A1, which will not have a successor. But the shortage of semiconductors put a lot of pressure on the numbers here, too, and so production in 2021 was only around 70 percent utilized.

One looks in vain for new models that promise large volumes and corresponding yields, because the important new products all bear the Cupra signet. Even more important: not only Wayne Griffith, but also the Spanish-leaning CEO Herbert Diess prefers Cupra without any hesitation. Mexico is already on the way, Australia is set to follow, and a young, cheeky brand with a lot of energy and a power stretch at the end of the decade can also be imagined for regions in Asia or South and North America. In addition to new vehicles, the Spanish VW group brand should also be about electric mobility of the future. A battery cell factory that is second to none is planned near Valencia. “This project is of the utmost importance – for Volkswagen, for Spain and for all of Europe. It is our goal to electrify Spain and we are willing, together with external suppliers, to invest more than seven billion euros in the electrification of our plants in Martorell and Pamplona and in locating the value chain of electric battery production in Valencia,” explained Thomas Schmall, Chief Technology Officer and Chairman of the Supervisory Board of Seat SA. Here, the Volkswagen Group is aiming for a production capacity of 40 GWh per year and wants to employ more than 3,000 people in Valencia. It should start in 2026. “In Valencia we will set up nothing less than next-generation cell production: a standardized factory in which the ultra-modern Volkswagen unit cell will roll off the assembly line,” adds Thomas Schmall, “at the same time it should be supplied with renewable energy to ensure sustainable battery production to allow. With a financial volume of seven billion euros, this is the largest single industrial investment in the history of Spain.

Source: Stern

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.