The German federal government wants to significantly reduce subsidies for electrified vehicles. This is likely to be a problem, especially for the plug-in hybrids that have been so popular recently. These could get under the wheels in a similar way as is currently the case in Great Britain.

In general, things are not looking good on most European car markets at the moment. The chip crisis and the Ukraine war are still having an impact on the entire economic cycle and this is having a major impact on the international car markets. It is therefore not surprising that the German passenger car market once again lost significant volume in June compared to the previous year. Compared to June 2021, the market lost 18.1 percent and ended up with a registration level of 224,558 vehicles. It can be assumed that this continuing trend will also have a negative impact on the car market due to persistently high inflation and the resulting falling real income.

The effects on the fleet market, which is so important in Germany, are manageable, because here the minus of 5.8 percent compared to 2021 is limited, while the private car market fell by 11.6 percent. Own registrations and rental cars are still under pressure with losses of 32.5 and 41.5 percent. The development of drive types in June breaks with the trends of the past few months. Diesel registrations fell by 19 percent for the first time since February 2021, less than those of petrol engines by 22 percent. The situation for fully electric vehicles also did not look good in June due to a lack of delivery options in June. Electric cars lost four percent, while they were still able to show double-digit growth rates in the first quarter of 2022. The plug-in hybrids are coming under increasing pressure; they fell by 16 percent.

Things looked even worse in Great Britain. The British car market lost almost 25 percent in June 2022. With just 140,948 newly registered cars, almost 50,000 cars are missing from the previous year’s volume of 186,128 units. This is the month’s weakest reading since 1996 and even lower than June 2020, when the coronavirus pandemic was in full swing. While electric cars gained 14.6 percent, plug-in hybrids lost 36.5 percent and hybrids lost 7.3 percent. A similar picture would soon be possible in Germany, because without the corresponding subsidies, the market for plug-in hybrids is likely to lose significantly. Unlike in the USA, normal hybrids do not play a significant role in the short or medium term anyway. If the hybrid models continue to come under pressure, it is conceivable that such vehicles will be pushed into the unloved rental vehicle market in order to cushion capacities. In Germany, the proportion of plug-in hybrids was just under twelve percent, while electric cars scratch the 15 percent mark. The currently best-selling electric car on the German market: the Fiat 500 Elektro. In Europe, the E-500 is in third place.

For many customers, plug-in hybrids are not love marriages. However, because these are only taxed at 50 percent and there are also significant purchase subsidies of over 5,000 euros in some cases, many customers have switched from petrol or diesel models to a vehicle with a plug in recent years. At the same time, many drivers do not take the opportunity to charge the vehicle electrically and thus drive locally emission-free and particularly economically, especially in the inner city area. After brands such as Mercedes or BMW have relied heavily on plug-in hybrids in recent years, most manufacturers are now reducing their commitment to partially electric vehicles and are concentrating on purely electric cars, despite longer ranges.

The best example is BMW. The Bavarian brand sold a total of 75,891 fully electric vehicles worldwide in the first half of the year, more than doubling its electric share compared to the same period last year. “Despite a very challenging environment, we were able to more than double sales of fully electric vehicles worldwide in the first half of the year,” says BMW Board Member for Sales Pieter Nota. BMW intends to more than double its sales of fully electric vehicles by the end of the year compared to the previous year. Britta Seeger, Chief Sales Officer at Mercedes: “Sales of our all-electric vehicles increased by more than 90 percent in the second quarter and by as much as 134 percent in the first half of the year. This clearly shows how convincing our range of fascinating electric vehicles is.”

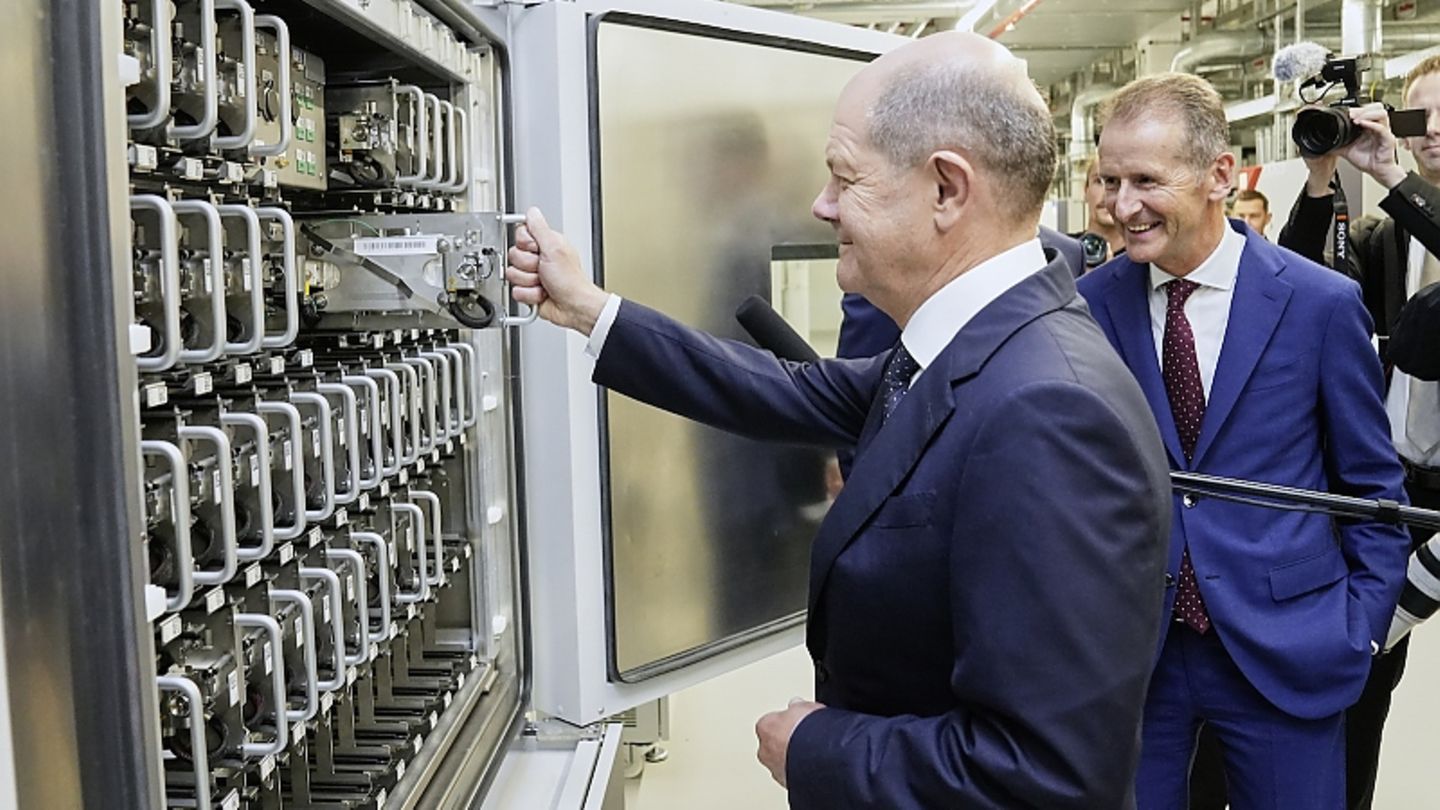

Volkswagen recently laid the foundation stone for a new battery plant in Salzgitter, which will produce cells for electric cars from 2025. In addition to cell production, the newly formed company PowerCo will be responsible for activities along the entire battery value chain. By 2030, together with partners, more than 20 billion euros are to be invested in the development of the business area and annual sales of over 20 billion euros are to be generated. It can be assumed that the currently high German electrical subsidies of over 9,000 euros, in contrast to the annual greenhouse gas quotas of more than 400 euros in some cases, will come under pressure. However, the demand for electric cars is not only likely to make itself felt in the European car markets as a result of the EU Commission’s recent decisions on the ban on combustion engines. Hard times for the hybrid models?

Source: Stern

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.