The chip crisis was just the prelude. Behind the scenes, the battle for raw materials that are important for battery production is raging unabated. A dependency would be fatal, especially for German car manufacturers. The way out of this dilemma could be a concept that Tesla practices.

The Ukraine and Corona crises have clearly shown how volatile the supply chains of the automotive industry are. The desperate search for semiconductors and production sites for wire harnesses has sidelined another major problem that continues to loom like a monstrous thunderstorm on the e-mobility horizon. It’s about the batteries, those components in the car that are full of valuable raw materials, including the so-called “rare earths” and the question of how supplies can be guaranteed.

How fragile the entire supply of these components is can be seen from the costs. In the last nine years, battery prices have only gone in one direction: down. Now, battery pack prices have risen for the first time since 2013. The trend could intensify. “Environmental, social and governance concerns, increased regulation and governments’ desire to localize battery production are adding pressure on already stretched global supply chains. All of these factors lead to potential bottlenecks that affect production,” explains Alexander Krug from the management consultancy Arthur D. Little.

A solution is needed. The federal government has set a target for at least 15 million electric cars to be on German roads by 2030. Even if this number is very optimistic, the number of electric vehicles will increase significantly by the end of the decade. Europe and worldwide. Analysts expect global battery production to increase 14-fold between 2018 and 2030. To quench this thirst for batteries, gigafactories are springing up all over the world. If all projects are implemented, battery production capacity in Europe is expected to reach more than 1,100 gigawatt hours by 2030. And that’s certainly not the end of the line.

It is obvious that this number of energy storage devices requires a large amount of raw materials, which are already scarce. The consequences if battery production falters because not all the elements are available would be fatal and would cause such immense damage to the car manufacturers that the effects of the semiconductor and wiring harness crises seem almost silly. The battle for raw materials has already begun. China has already positioned itself in the fight for the coveted battery ingredients and has secured important mining rights in Africa. One thing is clear: as soon as mobility and economic prosperity are at stake, everyone is on their own. It’s no different in Washington than in Beijing.

Being dependent on one supplier can have fatal consequences in this mixed situation. When the political climate turns chilly, the ice age breaks out in the automakers’ factories. A report by the Federal Institute for Geosciences and Natural Resources (BGR) shows how explosive the situation is, in which the “potentially critical raw materials” are listed: “The raw materials with high price and supply risks include, for example, rare earths, germanium, platinum metals and Gallium.” The consequences of the current Chinese dominance are also clearly stated. “Due to the high concentration of supply, market power can be exercised by dominant providers. This can lead to disadvantages for Germany as a production location.”

Being dependent on one supplier can have fatal consequences in this mixed situation. When the political climate turns chilly, the ice age breaks out in the automakers’ factories. A report by the Federal Institute for Geosciences and Natural Resources (BGR) shows how explosive the situation is, in which the “potentially critical raw materials” are listed: “The raw materials with high price and supply risks include, for example, rare earths, germanium, platinum metals and Gallium.” The consequences of the current Chinese dominance are also clearly stated. “Due to the high concentration of supply, market power can be exercised by dominant providers. This can lead to disadvantages for Germany as a production location.”

The resilience of German battery production has to be almost self-sufficient if it is to have the desired effect.

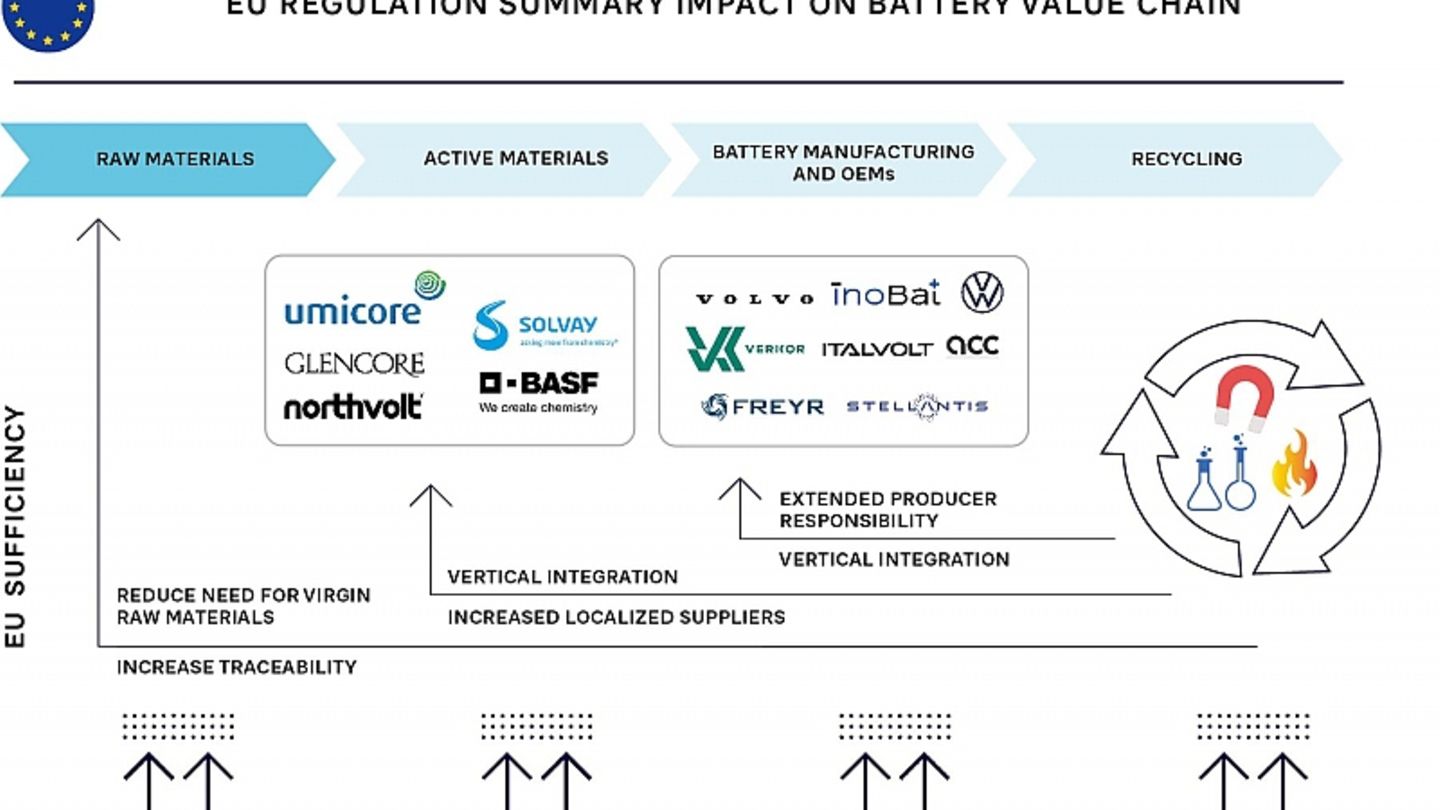

“The basis is valid forecasts that take into account various scenarios in order to control investments in such a way that the supply for production is guaranteed,” explains Alexander Krug, who also recommends a catalog of measures based on vertical integration, one strategy , which Tesla was already pursuing when it was not yet en vogue and people still believed in the crisis resilience of the supply chains.

Basically, that means nothing more than taking your fate into your own hands: i.e. developing and producing the batteries and semiconductors yourself, finding suppliers who cover as large an area of the value chain as possible, right down to mining licenses. Strategically smart partnerships such as VW, which have teamed up with the battery specialists QuantumScape and the battery producers Northvolt, are also important. Then the raw materials should come from areas that are as conflict-free as possible. BMW and Ganfeng want to work together to extract lithium in a sustainable way in Australia.

In general, long-term cooperation is a way to make the value chain more stable in the future. “Volatility and uncertainty require continuous synchronization of strategic, tactical and operational plans between all partners in the extended supply chain and the company’s internal organizational units,” said Krug. This close cooperation also results in the flexibility to be able to react quickly to changing situations. However, the question is whether this openness towards the suppliers is well received by the German automobile manufacturers, who have internalized the stronghold mentality over the years. Incidentally, the competition is not just about raw materials, but also about qualified personnel. The famous “War for Talents” continues to rage unabated, also in other areas.

Source: Stern

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.