During 2024, inflation in services doubled that of goodsa symptom of the relevant modification in the relative price scheme promoted by the Government of Javier Milei. Economists point to the exchange rate appreciation and the increase in rates as the most determining factors when it comes to explaining this phenomenon.

This Tuesday the INDEC reported that the Consumer Price Index (CPI) rose, at a general level, 2.7% in December. Thus, During the year it accumulated an increase of 117.8%.

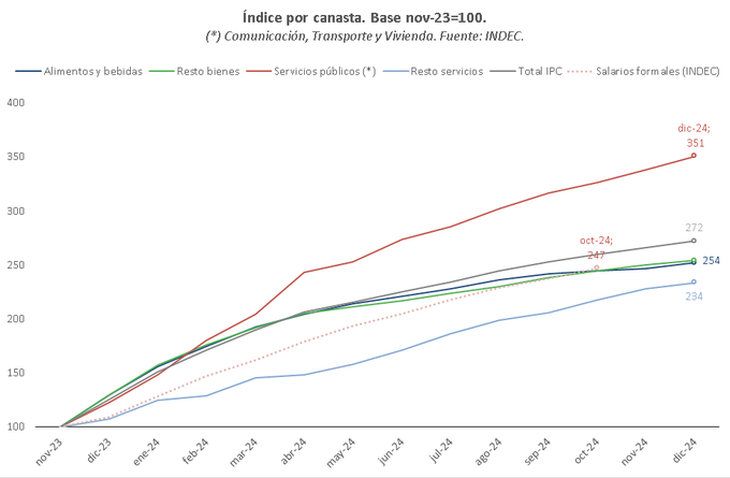

The dynamics between goods and services were very disparate; While the former increased 96.3%, the latter increased by 189%. Likewise, as reflected in a report prepared by the Economic Studies Management of Banco Provincia, public services climbed well above private services (which include restaurants, hotels, cinema and education, among other divisions), although the latter also did so due to above the goods.

Relative prices.png

Source: Economic Studies Management of Banco Provincia.

The dynamics of the CCL dollar and the official dollar are a determining factor of inflation

“The exchange rate appreciation was decisive in containing the products that are exported or imported, but it is managing to anchor the rest little.“, they highlighted in the work. In the same sense, they added that exchange appreciation was more important than fiscal adjustment to understand the relative price scheme that is shaping the decline in inflation and warned about the dependence that inflationary dynamics are having on the pace of adjustment of the official dollar.

From the Province they detailed in dialogue with Scope that The limited increases of 1% in food that were seen in recent months were more a consequence of the evolution of financial exchange rates that of the officer. “The key here is in the export dollar, which corresponds 80% to the official dollar but 20% to the CCL, which in July, August and November approximately fell around 5% per month and went from $1,400 to $1,100,” they explained.

Regarding the official, it is worth noting that, after knowing the inflation data, The Central Bank (BCRA) announced that the “crawling peg” will drop to 1% monthly from February, from the current 2%. The monetary authority justified the decision to reduce the pace of adjustment of the wholesale dollar in the recent trajectory of price increases and downward inflationary expectations.

Relative prices 2.png

Source: Economic Studies Management of Banco Provincia.

“The exchange rate adjustment continues to play the role of a complementary anchor in inflation expectations“, indicated the BCRA, aligned with the thinking of the Ministry of Economy led by Luis Caputo.

In the Province they maintain that Crawling is going to be very important for goods that are not food and beverageswhile in the case of food and beverages it will be important for parallel exchange rates to stabilize.

The EcoGo economist, Rocío Bisang, agreed that the exchange rate anchor was a key element to put a ceiling on prices in 2024 and warned that “Using the exchange rate delay as an anchor is a known strategy that did not always work well to lower inflation“However, he noted that confidence in the Government, the rate level, reserves, debt, fiscal accounts, among other issues, are other factors to take into account when looking at the evolution of the CPI from now on. .

On the other hand, the analyst maintained that “the rise in services over goods that we saw in recent times responds mainly to the delay that they maintained with respect to the rest of the prices (during 2023, a good part of the services were regulated and even frozen)

Rates, another key element in the change in relative prices

Another factor that had a strong impact on the change in relative prices was the increase in rates. “The cheap dollar contained the prices of food and other goods, but Subsidy cuts accelerated public services. Thus, salaries rose more than food, but less than rates,” the Province report deepened.

In that sense, the work reflected a ambiguous effect of inflationary dynamics on lower-income sectors since, on the one hand, the smaller increase in food prices favors this segment of the population but, on the other, the adjustments in electricity and gas bills generate an opposite impact.

Source: Ambito

I’m a recent graduate of the University of Missouri with a degree in journalism. I started working as a news reporter for 24 Hours World about two years ago, and I’ve been writing articles ever since. My main focus is automotive news, but I’ve also written about politics, lifestyle, and entertainment.