To avoid all kinds of problems when preserving savings, we recommend the most appropriate storage places.

It is normal among Argentines to use the purchase of dollars as a savings method in the event of possible devaluations or inflation. As the most accessible market to obtain this currency is the informal one, the most likely thing is to get the physical bill. So, the problem is where to store them to avoid deterioration or, in the worst case, theft.

The content you want to access is exclusive to subscribers.

Although the price of the dollar is currently remaining quite stable, in our country we know that there are likely to be sudden devaluations or quite drastic unexpected increases, which is why savers never stop choosing the purchase of the currency as their preferred method of saving. savings even if there are other options that seem more profitable.

Dollars

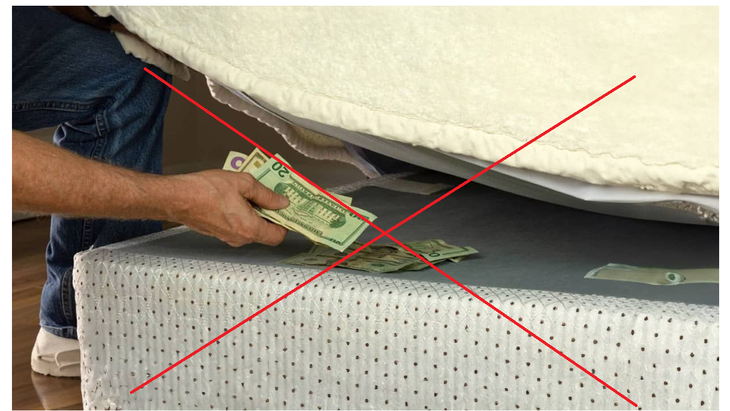

Dollars: the best hiding places for bills

To avoid deterioration of the banknotes or the possibility of losing them, it is important to preserve and hide the banknotes in cool and, above all, dry places, because the worst enemies of dollars are sunlight, heat and humidity. Therefore, below we will detail the most suitable places.

safe deposit box in the bank

Keeping them in the bank has the advantage that they are safe and protected. Obviously they are not exempt from suffering events such as cybercrimes or similar to the corralito that occurred in Argentina in 2001, but it is still one of the safest.

Safe in your home

It is one of the most efficient methods, especially if this safe is somewhere quite hidden. The risk of theft exists if they enter the house, in any case it is one of the safest methods there is and the banknotes are not damaged.

Investment Account

It is an account opened by a stockbroker or financial advisor with the objective of buying and selling shares or securities on the stock market. Securities may include stocks, bonds, mutual funds, and real estate investment trusts.

Crypto wallet (hot or cold)

This type of storage is usually given with the aim of generating some performance when it comes to preserving them.

Hot wallets: These are online wallets that are always connected to the internet. They are more convenient for making frequent transactions, but they are also more vulnerable to cyber attacks.

Cold wallets: These are offline wallets that are not connected to the internet. They are safer for storing large amounts of money, but are less practical for frequent transactions.

Source: Ambito

I’m a recent graduate of the University of Missouri with a degree in journalism. I started working as a news reporter for 24 Hours World about two years ago, and I’ve been writing articles ever since. My main focus is automotive news, but I’ve also written about politics, lifestyle, and entertainment.