“By decision of the President of the Nation Sonia Cavallo ceases to be the Argentine ambassador to the OAS”confirmed the presidential spokesman, Manuel Adorni, through his social networks.

The decision transcended after Milei hardly questioned the former Minister of Fernando de la Rúa and Carlos Menem, for the discrepancies marked by the former official with his management in his personal blog.

“The dollar has to fall like a piano. And I will tell him more, especially for the unpresentable of Cavallo, and I say it openly, because while he was Minister of Economy and insulted everyone when they talked about devaluation, The change of convertibility was today 700 pesos, “said the head of state this morning in an interview with A24.

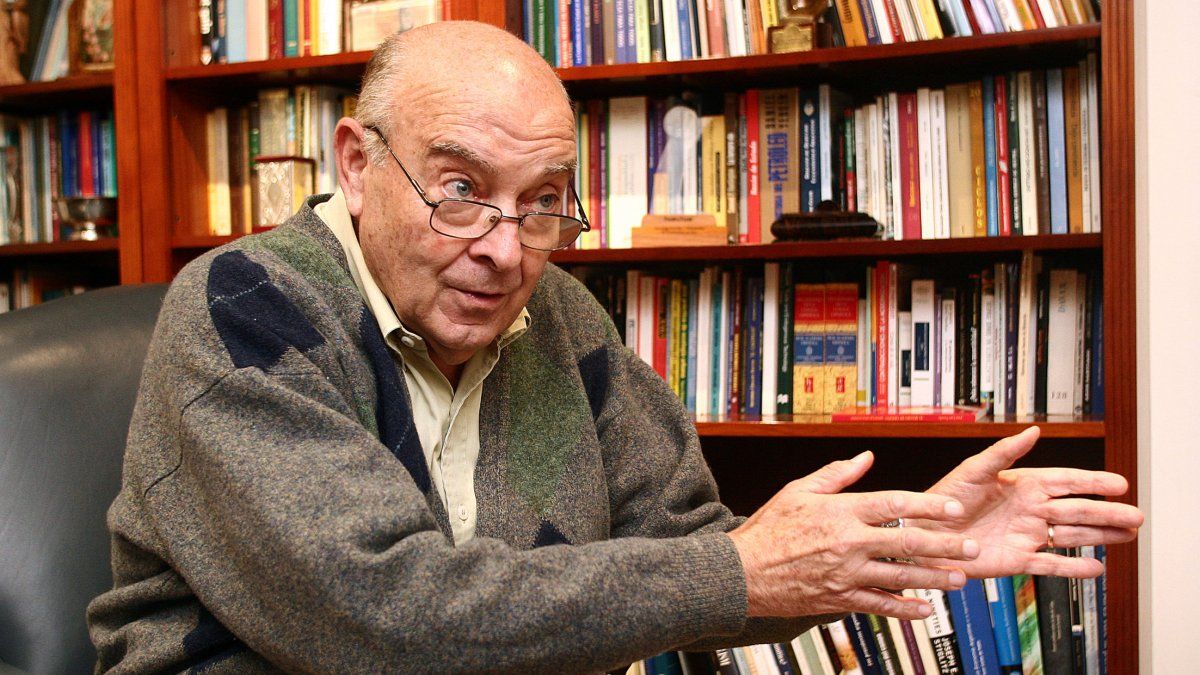

Las Palaras de Domingo Cavallo unleashed the wrath of Javier Milei

The former Minister of Economy Domingo Cavallo, He conducted a detailed analysis of his blog about the economic situation of Argentina in the context of the reforms implemented by President Javier Milei. And left one that caught the attention: “The additional disbursements of the International Monetary Fund (IMF) would not allow extinguishsince they would not increase net external reserves sustainably. “

The text makes it clear that additional IMF disbursements They would not allow the exchange rate to besince the former minister considers that they would not increase net external reserves sustainably. “Although greater financial support of the IMF would be a support for the government’s economic policy, the only real way to accumulate net reserves is through the surplus in the balance of payments.” Therefore, the exit of the stocks cannot depend on external financingbut of the country’s ability to generate genuine dollars through exports and investments.

Cavallo analyzes that the Milei government considers “You can only eliminate the exchange rate when net external reserves are positive. ” To achieve this, it seeks to generate surplus in the balance of payments and avoid external indebtedness of the Central Bank. Some proposed measures include the elimination of the Blend dollar, fiscal incentives for exports, restrictions on the use of currency for non -essential imports and tourism, and allow the entry of foreign investments through the CCL market. However, the exchange gap could be expanded, which could force the Government to accelerate the rhythm of the crawling PEG to avoid expectations of a sharp devaluation.

And it is that the IMF is involved in discussions on how Net external reserves go to positive land in 2025“Key condition to eliminate exchange stock.” However, any additional IMF disbursement above the payments committed to the Central Bank It will not contribute directly to improve net reservesbut it will only represent a support for the economic management of the government. “The only sustainable way of accumulating reservations is through the surplus in the balance of payments, either by the current account or the capital account,” says the economist.

Cavallo’s words

“Inflation fell much more than expected, but the Central Bank managed to accumulate few net reserves, despite a strong commercial surplus,” Cavallo wrote. Under his gaze, this is because the deflation was not only the result of monetary control and the elimination of the fiscal deficit, but also of the management of exchange rates.

“However, this strategy generated a real appreciation of the weight that affects the competitiveness of exporters, the agricultural sector, industry and services. The current appreciation, estimated at 20%, is similar to that recorded in the last years of convertibility and could generate recessive effects.

By 2025, the main challenge It will be to correct these effects without losing stabilityin a context conditioned by the electoral calendar. Cavallo points out that the success of Javier Milei’s economic plan will depend largely on a favorable electoral result in October, which would allow consolidating the direction of the government.

On the departure of the stocks, he proposes to eliminate exchange restrictions within a period of three months, establishing a free currency competition scheme. If this strategy is postponed, it suggests palliative measures such as retention reduction and increased exports reimbursements, in addition to temporary decrease in employer contributions to reduce labor costs without affecting wages. “The final decision should consider its impact on the economy and elections, since popular support is key to the success of the economic program,” he concludes.

Source: Ambito

I’m a recent graduate of the University of Missouri with a degree in journalism. I started working as a news reporter for 24 Hours World about two years ago, and I’ve been writing articles ever since. My main focus is automotive news, but I’ve also written about politics, lifestyle, and entertainment.