The financial panorama becomes increasingly unpredictable as 2025 progresses. Decisions from the United States on commercial and economic policy flood the global uncertainty markets. The constants Donald Trump threats of adopting protectionist measures and tariffs imposed, consequently, complicate the task of predicting yields and managing risks. However, the last report of the Bank of America (Bofa) offers some lights for investors and recommends three assets to those to bet this year.

Given the volatility, the first thing that experts recommend is to keep calm and adopt investment strategies that point to the long term. Diversify wallets, use coverage or even increase liquidity to face market fluctuations. For him Bofait is natural that “the markets react to current conditions and therefore the expectations are modified by 2025”.

And as well analyzes the document, the performance of the different financial assets so far this year (YTD, for its acronym in English), It exposes market volatility. For example, The gold He holds a solid yield after increasing 8.5%, while cryptoactives fell 8.6%. Other “Assets” like actions, commodities and treasure bonds (Treasuries) also have positive yields.

Market trends according to the Bofa

The Wall Street giant points out that the yields of the treasure bonds and the US dollar reached “several -year twin peaks”, which raises an upward trend by 2025 in these two assets. As for the yields of the actions, the Bofa explains that international markets anticipate a possible end of “American exceptionalism“And greater geopolitical stability, so he looks at other latitudes and projects the following yields.

- Brazil: +12%

- Germany: +10%

- China, United Kingdom, Australia: +6%

- Canada: +4%

- USA: +3%

- Japan: +1%

Bofa 2.png

It warns that the main variables that investors are closely followed by: the evolution of conflicts in the Middle East, Russia and Ukraine, and the possible escalation of the commercial war between the US and China, which is what “It really matters“Being a determining factor for global trade.

“American exceptionalism“It could be challenged by two factors:

- A second wave of inflation that forces the Federal Reserve (Fed) to raise rates.

- A weaker US economic growth than expected (for example, due to fiscal adjustments, lower job creation or a credit event).

The “Trade” for 2025

Unlike market consensus, Bank of America Bet on a “countercyclical” positioning, and weigh the: Treasury bonds due to price recovery with yields below 4%; the international actions that become attractive, since they offer opportunities in cheaper markets than the American and gold, which is the active refuge par excellence in a context of “high debt” and growing volatility.

And remember that, “historically, the large upward markets begin with a rebound in the bearish market.” In this context, bonds are the best coverage against a possible peak in assets prices. “A diversified portfolio in bonds (T-Bills, 30-year-old bonds, IG, Hy and EM) could generate performance from 9-10% If the yields fall again to 4%, “anticipates the colossus of the investment bank.

THE LOOK OF THE CITY

Although the Bofa report invites you to look for yields in other markets outside the American and other assets. Bridgethe Broker of the City of Buenos Aires, maintains an optimistic vision for the variable income in Wall Street by 2025, although something “more modest compared to last year.”

The evaluation of the stock company arises from an environment in which a slowdown in the growth of the United States is expected and where the interest rate is 4.5%, which favors the global fixed income given the high nominal yields that derive from it.

This scenario, which in essence is optimistic, is committed to sectors such as Energy, technology, industrial and financial. However, the key is to focus on companies with good foundations, high dividends or more attractive value (Value), since short -term risks persist that require careful selection.

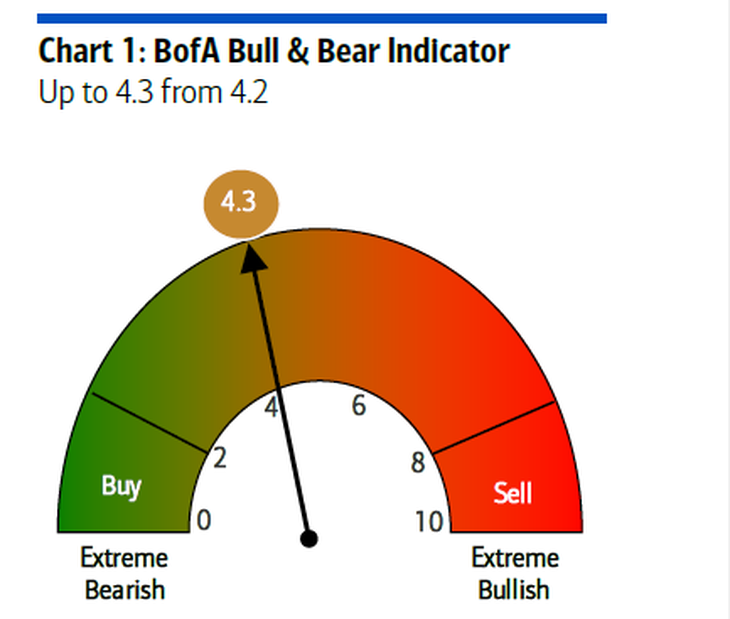

Bofa 1.png

And today, the actions have high valuations compared to their historical averages. For example, the S&P 500 quote with a ratio 12 months price/earnings 22.1 times, above the average of the last five years (19.8 times) and the last decade (18.2 times). However, and despite this, the consensus of analysts estimates that the index will reach the 6,510 points by the end of 2025.

In 2025, the commercial dispute between the US and China will persist, but a significant escalation is unlikely, since both economies have too much at stake, the Bofa slides between the lines. Actually, the trade war is divided into two fronts for investors: a strategic With China and another tactic With the rest of the world, since the balance between diversification and selection of assets in a methodical way will be decisive to capture opportunities in a market in constant movement.

Source: Ambito

I’m a recent graduate of the University of Missouri with a degree in journalism. I started working as a news reporter for 24 Hours World about two years ago, and I’ve been writing articles ever since. My main focus is automotive news, but I’ve also written about politics, lifestyle, and entertainment.