Menu

Payone is said to have done too little for money laundering prevention

Categories

Most Read

Prime Days Deal: Tommy Hilfiger Jeans for only 44 instead of 110 euros

October 8, 2025

No Comments

Retire early? With these tricks it is possible

October 8, 2025

No Comments

They suspended aluminum, steel and derivatives until the end of 2025

October 8, 2025

No Comments

Pension: How much can you collect without paying taxes?

October 8, 2025

No Comments

Drinks: agreement on trademark rights: Paulaner special is allowed abroad

October 8, 2025

No Comments

Latest Posts

Miguel Ángel Russo and the words of encouragement and respect for Fatura Baun: “He is a person who breathes football”

October 8, 2025

No Comments

October 8, 2025 – 11:01 Miguel Ángel Russo remains with a reserved prognosis and permanent observation after his health was weakened precipitously. The world of

Simone Biles is already in Argentina: at what time is the talk of the US Olympic medalist

October 8, 2025

No Comments

October 8, 2025 – 09:36 The renowned American gymnast arrived the country to give a motivational talk and a sports clinic. The details. Photo: Gtres

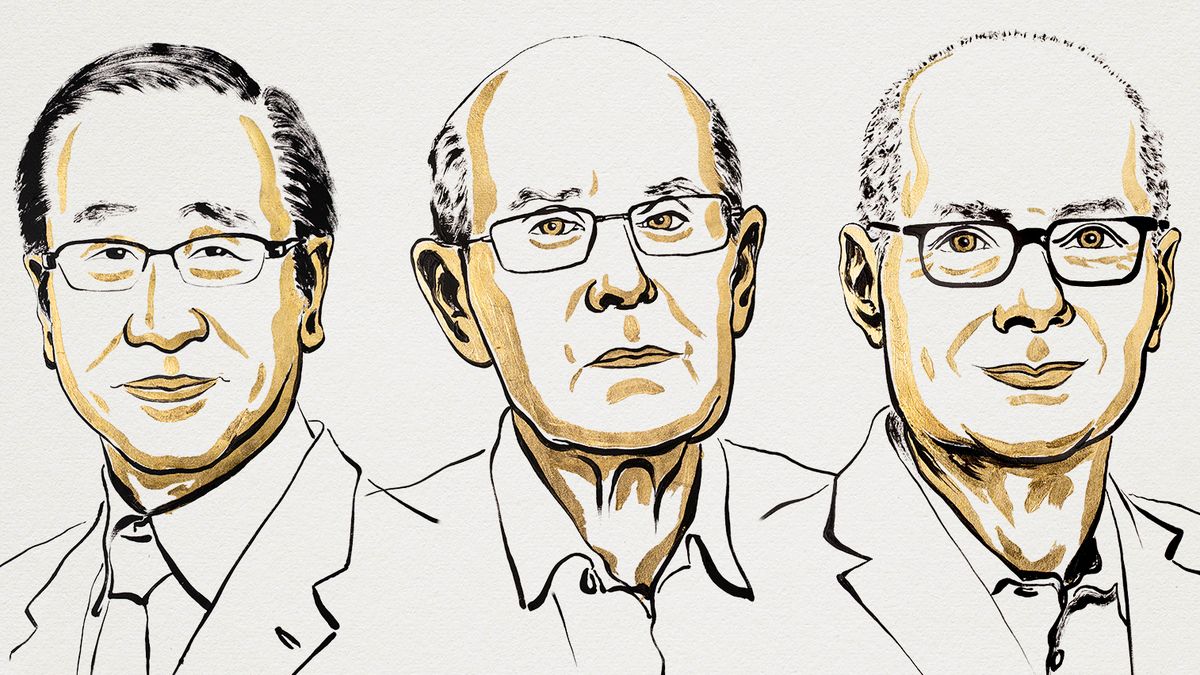

The 2025 Nobel Prize in Chemistry was for the study of the development of metal-organic structures

October 8, 2025

No Comments

October 8, 2025 – 09:31 Susumu Kitagawa, Richard Robson and Omar Yaghi were awarded for creating structures capable of storing gases, filtering pollutants and collecting

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.