Today the caution prevails in the international investment community. Everything is very dependent on what happens after October. Operators make accounts with Bonte 30 and the “Carry Trade”. They follow doubts with reservations and what everyone asks is how sustainable this rate of change is.

The MSCI novel ended, and as always a few took advantage of the “wave” and “empom” several with Argentine roles, in the week when the technical mission of the International Monetary Fund (IMF) landed, of which, appropriate, very few speak, or rather, interest, and also returned, as in the best times of the Government of Cambiemos, the local seminar of the Local Seminar of the Institute of International Finance Finance (IIF) “Argentina Economic Forum”. In this regard, already difference from that made in 2017, “Argentina Financial Summit”, this time there was less interest, or rather Less enthusiasm on the part of the international investment community, in terms that they are not hurried to continue buying Argentine assets. Of course, many of them already suffered the lesson of having opted for the plans of the then government of Macri. Today the caution prevails. Which does not mean that they do not monitor and contemplate entering again or even increase positions in Argentina, but that everything is very dependent on what happens after October. Today everyone commune with the main official play to reach the medium mandate elections with a ceiling to awaken the appetite of foreign investors.

The content you want to access is exclusive to subscribers.

The truth is, as it was clear in a meeting reserved by someone who not only knows the IMF, international finances, but also knows what it is to be in charge of an economic area, is that Argentina back became “invertible” For the sooner or later, if certain things are confirmed, such as that society reaffirms the current economic course and therefore to the current government, there will be a lot of appetite for Argentine bonds and actions. They recognized that The status of the MSCI, of not being “emerging market”, was not yet decisive, but would have helped some funds restricted today could enter. Today is not a critical element. In the political front, expectation for the closure of alliances in Buenos Aires, the next key stop.

Meanwhile, at the international level in the Middle East, it opened the way to some optimism, but the financial air was damaged before rumors that Donald Trump is already looking for replacement for Jerome Powell, head of the Fed, which impacted fully into the price of the dollar world 10%).

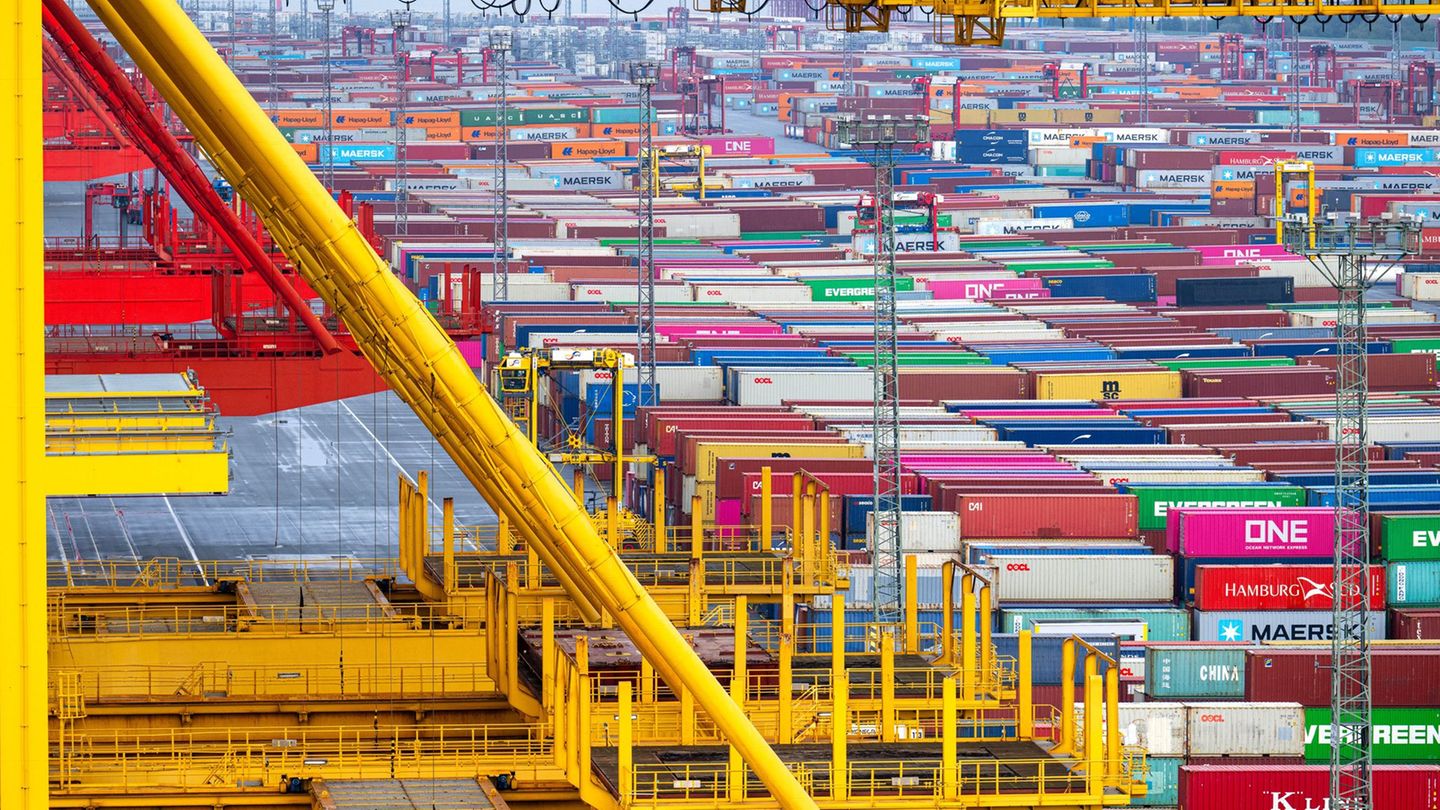

MSCI.JPG

It is recognized that the status of the MSCI was not yet decisive, but that it would have helped some funds restricted today could enter.

Economic variables and a traffic light

A traffic light from the people of Cohen circulated between the tables that contemplates a “Green” on the fiscal front (with a yellow light on the collection side, and two green for adjustment of the expenditure and maintenance of the primary surplus), a “yellow” on the political front (with a green, inflation on the ground current account deficit and negative net reserves), as a macro guide of “Where we are standing.”

In this regard, and although there are still a few months left for the high season of preparation of the budgets, in the Audi Lounge, the people of Leading discussed the keys to the main economic variables that will impact on the budgets of the companies of the next fiscal year. What was the summary?: Annual inflation +16%, GDP +4%, exchange rate $ 1,554 and salary increase +14%. What did a grupete that stayed to the post-cierre talk about?: Little interest in the IMF review, weighted the maintenance of the May fiscal and financial surplus despite the retraction of the resources and a fall in the much lower primary expenditure, Restlessness with reservation goals and currency purchases of the BCRA and the Treasury (it is estimated in the market that there are still $ 4,000 million to meet the agreed levels), they celebrate that the treasure already has the dollars deposited to cover the maturities of July without using the dollars of the IMF (In this regard, an expert on the subject pointed out that he believed that this was the main restriction for the review of the agreement and therefore the Government assumed a high cost to fulfill it), and unease for the numbers of the commercial balance (this year the surplus does not arrive in $ 1,900 million in five months compared to the almost US $ 8.9 billion of 2024).

“Carry”, reservations and doubts for the exchange rate

While a group of operators made accounts with Bonte 30 and the “Carry Trade” (It happens that the ability to broadcast Bonte is limited with a country risk in 700 basic points, and although it is an attractive “carry”, the problem is that if there is a good demand there will be more offer), their colleagues in the “Research” area in a “Call Conference” with foreign investors were concluded from the doubts that are outside is that The element that still does not close is the generation of currencies of the economy that does not reach for the payment of debts. Already without whitish to help and without the genuine collaboration of foreign trade, the dollars for BCRA reserves must come for somewhere.

A well-known Sub-60 economist explained, in this regard, a group of investors that, if “everything went well, in October” and economics gradually returned to access to voluntary capital markets, everything would be framed. But, if this does not happen and access to the markets is dilated then the government must invent some alternative, and go to a reservations of purchase program which would lead to some relative prices change. To good understand, there are plenty of words, What everyone asks is how sustainable this rate of change is. At these operations tables, they recalculate the future of interest rates with the elimination of Lefi. They know that there will be no apartment, but also that more volatility is coming. That is why some believe that the treasure has the alternative to intervene via short LECAP, but the banks could replace Lefi with races rate 0%. Therefore, everything is in the hands of the Treasury because the common investment funds are also affected.

Milei dollar markets.jpg

What everyone asks is how sustainable this rate of exchange raises the Milei government.

Scope

Are a new global regime being configured?

A group of men in the market who mixed work and pleasure, participating in the Global Investment Forum of New York Life Investments and the FIFA Club World Cup, some data were brought: A new global regime is being configured Where investors are rethinking the volatility, construction of portfolios and cross -border risk, which is modifying expectations on the performance and risk of assets, being one of the biggest concerns the cost of greater exchange coverage; Interest rates are expected to be higher, more volatile and divergent regionally; The concern for high levels of debt and increased debt load between developed market governments increased; Efforts are being redoubled in diversification for the re -mayor of the portfolio, a central theme; He is struggling more to find quality; and it is recognized that innovation (AI) is already transforming the capital allocation.

Already turned to the Río de la Plata commented on the closure of the total purchase of the Uruguayan stock market Corporation Uruguay by Balanz that has already added Nahuel Aristmuño Carassale (former nobilis) and the details of the Pictet event in Montevideo. They also had a lot of “feedback” of the last EMTA on emerging debt. In London’s, they presented on recent emerging debt restructuring Spencer Jones (Ankura Consulting), Stephanie Ouwendijk (Franklin Templeton), Ajata Measureratta (Greylock capital) and Alex Loomis (Quinn Emanuel Urquhart & Sullivan) who discussed recent developments of the market, including the performance of the instruments recently Restructured, reflections on the common framework, the current state of the legislative and statutory initiatives that affect the sovereign debt in New York and the United Kingdom, the preferential creditor state, the creditors committees and the recent contractual innovations in sovereign debt restructuring. While in Zurich’s, under the moderation of the people of the Bofa, the effects of commercial wars on the sovereign and corporate debt of emerging markets were discussed; which countries and sectors were more likely to benefit from “nearshoring” and a weaker dollar; Perspectives for China and the demand for raw materials, including oil; and the geopolitical high points and the prospects for reducing tensions. Among the exhibitors were John Montgomery (Balanz Capital), Hans-Christian Wietoska (Deutsche Bank), Dorthe Fredsgaard Nielsen (Swiss Life Asset Managers) and Jack Deino (UBP).

Source: Ambito