Menu

The inflation that looks for the Fed remained high in May while Americans reduce expenses

Categories

Most Read

Housing crisis: Pfandbriefbanken: Citizenship for Housing Construction

October 8, 2025

No Comments

Vegetarian food: can a soy schnitzel be?

October 8, 2025

No Comments

Why there is a historical opportunity for Argentina

October 8, 2025

No Comments

Fixed terms give ground and migration towards the dollar and FCIs grows in the run-up to the election

October 7, 2025

No Comments

Food and cleaning products climb up to 11% in nearby stores

October 7, 2025

No Comments

Latest Posts

At least he talks: Why Friedrich Merz deserves grace

October 8, 2025

No Comments

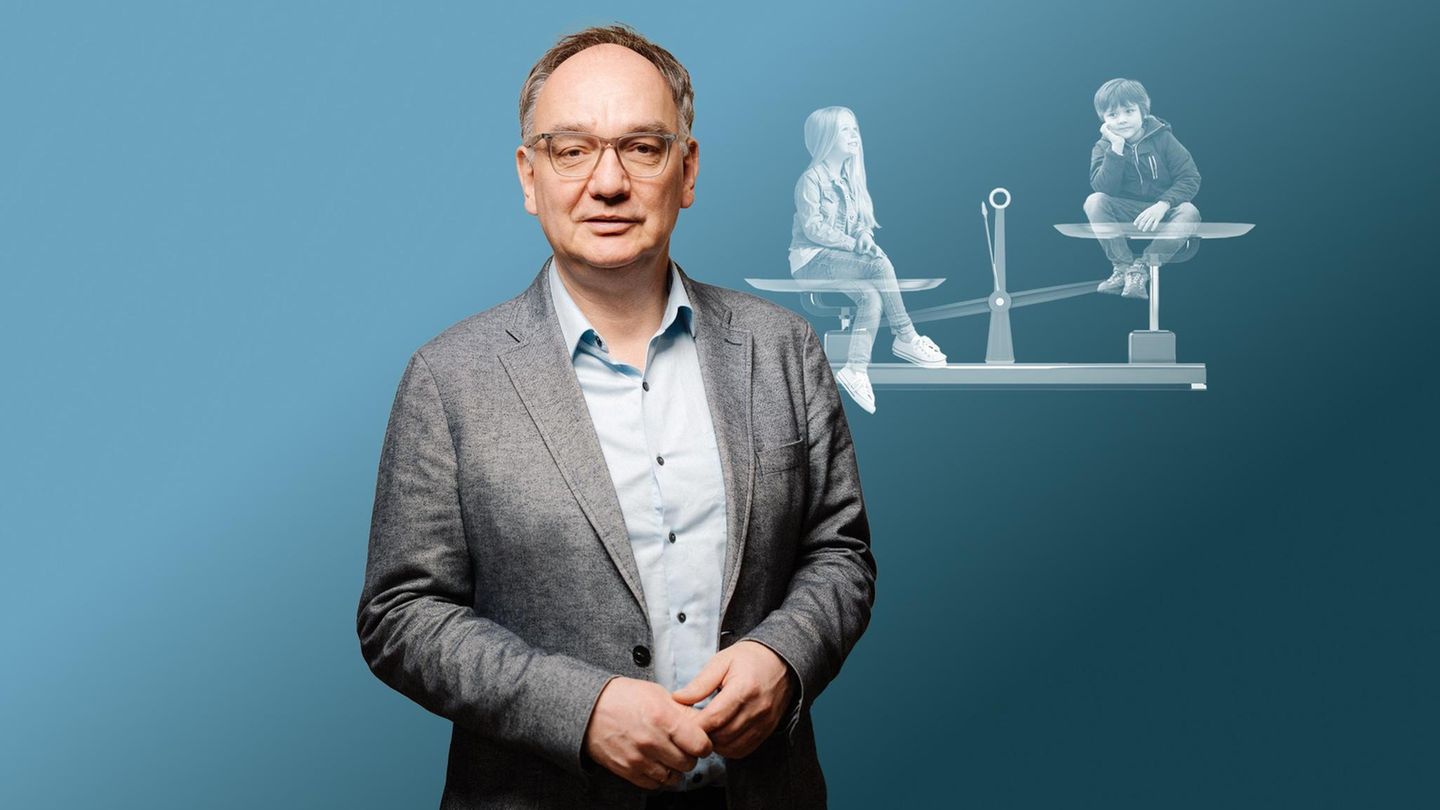

Fried – view from Berlin Friedrich Merz – why we should sometimes be gracious Listen article Copy the current link Add to the memorial list

The situation at an overview: Middle East talks: Hamas and Israel “insist on positions”

October 8, 2025

No Comments

IvanI have been working in the news industry for over 6 years, first as a reporter and now as an editor. I have covered politics

Hamas demands Israel’s complete withdrawal from Gaza and a permanent ceasefire to accept peace

October 8, 2025

No Comments

The group Palestinian Hamas demanded the complete withdrawal of Israeli forces from Gaza and a permanent ceasefire as a condition for accepting the peace proposal

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.