Menu

Auto industry: hard times for the car manufacturers – but not all lose

Categories

Most Read

Auto industry: Talks about savings round: Will the Porsche job guarantee be overturned?

October 11, 2025

No Comments

Aviation: Airline Association: Warning about the danger of drones for ten years

October 10, 2025

No Comments

Workers’ inflation reached 2.2% in September and reached the highest level since April

October 10, 2025

No Comments

Customs dispute: Trump announces 100 percent additional tariffs for China

October 10, 2025

No Comments

For the city it provides short-term relief, but doubts remain about the post-26-O scheme

October 10, 2025

No Comments

Latest Posts

Duchess Meghan: She shares emotional message to Prince Harry

October 11, 2025

No Comments

Lisa HarrisI am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor

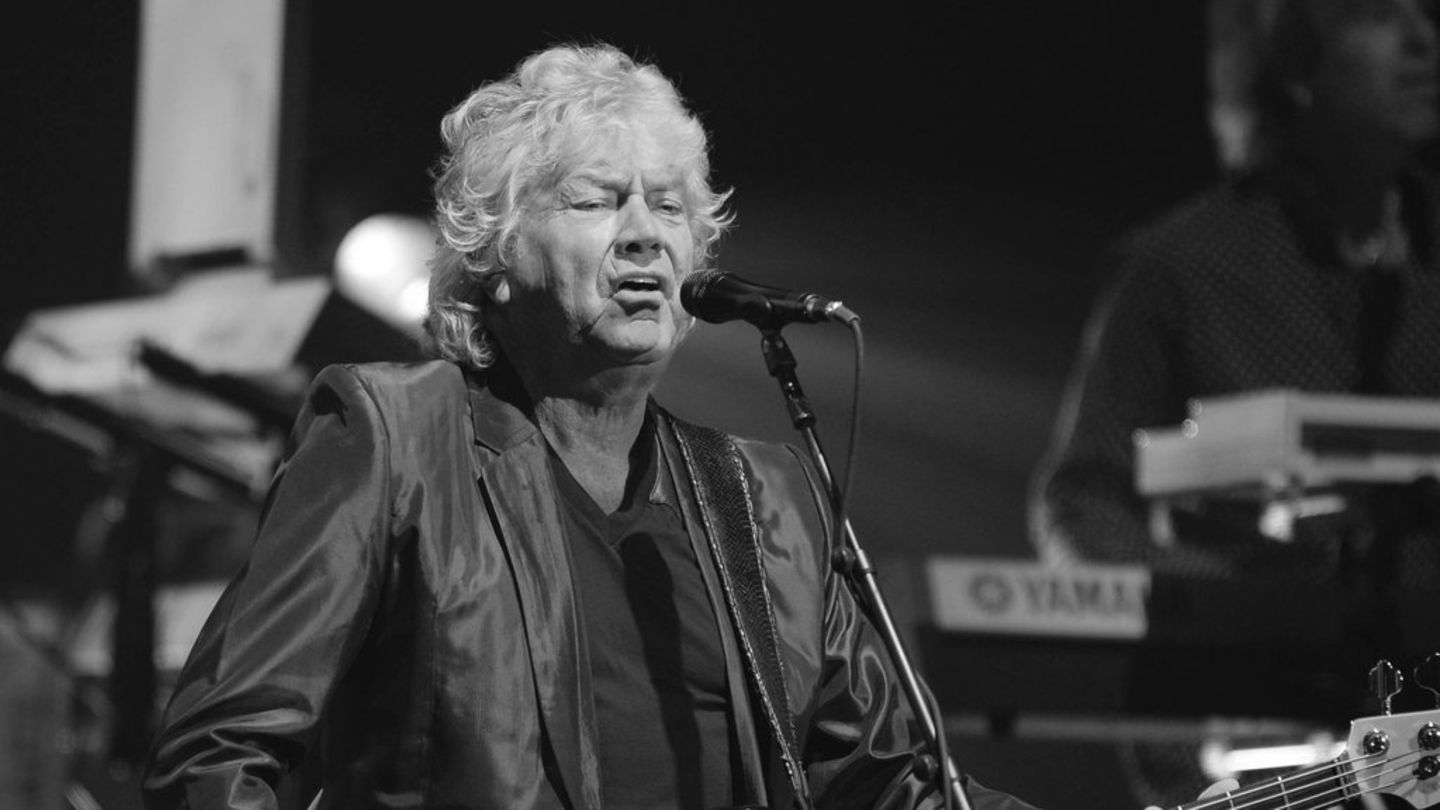

John Lodge: Moody Blues bassist dies aged 82

October 11, 2025

No Comments

Mourning for musicians Moody Blues star John Lodge is dead Copy the current link Add to watchlist Mourning in the music world: A star of

Real estate: Lawyer for the Republic suspects Benko’s assets are in foundations

October 11, 2025

No Comments

AngelicaI am an author and journalist who has written for 24 Hours World. I specialize in covering the economy and write about topics such as

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.