The Autonomous City of Buenos Aires would be the district that, in relative terms, would benefit more because its portion would rise 750%. The PBA would duplicate its funds.

The project approved by the Senate to redistribute taxes on liquid fuel transfer Already the emission of carbon dioxide represents a loss of resources from the national state of $ 1.5 billion in a yearapproximately.

The content you want to access is exclusive to subscribers.

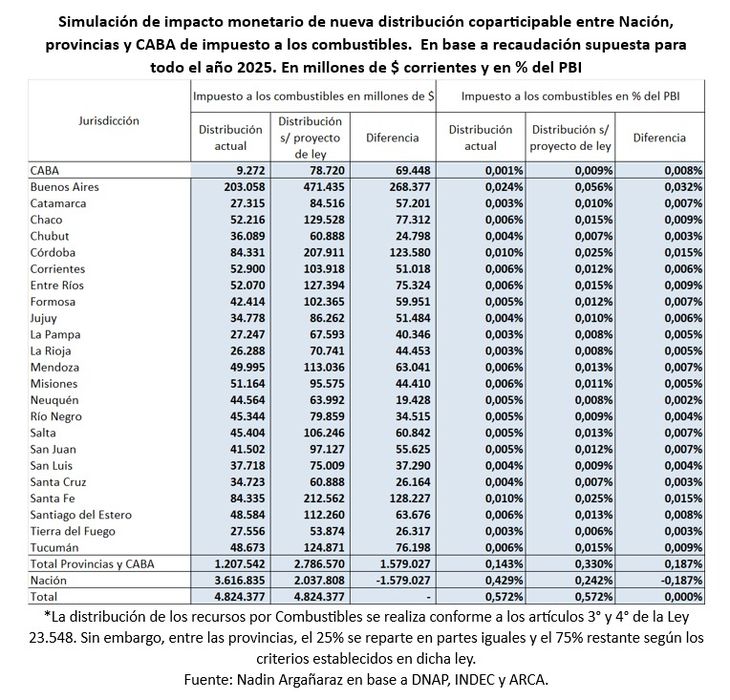

This is estimated by the economist Nadín Argañaraz, head of the Argentine Institute of Fiscal Analysis (Iaraf). It should be noted that both taxes already have a distribution with the subnational states. 25% is distributed equally with all provinces and 75% depending on criteria established by law.

The two taxes $ 4.8 billion raised a year, equivalent to 0.57% of the product Internal gross (GDP). Of them currently The nation stays with 0.429% of GDP. With the changes it would drop to 0.24%.

On the other hand, the whole of the provinces and the city of Buenos Aires would go from receiving $ 1.2 billion per year (0.143%) at $ 2.78 billion (0.33%).

Depending on the number of liters of fuels sold in each subnational state, which would take most of it is the province of Buenos Aires, which would go from $ 203,058 million to $ 471,435 million a year.

Second appears Santa Fe, which would go from registering revenues of $ 84,335 million a year to $ 212,562 million. Then it is Cordovafrom $ 83,331 million to $ 207,911 million and the Buenos Aires Cityfrom $ 9,272 million to $ 78,720 million.

In relative termsthe Federal Capital It would be the most benefited state. His increase would be 750% Regarding your current situation.

fuels.jpg

As commented to Scope lawyer Diego Fraga, Specialist in Fiscal Legal issues, the National Constitution “It does not establish limitations for specific allocations” of taxes to the cameras. That means that both deputies and senators can initiate projects to change the fate of the funds. Instead clarified that “for AGREEMENT LAW, such as federal tax co -participation, has to be initiated in the Senate. ”

The initiative that has The sanction of the upper house contemplates the elimination of six trusts (of water infrastructure; transport infrastructure; and integrated road system; and the compensating funds; special of electrical development of the interior; and national housing) financed with both taxes.

Source: Ambito