This reflected, for example, an analysis of the Economic Studies Management of the Province Bank. It showed that, in the region, the correlation between reserves and country risk is high. Indeed, Bolivia, Ecuador and Argentina, the three nations with the highest cost of indebtedness, are at the same time the three that have less reserves, measures as a percentage of the Gross Domestic Product (GDP).

image.png

From the province they clarified that this does not necessarily speak of a causal relationship, since the high level of reserves can be a consequence of the low cost of indebtedness. Even so, the perceived correlation between both variables shows a significant robustness.

The fiscal deficit does not necessarily translate into a high country risk

In parallel, they added, The relationship between country risk and primary fiscal result is more diffuse. On the one hand, six countries in the region have surplus: however, two have cheap credit (Guatemala and Costa Rica), three or so (Mexico, Honduras and El Salvador) and one directly does not have: Argentina.

On the contrary, within the eight countries with deficit, seven have access to international markets and only Colombia shows a “medium” debt risk. “Having fiscal deficit does not imply having a high country risk“The report said.

image.png

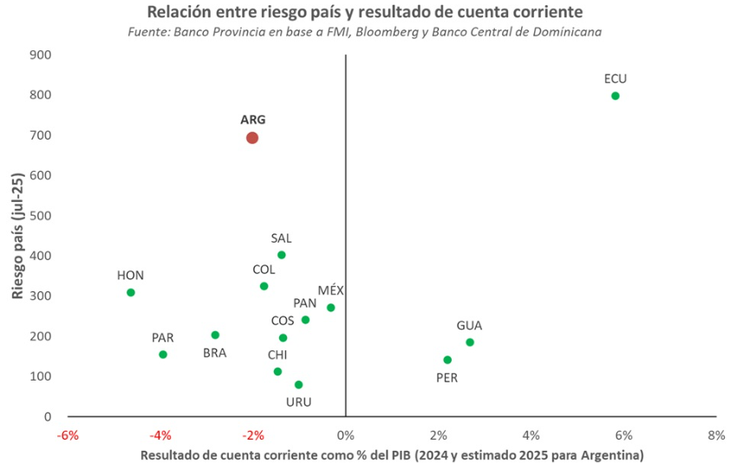

As for the relationship between the country and the current account, the province also noticed a weak link. As an example they can put on Argentina and Ecuador, two territories without access to the markets, but the first with currency deficit and the second with surplus. Something similar also occurs in the comparison between Peru and Chile; The two have a low country risk but the first generates more dollars than it consumes, and the second has a “red” in this aspect.

Fiscal balance does not guarantee external sustainability

The discussion about the relationship between the fiscal balance and the external front gained relevance for the repeated statements launched from the government, which gave importance to the accumulation of reserves and the shortage of dollars since, as there is fiscal surplus, “this time is different.”

In a recent exhibition, the Minister of Economy, Luis Caputo, said that, although the government pays attention to the current account, the deficit does not represent a concern and even It is something “necessary”, since it is the result of transactions between private and not of an excess of pesos generated by a fiscally irresponsible state.

The official gave as an example that of a person who buys dollars because he wants to travel with his family, and another who wants to sell because he wants to pay the rent. “The two are happy with their transaction,” he said.

However, specialists agree that LAt the appreciation of the exchange rate and the lack of reserves, make it difficult to enter the economy to the economy. And, in that sense, no matter how much the national state has the weights, currencies are needed To face debt payments, the growing increase in imports and services deficit.

“The correlation between reserves and country risk is stronger than the correlation between it and fiscal result. This does not imply that the deficit is irrelevant, in any way, but yes, but reflects that a balanced public sector does not guarantee external solvency“The province explained.

Meanwhile, after despising the accumulation of reservations, the treasure began buying dollars in recent days, mainly through bilateral operations called “block purchases”, showing some attention to the questions received by the dynamics of the external front.

Source: Ambito