After knowing the June inflation, Arca will make adjustments in income amounts and amounts to be paid in the simplified regime and in the income tax of the employees.

When the National Institute of Statistics and Census (INDEC) Confirm the new June consumer price index, which It would be about 2% according to stiration, The annual billing limit for Staying inside the monotax would become $ 95 million annually. In the case of Profit Tax of the wage earners, the Minimum non -taxable It would become $ 2.6 million for a single without children.

The content you want to access is exclusive to subscribers.

This is determined by the laws of the fiscal package approved by Congress last year, which established that both billing scales and quotas to Pay they adjust for inflation. The accumulated inflation in the first six months of the year was of the order of the 15.5%.

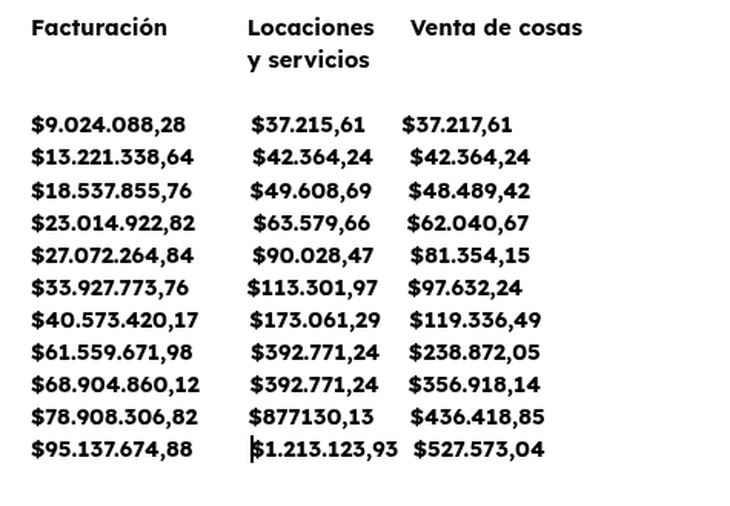

Billing amounts and quotas

monotax.png

Scales and value of monotax quotas.

It should be remembered that This year the taxpayers of the simplified regime will have time until August 5 for semiannual recategorization. To do this, the ark system informs you of the billing amount of the last twelve months and the category in which the system is located. The person can confirm or make modifications if they do not match their records. If not, Ark will do it ex officio.

Profit tax: What will be the non -taxable minimum?

Meanwhile, in the case of employees of the Profit tax, the minimum non -taxable It will go from the current $ 2.3 million to $ 2.6 million gross For a single without children. In the case of a married woman with two children It will go from $ 3 million to almost $ 3.5 million.

Also the workers in this segment will have as its benefit the increase in deductions, such as rental expense, domestic staff and schools of schools and universities.

The Lower tax scale is 5%. They are followed in progressive increase 9%, 12%, 15%, 19%, 23%, 27%, 31%and 35%.

Source: Ambito