That data in the consumer price index coincided with the midpoint of the object of the ECBaccelerating slightly from 1.9% in May, and in line with the expectations of analysts. Besides, If the most volatile elements are excluded, such as food and fuelthe nucleus inflation was 2.3%, matching the level observed the previous month.

A “firm hand” is required to deal with the uncertainty unleashed by the last tariff threat of the Republican president, he said The head of the monetary policy of the European Central Bank, Joachim Nagelto the newspaper Handelsblatt, earlier this week. And he added that The effect of geopolitical fluctuations and commercial tensions with the US on prices was “extremely uncertain”.

In this sense, that measure is complicating the decision making of the ECB, but It is unlikely to derail a pause plans in the feat cuts next weekthey ratified five responsible for the monetary policy of the ECB to Reuters.

In a recent report to their clients, analysts of Personal Investor Portfolio (PPI) They considered that “although Trump is open to agreements that reduce these aliquots, in the last interviews he showed that he is not interested in long negotiation processes. This revives uncertainty just when several countries (such as the European Union) sought to close agreements to avoid a new escalation“

To that is added the climbing in Trump’s pressures to displace the Federal Reserve head (FED), Jerome Powellmainly because of its reluctance to lower interest rates due to the impact of tariffs on inflation. This Thursday, the Republican president He said he is “unlikely” Let it say it, after it transcended precisely the opposite.

Trump Tariffs.jpg

Donald Trump, when he showed the tariff tables and began the commercial war.

The revaluation of the euro

From XTB they stated that “The reaction of financial markets suggests that investors mainly interpret the announcement of tariffs of 30% as a Negotiation tactics by Trump. “Similarly, Morgan Stanley’s strategists led by David Adams stated that An advance above US $ 1,30 for the euro “is not a risk that should be underestimated”according to Bloomberg.

That way, Morgan Stanley joined Deutsche Bank, BNP Paribas SA and Barclays, who also expect a strengthening of the euro. In fact, the common European currency It rose 11.8% in the comparison against the dollar so far this year.

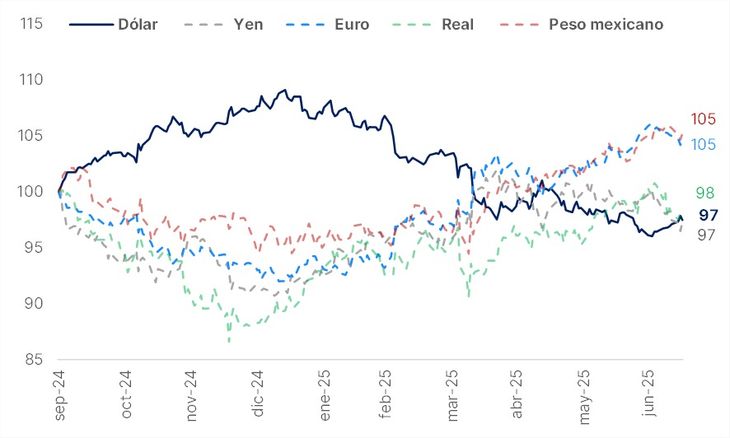

GRAPH PPI DOLAR

Performance of the dollar against a coin basket, including the euro. (Source: PPI)

Consulted by Scopehe Head of Inviu Research, Mateo Reschinihe commented that they hope “The euro remains strong, but not for a matter of the euro, but for a matter of the dollar. And they deepened: “We believe that The dollar is going to keep the rest of the year weak And that probably has an impact on all assets called dollars. “In fact, the American currency has come from having its worst semester since 1973, according to the Financial Times.

For its part, Alan Mac Carthy, CEO of Front Investmentshe argued that the recent strength of the euro is due to the fact that “the ECB cut rates before the Fed, which favored the euroand the dollar lost ground due to fiscal, political and geopolitical uncertainties in the US among them Trump’s discussion with Powell, the war with Iran, the robust deficit and fear of additional rates with more commercial partners. “

Anyway, Carthy explained that “the euro has reached levels that concern the ECB (U $ S1,18 or more) because A currency too strong can hinder European exports and bring inflation below the objective. “Therefore, he added,” we will have to follow Christine Lagarde and company closely to see if they correct or let this trend pass. “

Did the dollar make a floor?

For its part, from the Bank of America (Bofa) They warned in a recent report of a possible short -term dollar rebound. “We maintain a medium -term USD bassist vision, but the risk of a rebound in summer has increased,” said Bofa’s strategist, Adarsh Sinha.

Consulted by this means, the PPI analyst Martín Cordeviolahe explained that “the combined effect of commercial war, institutional weakness for clashes and fiscal course in the United States caused a strong drop in the dollar: The DXY retreated 9.5% so far this year or 10.7% from the peaks they had reached before Trump assumed the presidency. “

However, he added: “Forward, I don’t see much space for this dynamic to lastwith dxy levels below the minimum of September 2024, considering that the ‘Big Beautiful Bill’ was already incorporated into prices and that The commercial war will apparently be less aggressive than was feared in April (although it is still one of the open fronts) “.

Similarly, Insider Finance CEO, Pablo Lazzati, estimated that “The ‘GAP’ between these two coins will be shrinking as we approach at the end of the yearbut always leaving the euro slightly above the American currency. “

The impact of tariffs on Europe

The United States is the main commercial partner of EU goodssince it concentrates a fifth of all exports outside the block. Only last year, the EU exported goods for a value of US $ 615,800 millionwhich is equivalent to almost the 3% of the total GDP of the European Union.

“The increase in tariffs of the current level of the 10% to 30% would cause a drastic increase in European products, with the consequent risk of a Strong drop in imports “they explained from XTB.

On this point, they highlighted that the most vulnerable sectors are the Pharmaceutical products (more than 20% of ñas exports to the US), cars (about 10%), industrial machinery (more than 6%), electrical machinery (6%) and Specialized machinery (5%).

As a consequence, Economic activity would receive an important impact. According to Bloomberg Economics, the GDP of the Eurozone would fall 0.6%while The European Parliament estimated a contraction of between 0.2% and 0.8%depending on the application of retaliation measures. For its part, Goldman Sachs calculated that if 30% tariffs are maintained for a prolonged period, The activity could drop 1.2% accumulated towards the end of 2026.

Source: Ambito