The industry shows significant losses and family consumption is sustained from a growing indebtedness with credit cards.

The University of Buenos Aires (UBA) warned that The “fragile” rebound of the economic activity of the last four months responds to a “rebound effect” and that there is a “prolonged stagnation risk with greater social pressure”since some sectors do not exhibit solid improvement signals.

The content you want to access is exclusive to subscribers.

A recent report from the Center Ra of the Faculty of Economic Sciences of the UBA remarked that Although the economy shows signs of a recovery, it would be supported by the possible stock liquidation and the growing indebtedness of households for the financing of basic expenses.

According to the text, the economic setback touched its most critical point in March last year, with an 8%collapse, and it was not until April of the current year that there was a significant year -on -year growth of 7.7%, promoting by key sectors such as construction (+17.5%), trade (+15.6%) and industry (+7,58).

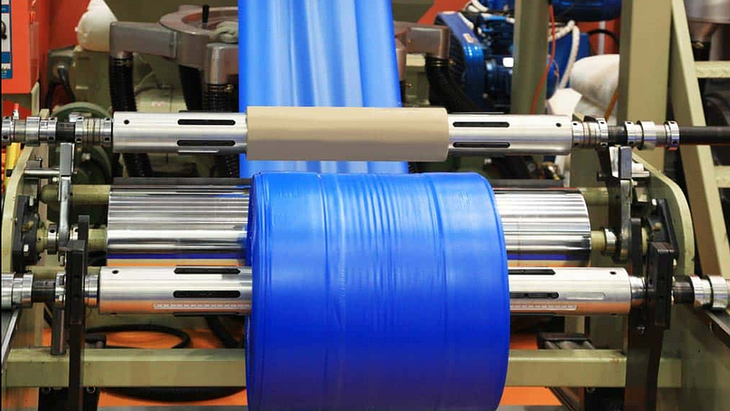

Plastic industry

The industry had fallen around 15% in April 2024.

In April 2024, Industry and commerce had fallen around 15%, while construction had done it up to 25%from the initial government adjustment.

Wholesale sales accumulate a drop of 21%

From the beginning of the administration, the accumulated fall remains close to 6%, while Wholesale sales continue to decreasewith a decrease of 21%. This dynamic could indicate that supermarkets are selling accumulated stocks in previous periods, without replacing them through wholesale purchases due to the uncertainty of future demand.

On the other hand, the UBA Research Center emphasizes that The use of credit cards for supermarket purchases increased by 8 percentage points (PP)since it went from representing 39% of sales at 47%, which would show that families are resorting to indebtedness to acquire food, essential items and cleaning products.

Source: Ambito