The founder of the Mercado Libre resumed one of the foundational axes of the libertarian ideology by publicly requesting the closure of the BCRA. The statement revived the discussion about fractional bank.

The businessman Marcos Galperinfounder and CEO of Free marketrevived one of the most controversial debates of libertarian space by manifesting openly in favor of the closure of the Central Bank of the Argentine Republic (BCRA). “Closing it is the way”, He wrote in his X (former Twitter) account, in response to an economist analysis Ramiro Castiñeirawhich praised the latest reforms in the monetary entity.

The content you want to access is exclusive to subscribers.

The post did not go unnoticed. Castiñeira had described as a “Impressive institutional upgrade“To the new operational scheme of the BCRA, stressing that, for the first time in decades, the institution has” full control of primary money “. Galperin, far from celebrating the institutional progress, was blunt: close the BCRA is still the best option.

The entrepreneur’s position not only reopens a technical discussion of high complexity, but also puts one of the foundational promises of President Javier Mileiwho during the electoral campaign promised, in a provocative tone, “Dynamit the Central Bank” as part of its monetary reform and fight against inflation program.

Screen capture 2025-07-21 085912

Replica and counterpoint: Maslatón replied

Galperin’s statements generated a quick and detailed Liberal lawyer and analyst Carlos Maslatónwho explained why he considers the elimination of the Central Bank to the modern financial system unfeasible. “As long as there is a bank credit system that multiplies money, You need Central Bank, Lace and Salvage Regulation To prevent bank runs, ”said Maslatón, in a defense of the stabilizing role of the monetary authority.

The lawyer went further and used as an example Galperin’s own company: “What makes free market remunerating deposits at will and lending money, that is, creating and multiplying bank currency, it could not exist without a central bank”, He rebuked him, leaving the apparent contradiction between the Fintech business model and the entrepreneur’s radical position.

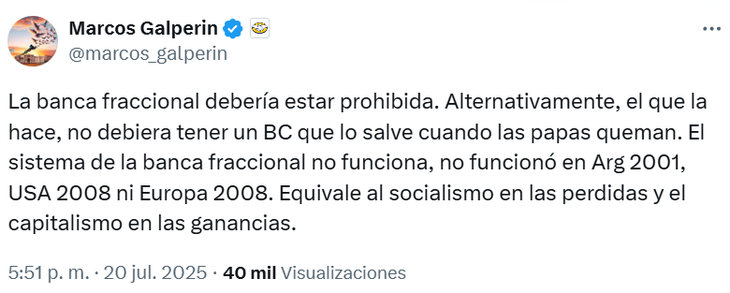

Marcos Galperin insists: “Fractional bank should be prohibited”

Far from going back, Galperin redoubled the bet and signed up directly against the base of the current banking system: Fractional reserve bank. “It should be prohibited. Not working”He said, and cited as emblematic examples of his structural failures the Argentine crisis of 2001 and bank bankruptcies in the United States and Europe during the financial crisis of 2008. In his opinion, it is an unfair system that socializes losses and privatizes profits: “Socialism in losses and capitalism in profits”wrote.

Embed

Galperín, to close the Central Bank the monetary system has to be like that of the Bitcoin or the classic gold pattern, without the possibility of secondarily multiplying the money or without monetary aggregates. While a deposit can become more credit than that same …

– Carlos Maslatón (@carlosmaslaton) July 20, 2025

A background discussion in the heart of the model

Galperin’s pronouncement is not less. It is one of the most influential entrepreneurs in the country, a reference for innovation and closeness with the ruling party, which Put one of the most radical ideas of Javier Milei’s economic program on the table again: The elimination of monetary authority as a previous step to an eventual dollarization.

Although during the first months of management the government adopted a gradualist strategy and left aside the disruptive ads in monetary matters, the public support of private sector figures such as Galperin could reactivate the debate in technical and political circlesespecially if combined with advances in the sanitation of the BCRA balance.

In a moment of economic transition, with focus on disinflation, the accumulation of reserves and the state reform, the debate on the role and existence of the central bank itself Follow latent. And this time, who turned on the fuse again was not a politician, but one of the most admired businessmen – and controversial – in the country.

Source: Ambito