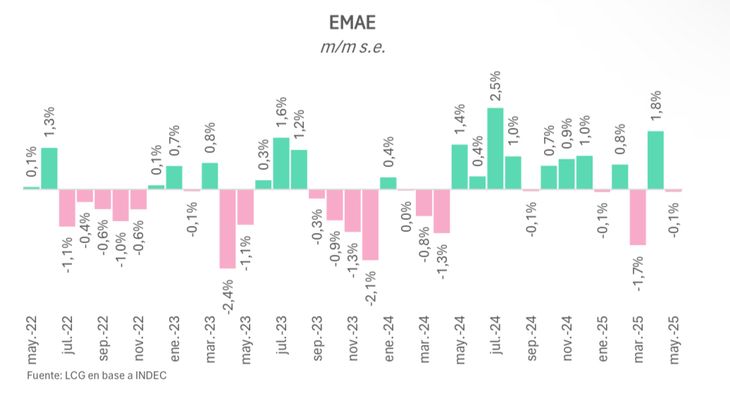

Production enters the second semester with fatigue signs. The data of May of the Monthly Economic Activity Estimator (EMAE) confirmed that The economy has been stopped since March. With this backdrop, the second half of July arrived with Strong volatility of interest rates After the Elimination of the Lefis, which Add uncertainty Regarding the evolution of productive dynamics.

The abrupt rise in rates began the July 10 After the disarmament of Fiscal Liquidity Letters (LEFIS)that until then offered a annual nominal rate (Tna) fixed 29%.

The elimination of the instrument first generated a contraction, but then -With the reappearance of passive passes as an absorption mechanism– The market experienced a jump.

So, Short rates quickly climbed 36%while the Treasury validated an internal annual effective rate (TIRA) of 45% in a debt tender in pesos out of calendar. In addition, this week the Cautions stock market They flew to 80% TNA, and then retreat more than 20 percentage points.

industrial.jpg

The industry could suffer the blow of the volatility of the rates.

Altered rates

In parallel, The official dollar rose 3.1% In the last four and a half weeks, also reflecting the new balance sought by the Government. According to the analyst Christian Buteler, consulted by this means, the rates should go back from their current peaks, even if they will maintain “Something volatile”As for the dollar, he projects that he will move Between the center and the roof of the band of official flotation in the remainder of 2025.

Under this panorama, which worries analysts is the very volatility of the scheme and its impact on the activity. The economist Adrián Yarde Buller He warned this week from his X account: “May EMAE confirmed what they had already anticipated other indicators: the recovery of the activity entered a pause. In July, the strong rise of real interest rates hardly helps. ”

Rates and risk for economic activity

In line with that diagnosis, the economist and director of CP Consultant Pablo Moldovan He pointed out that the credit, which until now worked as the only impulse channel, is increasingly deteriorated. “The rates They were already high, and now they went above. This puts a recessive impulse to the scheme that is very complexeven more so in the election year, ”he said in dialogue with this medium.

In addition, he argues that the government still fails to consolidate a new monetary policy regime. “The lack of a clear reference rate and The pressure on banks add a volatility layer that moves to the entire economy, ”says Moldovan.

The economist Juan Manuel Telecheaon the other hand, he relativized the short -term impact but agreed on the risk. “What dominates today is noise. One day rate rose to 80% and dropped to 35% in hours. But if the rates are stabilized above 35%, the effect on the activity will be inevitable, ”he explained.

A recent report of Criteria He also points out a messy exit in search of the regime change: “The ‘Price Discovery’ process was erratic and messy. Without a clear signal of the BCRA, the market pressed on the exchange rate in advance”, Says the document. The Government, according to Criteria, is not willing to validate an inflation acceleration, and that is why it redoubled the effort to absorb weights of the system, although that implies to stop the economy.

1C353891-E259-475C-8C23-E92891B189C6

That brake is already glimpsed in the latest data. The LCG consultant warned that the activity in May did not grow over the previous month and that since December accumulates an increase of just 0.7%. Although year -on -year growth was 5%, almost everything is explained by the “Statistical drag“After the initial recovery.

For the rest of the year, LCG projects a 5% growth of GDP, but 4.7 percentage points would come from that drag, which would mean that The economy would not grow genuinely in this second semester.

Among the June indicators, the signals are mixed: the consultant indicates that They improved VAT DGI, pledge loans and import assets imports, But retail sales, check tax and card loans fell. In key sectors such as construction and industry, the data still does not give certainty of a sustained recovery.

Source: Ambito