In a federal country, such as Argentina, the way in which resources are distributed between the nation and the provinces It is not a simple issue: it is one of the master keys of economic development and balance in public finances. However, Law 23,548, which regulates the federal tax co -participation, It was sanctioned in 1988 and It was never reneweddespite the mandate of the National Constitution of 1994.

In recent weeks, this issue was evident, for example, with the case of Mercado Libre with the province of Santa Fe in relation to gross income. A few days ago, the e-commerce company and payment services made a statement in which he expressed his decision to increase commissions to the sellers of his platform in Santa Fe, Córdoba and Jujuy, arguing that in those provinces he weighs a greater tax burden. But the problem is greater than this specific case.

The Study Center Found published the report “Towards a new Federal Tax Coordination”prepared by Agustín Lódola, Guido Zack and Cynthia Moskovitswhich offers a forceful diagnosis on the limits of the current regime and a Comprehensive reform proposal. The thesis of this study is that federal fiscal uncoordination constitutes a permanent source of “inefficiencies, inequities and economic uncertainty” and is a fundamental part of the lack of sustainability of public finances.

A outdated system that deepens inequalities

In Argentina, the differences between provinces not only respond to geographical or historical aspects, but also to a system of Transfers that do not compensate asymmetries in collection capacityprovision of natural resources or spending needs.

According to Argentina is the third country with the greatest territorial inequality between 42 cases analyzedonly behind Russia and Slovakia. While the Autonomous City of Buenos Aires has the highest GDP per capita in the country, Formosa generates just 10% of that value. The distribution of natural resources – which the constitutional reform of 1994 declared the property of the provinces – also accentuates these gaps: jurisdictions such as Neuquén, Santa Cruz or Chubut receive income for royalties That other provinces do not have, which introduces volatility that complicates the countercyclical fiscal policy at the national level.

Institutional architecture and its failures

Argentine fiscal federalism combines elements of different international models. There are exclusive federal taxes (such as export rights), concurrent taxes between Nation and Provinces (such as VAT) and own provincial taxes (such as gross income or real estate). However, the heart of the system remains the National tax co -participation: a distribution mechanism that, since 1988, is maintained by successive automatic extensions.

The 1994 constitutional reform established that a new law should be sanctioned before 1996, with an agreement between all provinces, Congress and local legislatures. That consensus was never reached. The result is a system that does not reflect the current functions of the State, nor does it contemplate the existence of new provinces (such as Tierra del Fuego) or the autonomous status of CABA.

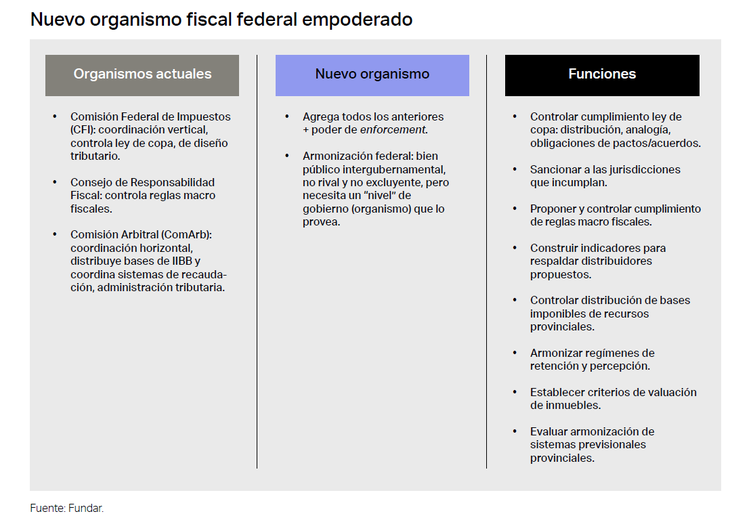

In addition, secondary distribution – that is, the distribution between provinces – is not based on objective or transparent criteria. And, as founded, There is also a federal tax agency with sufficient power to supervise or coordinate the operation of the systemwhich has resulted in a “tax anarchy” with multiple overlap and litigation.

Screen capture 2025-07-24 093906

Percentage of resources participation according to each province. Source: Found

Transfers, pacts and patches: recent history

In the absence of a new framework law, The fiscal coordination system was sustained on the basis of fiscal agreements, consensus and bilateral agreements between Nation and provinces. Between 1992 and 2021 at least eleven fiscal pacts were signed, with unequal effects and in many transitory cases. Some sought to finance pension reforms, others tried to harmonize provincial taxes or compensate imbalances such as the Conurbano Fund.

To this discretionary transfers were added, the creation of non -co -participible taxes (such as the country tax or withholdings), and a growing judicial litigation between the nation and the provinces, especially since 2015. The result has been a fragmented, unstable scheme and without a strategic vision.

The proposal to found: a new federal tax coordination

Faced with this panorama, Fundar proposes a road map for structural reform. Central guidelines include:

- Redesign the primary distribution of co -participible resources between Nation, Provinces and a new actor: the pension system, which would be assigned a specific portion of the co -participible mass.

- Establish objective criteria for secondary distribution between provinces, including population, basic needs, fiscal capacity and public services provision costs.

- Create a federal tax agency, with technical participation and political representation, in charge of monitoring, coordinating and sanctioning breaches of the co -participation regime.

- Harmonize provincial taxes, especially those that affect interjurisdictional competitiveness and generate distortions, such as gross income or stamps.

- Incorporate normed flexibility to the system, so that it can automatically adapt to economic, demographic or social changes without the need for permanent reforms.

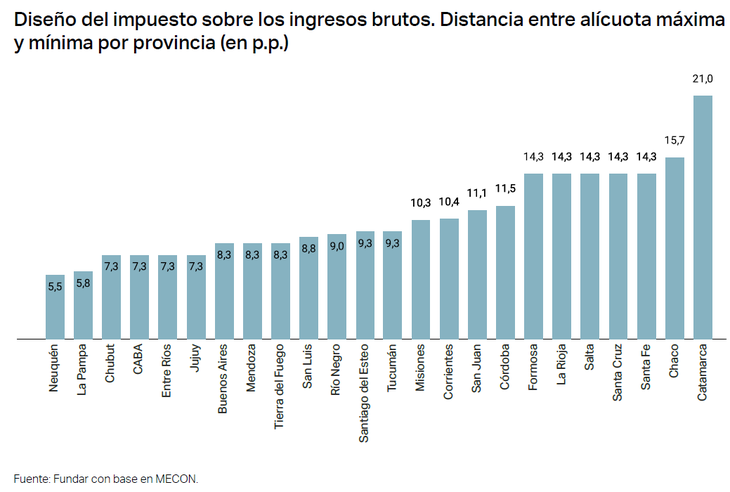

Screen capture 2025-07-24 094027

The disparity of the Aliquot of Gross Income (IIBB) according to each province

International models: what can be learned

The report analyzes experiences of fiscal federalism in countries such as Australia, Canada, Germany and Switzerland. In these cases, there are income or cost equalization systems that seek to guarantee minimum standards of public services and compensate for territorial gaps.

For example, Australia has the Commonwealth Grants Commission, an independent body that evaluates the fiscal capacities of each state and defines transfers to match opportunities. In Germany and Switzerland, transfers include horizontal components (between states) in addition to vertical (from the central government). Italy and Spain have also advanced towards distribution formulas based on updating data and automatic mechanisms.

In these experiences, the report points out how asymmetries were reduced in these countries, for example by mentioning these alternatives:

- Income equalization: a representative system is applied, with the same definition of bases and aliquots, to determine the tax capacity of each State, being able to include some or all taxes collected at the subnational level.

- Cost equalization: The objective is that jurisdictions can offer a basic level of public services.

- Equalization of gaps: Gap-Filling, which combines the two previous criteria.

Reform as an opportunity (and political challenge)

The sanction of a new co -participation law will not be simple. Requires one majority qualified in the congress and the endorsement of all provinces. The tensions between jurisdictions with high income and those most dependent on transfers are real. The background of frustrated agreements and the electoral logic that often interferes with the structural reforms also weighs.

However, Fundar argues that moving towards a new tax coordination regime is not only desirable, but essential to order public finances, reduce litigation, promote productive investment and guarantee greater territorial equity.

As the document concludes: “The Coparticle Law, subordinated to the National Constitution and what the federal tax agency that is mandated to institute, is erected as the main Federal Coordination Standard. The sanction of a new law is not exempt from obstacles, But it is a crucial opportunity to strengthen commitments and define the relegated federal fiscal coordination. ”

Screen capture 2025-07-24 094619

Source: Ambito