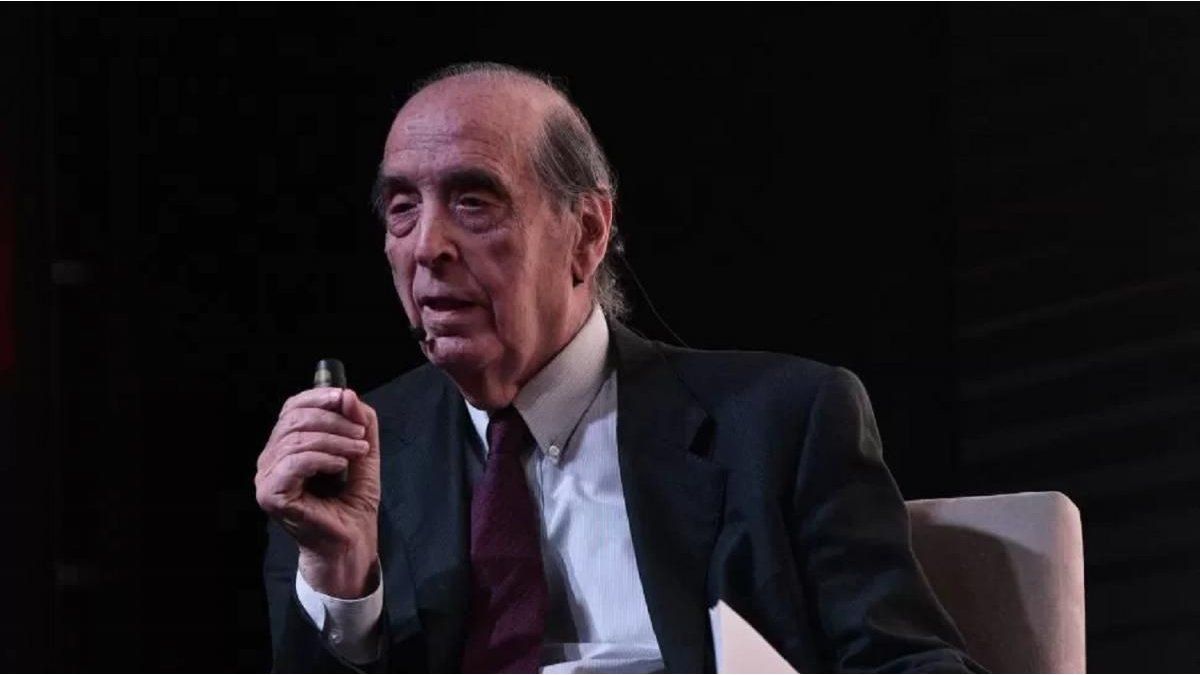

Economist Ricardo Arriazuhe presented his vision of the macroeconomic situation during a presentation before the SYC Investments Investment Committee. In his exhibition, he addressed key issues such as exchange rate, inflation, central bank reserves (BCRA) and the evolution of economic activity.

About him future of the dollar, In the middle of an election year, the founding partner of Arriazu Macroanalistas explained that “The government is not satisfied with a dollar to more than 1,300” And in that sense he predicted that the BCRA will use “all the instruments it has” so that the value of the currency does not rise Towards the ceiling of the flotation band.

Arriazu’s analysis on the dollar

During his presentation, Arriazu stressed that liquid reserves —Without counting the Swap with China, ”they ascend to U $ 27,000 million. In that context, he said: “It is the silver it has to face capital maturities of less than US $ 2,000 million here until the end of the year. Therefore, here the game is not played. ”

As for the Current exchange regime – with the band scheme –explained that, after the agreement with the IMF, the effective exchange rate for exports increased 2%, while for imports it did in 8%. At the same time, he pointed out that the real exchange rate “16.7% was devalued since the end of last year.”

Dollars

The future of the dollar and the role of the BCRA: the foci of Arriazu’s analysis.

Although the Central Bank does not explicitly intervene in the Mulc, the economist said that “the central will not let the exchange rate rise far beyond $ 1,300 using all the instruments it has.” The upper scheme band is today at $ 1,414.

“The government is not satisfied with a dollar to more than 1300. It is my impression. MIn the black swan of the elections exists, Argentina will maintain a high country risk. The government has all the tools to sustain or lower the dollar. He has a lot of back, ”he said.

In this sense, Arriazu analyzed the behavior of the financial market after the lifting of numerous restrictions of the stocks. “The purchase of foreign exchange by individuals was significant after the opening of the stocks, with near U $ 3,000 million dollars going to deposits. This demand requires pesos, and deposits in pesos and dollars have grown. In the money market, the decision of the Central Bank of drawing the Lefis left 10 billion pesos in the market, which collapsed the interest rate. Given this situation, the Central Bank intervened vigorously, carrying the interest rate to the cloud, ”he deepened about the current currency demand.

In that context, he pointed out that the elimination of financing letters (Lefis) left “$ 10 billion” in the system, which caused a collapse in the interest rate. Faced with that scenario, the BCRA “intervened vigorously, carrying the interest rate to the cloud.”

The analysis of inflation and economic activity

Beyond the value of the dollar, the economist also examined the evolution of prices. Thus, he explained that the Inflation slowed down in recent months, with 1.5% records in May and 1.6% in June. In this context, Arriazu warned: “Everything related to labor is rising. Much more than food.” For July, he projected an index “also below 2%.”

Regarding the level of economic activity, he pointed out that the Monthly Destationalized Indicator “in the month of April reached the maximum absolute historical level ”, although he clarified that the rebound is “tremendously heterogeneous.”

Thus, he highlighted the rise of sectors such as Sale of refrigerators who, as stated, advanced “Like 100%.” In the same group he also remarked the automotive industry, thanks to the granting of “Credit and with quotas”

Despite the hopeful analysis, Arriazu focused on the Sustainability of that rebound: “Many of these things are not going to be repeated. The refrigerator is bought for once, a car for once and is renewed every so often. Tourism already gave themselves“In turn, he mentioned that the rate rise and the growth of deposits in dollars above the credit in that currency are” cooling the economy “and causing a” low of aggregate demand. “

Of face 2026, Arriazu anticipated a recovery of the value of the harvest, Favored by soil moisture, the presence of a “modeling child” and the decline in retentions.

Source: Ambito