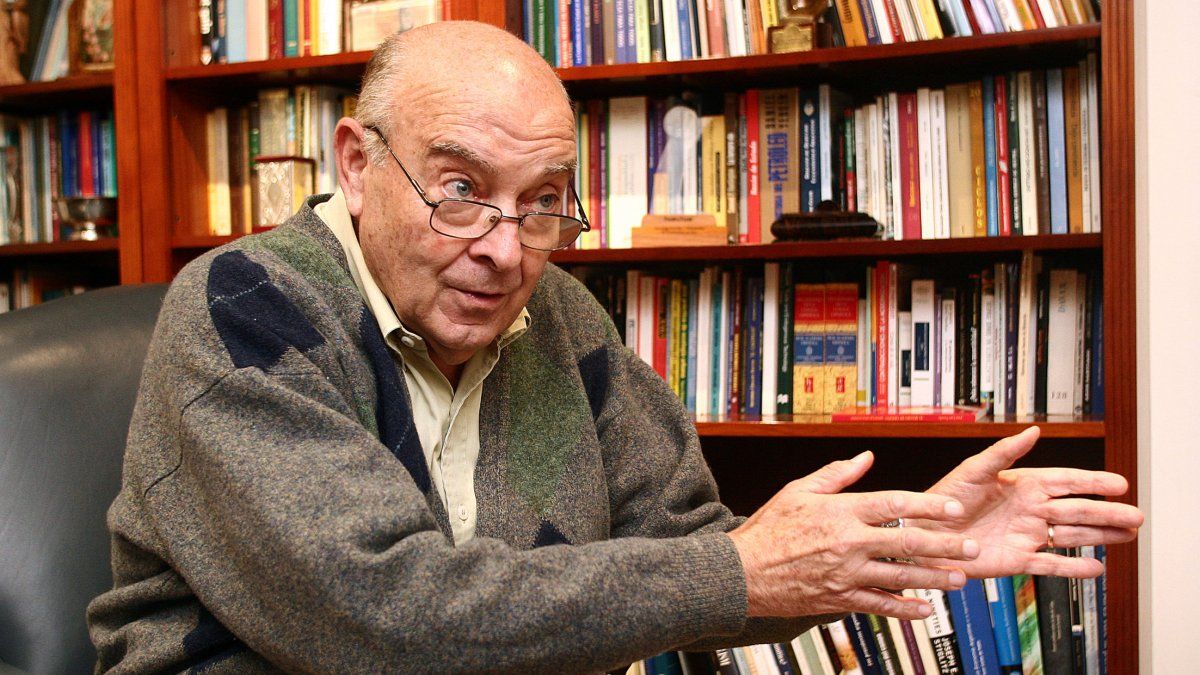

The stability of exchange rate It became, once again, the backbone of the Argentine economic agenda. He dollar growth In July, he promoted public appearances of the Government Management Team, which seek to appease the behavior of financial actors while the values remain among the Band margins. That is the context in which the former minister Domingo Cavallo He rehearsed on the current scenario of the national economy.

“While the partial output of the CEPO produced an initial exchange rate of 10%, which gradually approaches 25%, The trend of the inflation rate has not varied And around 2% monthly is maintained, “he said in his personal blog, where he pointed out that”The level of activity That, despite large sector differences, it had recovered until the first quarter of the year, according to the most recent indicators, He is tending to stagnate. “

To that reading, he added an interpretation of the situation of the financial order: “The problem, which was not expected by the economic authorities, and that worries, is that The country risk rate has not fallen sufficiently and the interest rates that the treasure has to pay to renew the maturities of its debt in pesos has increased significantly in real terms. “” There is no improvement of the balance of the current account of the balance of payments, which remains negative and does not reach to be compensated by the net capital of capital, “he added.

Milei Caputo Bausili Daza Furiase.jpg

Milei with his economic team.

According to his gaze, this is explained because “aThe entire stock has not been eliminated And partly because there is not enough for companies. This matters because companies and financial entities are those that can mobilize large amounts of capital and are very sensitive to the risk of being trapped without exit when they have to decide if they bring dollars to the country. This means that, despite having eliminated part of the restrictions (stocks), It has not been possible to consolidate a climate of monetary and exchange stability capable of underpinning the sustained recovery of the level of economic activity“

Then, Cavallo understood that there is “the preference of the rules over discretion”: “This means whatAnd the first thing to do is establish the rules of organization of the system that allow operators, to be able to predictor at least understand the steps that the government is taking to achieve its objectives. In this matter, there is still a way to go. “

“Some of the monetary policy decisions are difficult to understand and explain. Since the introduction of the concept of ‘expanded monetary base’ and ‘endogenous dollarization’, the elimination of the passes and the replacement of the LELICS by the Lefis to get the interests of the accounts of the Central Bank and pass them to the Treasury. And finally pay the Lefis with issuance of the Central Bank. This lack of clarity about instruments and times is perceived as a discretion in monetary management And it has surely contributed to monetary and exchange volatility, “he said.

Within that framework, he pointed out that “maintaining the restrictions that severely prevent or limit financial intermediation in dollars and the convertibility of the weight, while The treasurement of dollars of people and tourism abroad is facilitated, it also does not contribute to the stability climate“Then, he understood that” I know It feeds the expectation of an additional devaluation jump to the already produced. That expectation discourages capital entrance that is not Carry Trade and leads to interest rates in pesos tend to increase. “

Dollar: They estimate that the exchange rate almost ceased to be late

The recent rise from Official dollar value leaves Argentina in a much better position than the one I had seven months ago to face your own competitiveness problems. The correction that was carried out, more than anything in July, He left the real multilateral exchange rate (TCRM) slightly below the historical average.

This was stated by the strategist Chief of Cohen Financial Allies, Martín Polo, In a talk with investors. “We have to real exchange rate against the dollar rose 10% and If we take Against the basket of our business partners, we are closer to a gain of 20% than the truth is a lot ”, Pole pointed out.

The market analyst considered that “It was not in our calculations that the real exchange rate could improve 20% in just 7 months.” With that strong correction of the distortions that the dollar had “cheap”, In Cohen they hope to see that with these exchange rates more exports and more foreign currency financing are encouraged And demand is discouraged, either via imports, less demand for services and the formation of external assets.

Taking like Base the real exchange rate of December 17, 2024Cohen’s analysis indicates that the exchange rate against the dollar is at a 103 level, while the average of 30 years is closer to 110.

Source: Ambito