The accumulation of reservations held by the Central Bank of the Argentine Republic (BCRA) is One of the issues that most worries the International Monetary Fund (IMF) As results from the last report of the agency referring to the first approval of the Argentine program. So much so that It eventually recommends the flexibility of exchange restrictions for the sake of accumulating reservations and proposes that the BCRA establish a currency purchase scheme.

The IMF indicates that net international reserves were located in a negative field of 4.7 billion dollars at the time of the first program evaluation (last June 13) “Well below from the floor of the program of -1,100 million dollars ”.

However, the fund recognizes that the government is carrying out corrective actions To increase reservations, consisting of bond emissions and currency block purchases that have increased reserves by around 2,000 million dollars since the beginning of June.

AND “It projects that net international reserves will be further strengthened until the end of July, as well as during the rest of the yearsafeguarding the goals and objectives of the program ”.

Caputo, Bausili, Quirno and Georgieva.jpg

The government’s economic team together with the head of the IMF.

It is considered that, in the face of the future, the accumulation of reserves will also be supported by the Privatization and sale of public sector assets and concessions as well as for the continuous support of other official creditors. In this regard, it is recalled that on July 18, the authorities announced the privatization of the AySA Water and Sanitation Company, through the sale of the state shares in the power of the State to local and international investors.

For now, the fund indicates that “SAnd he hopes that the Central Bank will play a more active role in the process of accumulation of reserves, even buying currencies through a predictable schedule (as Chile, Colombia and Mexico did, in the context of their respective flexible exchange rate regimes) ”.

Confirming the anticipated Thursday by the Minister of Economy, Luis Caputo, the agency reduced the meta of accumulation of net international reserves by the end of December 2025. The objective is “to mainly reflect the initial deficits, which are being approached gradually through the agreed corrective actions”.

In this way, it is expected that The reserves would increase by 2025 by approximately 5.5 billion dollars compared to the start of the program (from -8.2 billion dollars to -2.6 billion dollars), generally maintaining without changes compared to the levels of end of 2024.

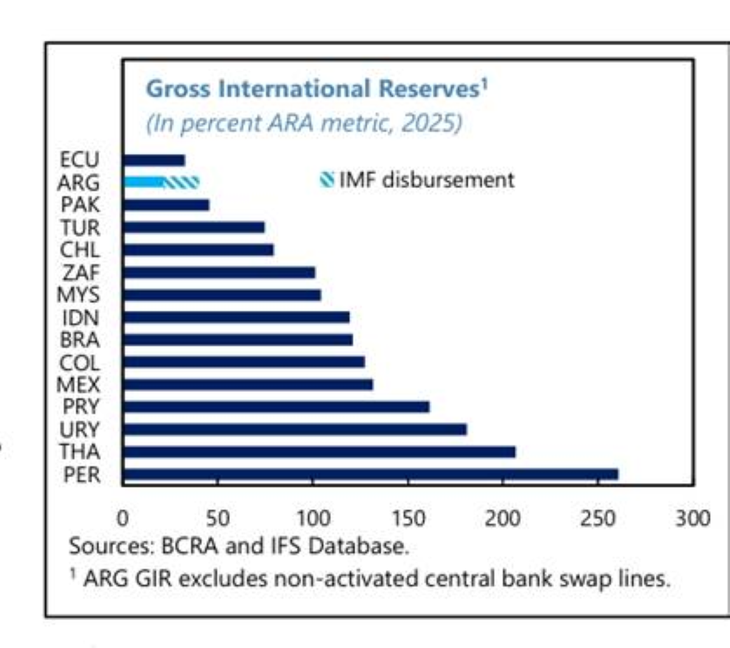

The fund expects the accumulation of reserves to accelerate even more from 2026 and that The original objectives of the program are achieved by the end of 2027.The expectation is that the reserves reach the end of the program at approximately the 100% of the Ara metric.

This acronym refers to ASSESSING Reserve Adequacythat is to say the evaluation metric of the adequacy of the IMF reserves used to Calculate if a country’s currency reserves are enough to meet the potential needs of paymentsparticularly during adverse economic conditions. It is a compound indicator that considers several factors, such as short -term debt, money in a broad sense and exports, to evaluate the vulnerability of a country to external shocks.

The forecast of the fund is that by the end of 2027 the country has net reserves for 22.9 billion dollarsbased on continuous access to financial markets and higher capital entries, including the continuous expansion of energy and mining exports.

Argentina FMI risk

Vulnerable

But, the agency expects reserves to keep relatively low in the short term (below 60% of what is necessaryaccording to the metric), “which will limit Argentina’s ability to absorb possible shocks derived from the growing external and internal uncertainties. ”

This context explains the statement of the fund in that “the flexibility of the remaining exchange rates will be carefully calibrated and expanded if necessary. The elimination of pending exchange restrictions during the course of the program, particularly in inherited dividend payments and commercial debt, would remain conditioned to continuous progress to reconstruct the reserves and alignment with the objectives of the program ”.

He adds that “although the renewed interest of non -resident investors in the local debt market is a welcome advancethe prudential regulation will continue to be agile to mitigate the risks of short -term volatile entries and possible exchange declines. ”

In this sense, it points out that bank supervision is also being improving, especially in a context of increasing doubtful loans. Meanwhile, recent measures aimed at promoting the use of US dollars maintained outside the formal financial system “They will be totally consistent with the rules against money laundering and terrorism financing (AML/CFT), as well as solid taxation and income administration.”

Meanwhile, and although it seems contradictory, the Argentina is a net creditor country in the world given that At the end of 2024 the difference between external assets and liabilities amounted to 59,000 million dollars (9% of GDP), by virtue of “A greatly positive net exterior position of households and companies (more than 200,000 million dollars) after decades of macroeconomic poor management, Often in the context of capital controls. ”

Source: Ambito