In the financial sector they see contradictions within the government itself. The automakers put first and another episode of the war between supermarkets and suppliers is coming.

The climbing of the dollar more than a month of the elections in the province of Buenos Aires lit the alarms in the government of Javier Milei. Behind the fake calm that the economic team officials showed in streaming programs, There were calls to banks, reproaches and contradictions. The automotive already highlighted and Supermarkets warn that the “noise of sabers” began to sound in battle with their suppliers for prices.

The content you want to access is exclusive to subscribers.

Although the government validated interest rates of the double expected inflation and the dollar was dangerously approaching the band’s roof, Economy Minister Luis Caputo insisted that everything march according to the plan: “Before the Kuka risk, some decide to cover themselves, it is nothing we have not expected,” he said.

Behind that comment Other explanations occurred: That the Congress with the Vice President at the head is putting in check the fiscal balance, that the Joseph Stiglitz Economy Award conspires against the government, that the banks put together a run and finally, that it was the treasure itself that withdrew the offer of currencies because it bought US $ 1.5 billion in recent days.

Screen capture 2025-08-02 at the 5.43.18p. m.

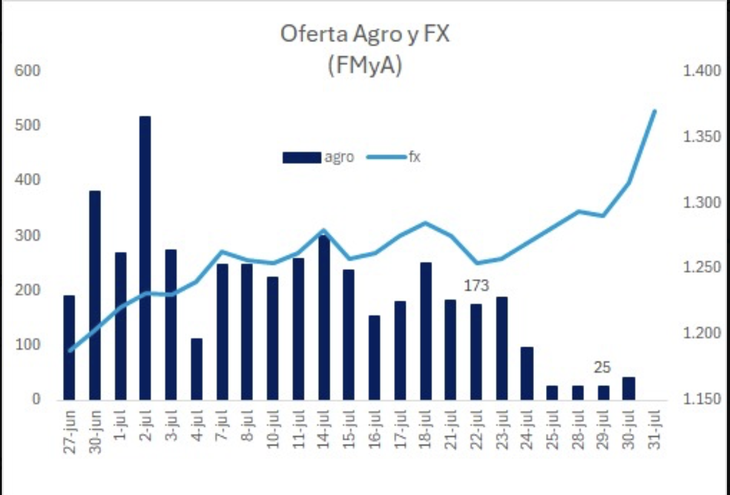

A no less fact that they forgot to mention is that After record liquidation in the first semester, the offer of agrodollars began to fall. The economist Emmanuel Álvarez Agis once explained it, the Dollar Soja type programs advance sales, but do not generate new dollars. That is, the currencies that were liquidated extra in the first semester, are the ones that will be missing in the second.

The calls to banks

Despite the calm that the economic team tried to convey, The BCRA quoted the representatives of some banks individually in the last hours. As explained by the protagonist of one of those meetings, at the meetings the managers of the monetary authority asked banks to stop “operating shortly” and go to longer instruments.

In the financial sector they see contradictions within the government itself: “They say one thing and they do another because two minutes after asking not to operate in short, they opened the window with high rates of Repo to suck pesos,” said the director of an entity consulted by scope.

Another of the contradictions pointed out by the financial sector is in the distribution of posts posts of the dollar. First Javier Milei pointed to a National Bank, but then Caputo and Bausili sought foundations in the disarmament of end of the month of international entities and the purchases of the treasure themselves that withdrew offer from the change market.

The “noise of sabers”

In the tonic that always, at every moment and circumstance “all march according to the plan”, Caputo celebrated that the increase of the dollar had so far a low transfer at prices. The preliminary surveys of various consultants agree that Julio’s inflation data will be around 2%.

But that was with the first jump that approached the price of the National Bank to the area of the $ 1,300. Already with the American currency approaching $ 1,400, the story could be another. The automakers were the first to correct the lists, the increases that before the dollar shoot were not going to exceed 3%, had a roof of up to 12%.

Intense days come because “The noise of the saber began”as one of the referents of the supermarket sector to scope told him. The reference points to the clashes, already common, among businesses that do not want to validate new increases and their suppliers that seek to transfer the rise in costs to prices. In mass consumption, the mother of all battles is disputed to determine the bulk of the transfer at prices.

Source: Ambito