Menu

Insolvency statistics: The strongest increase in company bankruptcies since October

Categories

Most Read

Prices, housing, the economy: What does the Olympics bring to the economy – and what doesn’t?

October 24, 2025

No Comments

Vehicle safety: Tüv and Co: Inspectors are finding more serious defects in cars

October 24, 2025

No Comments

The CEO of JP Morgan met with Argentine bankers and businessmen

October 24, 2025

No Comments

Supermarket sales fell in August for the fifth month in a row

October 23, 2025

No Comments

They project 3% for October due to the volatility of the dollar

October 23, 2025

No Comments

Latest Posts

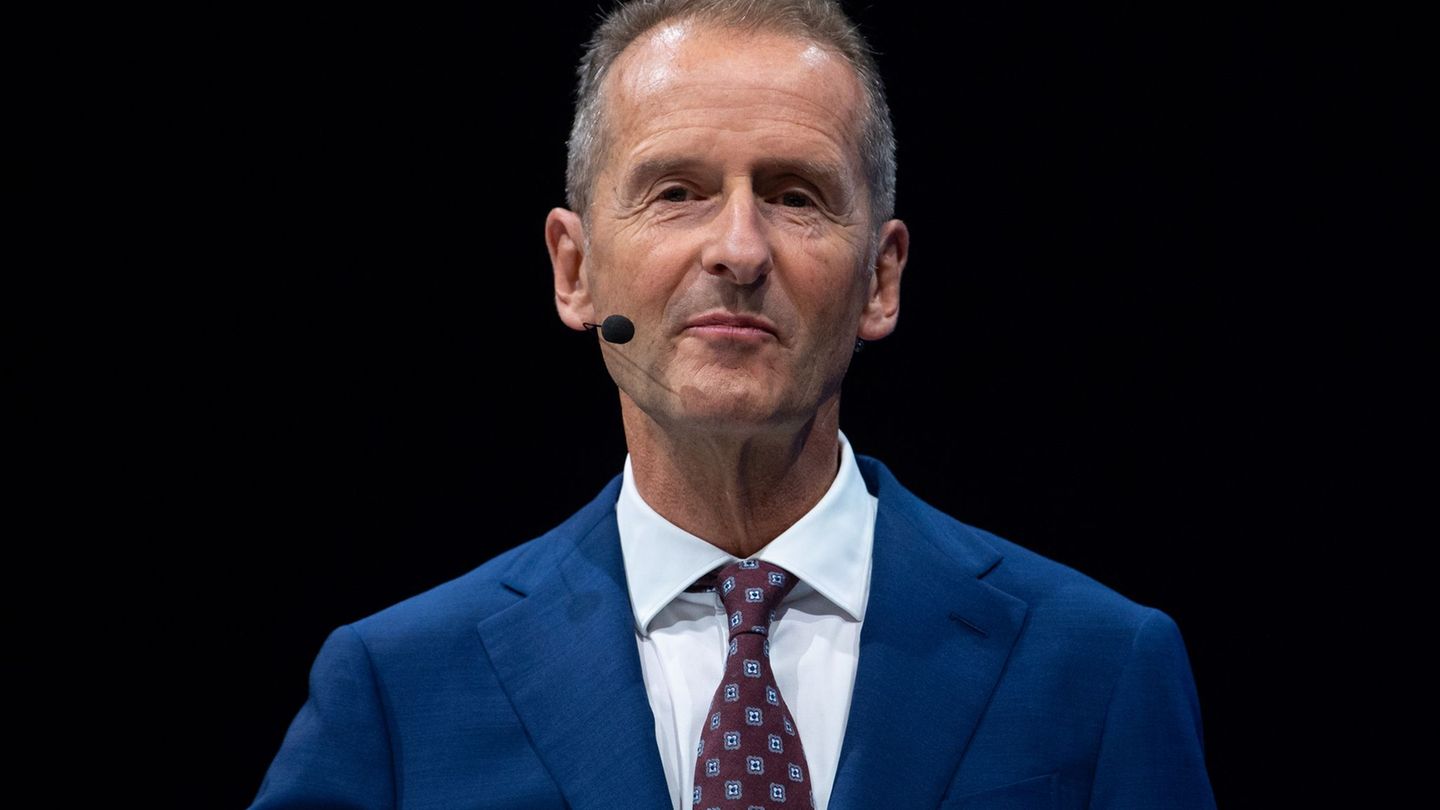

Retirement at 67: Herbert Diess finally leaves VW – retirement begins

October 24, 2025

No Comments

Retire at 67 Herbert Diess leaves VW permanently – retirement begins Copy the current link Add to watchlist He has not been at the top

Football: Survey: Majority does not believe in World Cup title for DFB team

October 24, 2025

No Comments

PierceI am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five

Prices, housing, the economy: What does the Olympics bring to the economy – and what doesn’t?

October 24, 2025

No Comments

Prices, housing, economy What does the Olympics bring to the economy – and what doesn’t it? Copy the current link Add to watchlist On Sunday,

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.