In an extraordinary tender for banks, it will try to get about $ 6 billion. They warn that there may be activity drop, financial tension and even transfer to financial cost prices.

He Ministry of Economy, Luis Caputo, will go on Monday to dry the pesos square through a new call to tender debt bonds outside the program. He will try to reabsorb a little less than $ 6 billion that were left out of the call last Wednesday.

The content you want to access is exclusive to subscribers.

To do this It will negotiate with the tamar bonds bankswhich are adjusted by the wholesale interest rate, which in turn will be accepted by the Central Bank to comply with the new lace standards For deposits in view already fixed term.

It is to remember that eLast Wednesday the treasure tried to renew $ 15 billion, putting a limit to the amount of bonds that could be bought as less than a month. But the renewal level was much lower than expected, of only 61%.

As indicated to Scope banking sector sources, financial entities They needed about $ 2 billion on Wednesday to comply with immobility standards according to the regulations in force until that moment. On Thursday the BCRA modified the lace and saveA would have to integrate another $ 4 billion.

But the entity directed by Santiago Bausili will allow them Use those tamar that the treasure will offer. As they evaluate it from the capital market, By accepting bonds as lace, in the BCRA it would be validating in return of paid liabilities, with the exception that in this case the interest will be paying the national treasure and not the governing entity of the financial system.

All that lack of COordination hit interest rates, which last Thursday reached 80% in the case of stock market couccion Already similar levels for the discovers of companies, which is the main route of financing of working capital.

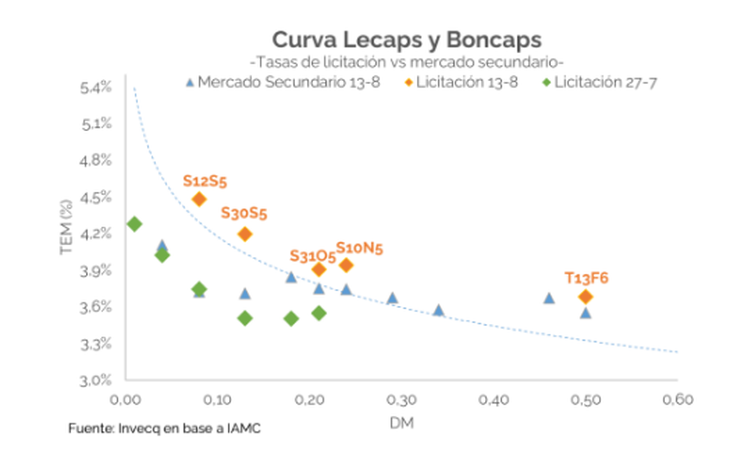

Lecaps curve

Maximiliano Ramírez, from Lambda Consultores He said that the government “does not feel very nervous to put rates at 60 70%”

“The government is aligned with a goal of avoiding a rise in the dollar, at the expense of breaking the payment chain, that there is a break in economic activity or that there is a slip with a problem further in the real sector, ”he explained.

In fact, some analysts Consulting by scope do not rule out that a part of the rise in the financial cost of companies can translate into a price increase. Although what is first expected is for companies to lower their production, in a second stage they would try to transfer the increase in financial cost at prices.

Invecq Consultores points out in his last “This scheme, could consolidate high levels of interest rates in the coming months -In a context where maturities still remain for about $ 9 billion in August-. ”

“While strategy BUSCA contain exchange pressures and anchor inflation, also increases the risk of greater deceleration of economic activity and that the government reaches the elections in a scenario of high financial tension, ”warns the report.

The market is still shown with little disposition to go in longer installments that exceed the electoral period. The fear is that after October there may be a modification in the exchange scheme.

Source: Ambito