Next, the full interview with Financial scope.

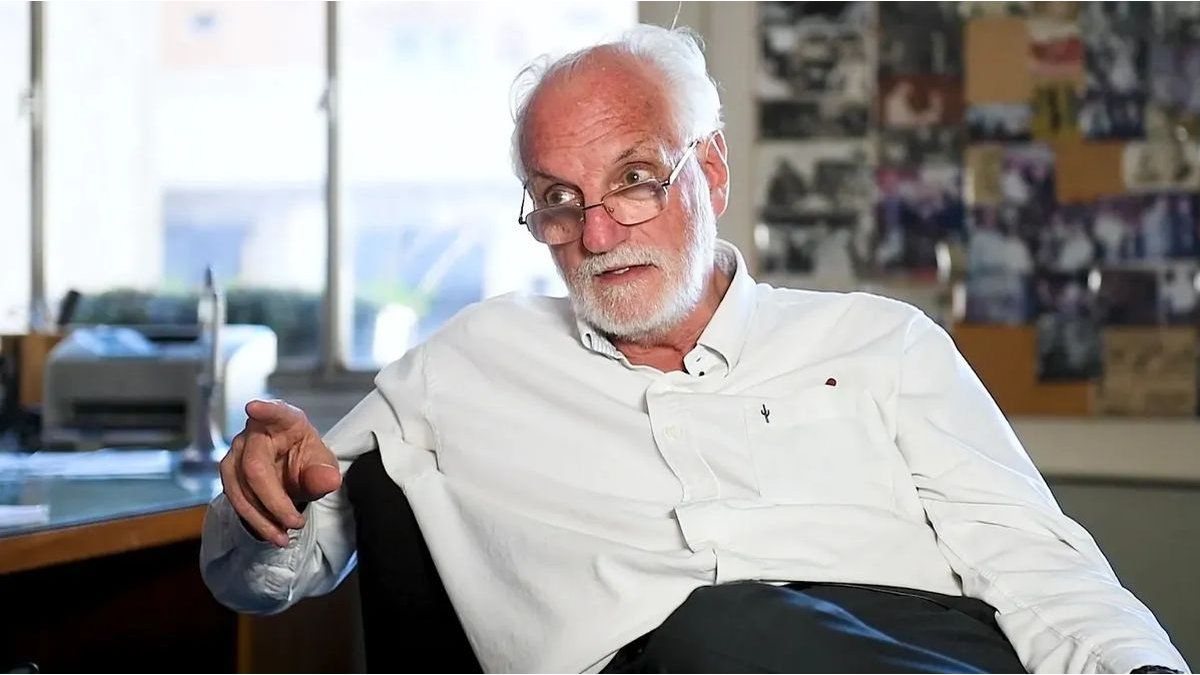

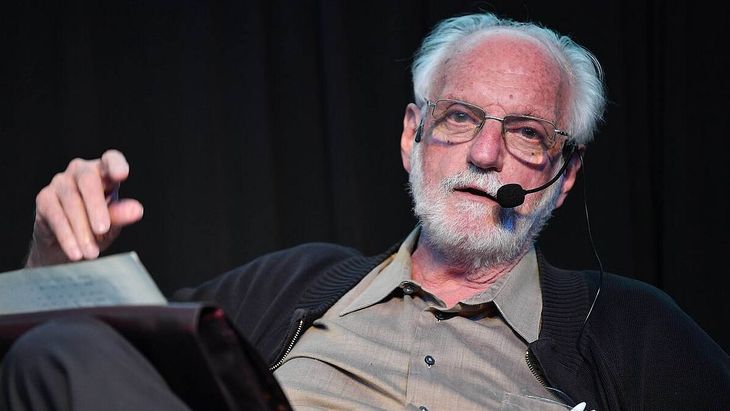

Juan Carlos de Pablo

The renowned economist is one of the voices that President Milei most hears.

Journalist: How do you think the market has been responding to the latest measures taken by the Government in terms of monetary policy?

Juan Carlos de Pablo: First, I am not an expert in this, but second: there is no way to know. That someone knows … I don’t believe it. Here what we are seeing is a trial and error scheme. The question is not whether mistakes are made, but at what speed they are corrected. From what is observed, it is a bracelet whose base seems clear to me: there is no deficit, there is no monetary emission of flow, which would be highly worrying. Obviously it seems to be a clip between pesos and dollars.

Q: Is that bracelet influenced by the electoral era or responds to programmatic issues of the model?

JCP: I have how to know.

Q.: In the last tender the government managed to capture 61% of the maturities, at a rate close to 70% in the short term. Do you worry that level?

JCP: More than worrying, I look at him as a professional. They are circumstantial limits. If a pizzeria changes the oven, that decision is structural. If someone buys a mattress in 12 installments without interest, it is conjunctural. The same goes for rates: they are transitory. If you are desperate, take the rate; If not, expect a little.

Q: Regarding the exchange scheme from October, do you think it would deserve a correction or continue with the exchange bands is the right thing?

JCP: I have how to know. If today the exchange rate is at $ 1450, what the Central Bank has to do is sell. You cannot change the criteria from Monday to another. Then what happens will be seen.

Q. When the exchange rate was around $ 1000 it was warned for its appreciation, but then rose to the $ 1,300 area. Is this a dollar more in accordance in this economic context?

JCP: There is no such thing as that. The same exchange rate that benefits an exporter, complicates an importer. Nothing is neutral.

The important thing is that we are in flotation regime. If someone wants to travel, he goes to the square, offers pesos and gets dollars. While the price is maintained below $ 1,450, it does not compromise the central bank rule. The qualifiers on the exchange rate depend on the situation of each one, but do not alter the exchange regime.

Juan Carlos de Pablo.jpg

The “teacher” of Pablo spoke with scope and analyzed the path of the government’s economic plan.

Q: In July inflation was 1.9% and economists say that the exchange rate has no correlation. Does it coincide?

JCP: First, the facts: in July the exchange rate rose 14%. According to past criteria, that should have generated an immediate transfer, and did not happen. I also don’t see it in the first days of August.

When I studied in the ’60s and ’70, we used Julio Olivera’s models on passive money, based on the descending flexibility of nominal prices. It was a principle to model, not a reality. Olivera himself said in 1964 that “the inflexibility of prices depends on the monetary conditions of the economy.”

Today nothing is validated. Moral: There is flexibility. Prices rise, they go down, correct, depending on the circumstances. It is not as linear as transferring everything at prices.

Q: Do you consider that there is a real risk of generating a certain collapse in the market if Peronism is doing well in the September elections?

JCP: I would like to specify what we understand by “market.” I guess we talk about dollar, titles and shares. To answer, I would have to know why people buy or sell those assets, and I don’t have that information. The rest would be pure imagination.

Now, in the face of mid -term elections, I heard two important things. Rosendo Fraga says: “As Milei has a new game, even if it goes wrong, it will have more legislators.” Carlos Ruckauf says: “Although Milei is doing well, he will not have an absolute majority.” Then, the second half of the period, if it is reelected in 2027, will be a gorge. The Executive Power aspires to have enough legislators to be able to block an eventual insistence of the congress in front of a veto.

In addition, for my poor knowledge of statistics, I tell you: let’s not waste time looking at surveys. When the vote intentions are very pair, there is no survey, why it is made, that anticipates the result. More than waiting, we will have to see what happens on the night of September 7 and in the morning of the 8, in the case of the province of Buenos Aires. And on the night of October 22 we will know who is who.

Q: On the unwavering fiscal surplus policy, is there the possibility of carrying out the projects approved in the Nation Congress?

JCP: When you are a deputy or senator belonging to a collegiate body. In those bodies the responsibility is diluted, no one is guilty. If these projects are put into practice and “fly everything for the air”, no legislator will feel responsible. That is the legislative logic.

Executive logic is another: Milei is not here to get material for a history book, it is to generate results. Then the bracelet is objective, and on top of the electoral situation. Economic policy is simple: it is fiscal. There is no chance that this changes. How will it achieve it? They don’t even know.

Q: The International Monetary Fund was in the country to review the program. Although the Government had not fulfilled the goal of reservations, the fund reduced its demand. Because?

JCP: Things never end, they continue. Recall that in 2018 Macri closed a political agreement for which they lent us 45,000 million dollars without technical foundation. In 2022 another agreement was negotiated, knowing that with our own effort we were never going to pay. The key today is the fiscal goal, and there the overly government. The rest of the goals are more flexible.

About reservations I have heard colleagues say that the BCRA should have US $ 100,000 million. What do you buy them with? With debt, with issuance or with fiscal effort? It is nonsense. And also, what happens if in 2027 another government wins and you spend them? It makes no sense. In exchange flotation, reserves do not serve to directly manage exchange policy.

Q: Does Argentina have chances of accessing external financing in 2026?

JCP: I have how to know, but I don’t have too much enthusiasm either. The Argentine history shows that a country like ours, when it gets access to international markets, patina is guided.

Q: It is usually pointed out that sectors such as oil and mining could contribute the dollars that the country needs. What reforms would be necessary to enhance these investments?

JCP: I am not an oil expert, but it is clear that this sector will continue to contribute. I also heard that exports linked to artificial intelligence and technology already arrive on 9,000 million, which is phenomenal. Argentina is not a monoculture country, and that is positive.

On reforms, you have to be specific. The labor issue, for example, is not resolved only by changing laws. There are also jurisprudence problems, judges, medical boards. If a union blocks a factory, that is already illegal. It is not necessary to change the law, but apply it.

In the tax, the same. You have to listen to specialists and design concrete measures. Economic policy has to be accurate. Generalities do not work.

Source: Ambito