SGR 2

Transversal support to SGR

The support of the system is massive and transversal. The Argentine Industry Union (UIA) and the Argentine Confederation of Medium Enterprises (CAME) They head support with 24 organizations that group more than 3,700 cameras and 650,000 SMEs throughout the country. The FECOBA, Paetac, Adimrabusiness chambers of Mendoza, Neuquén, Río Negro and Santa Fethe Federation of collectorsthe Industrial Union of the Province of Buenos Aires, Coninagro and the Professional Council of Economic Sciences. They also expressed their rejection of the elimination of the exemption the six Trade bagsthe markets Mav, Byma and A3the Securities boxmore than 30 Banks Nucleated in Adeba, Aba and Abehe National Bankand some 300 Fintech represented by the Argentina Fintech Chamber.

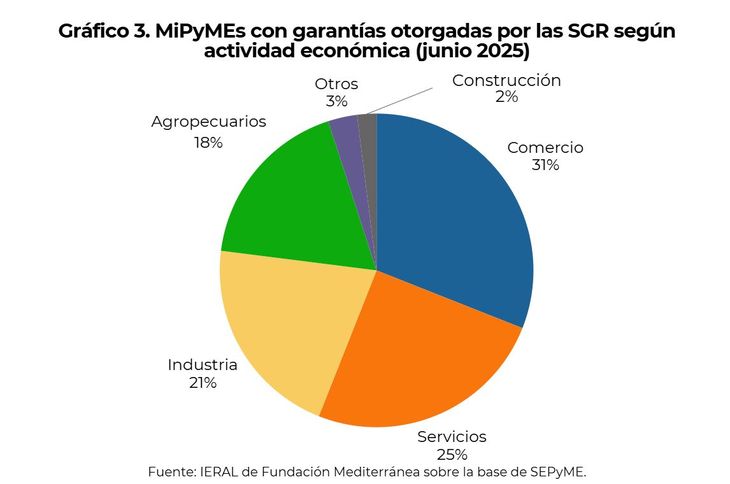

The numbers are overwhelming and vital for SMEs: last May, by case, the system granted guarantees by the equivalent of U $ 2,500 millionwith a strong bias towards the smallest firms, according to data from the Sepyme. In fact, 9 out of 10 guarantees are destined for micro and small businesses, and it is estimated that 1 in 3 SME loans in Argentina today has the coverage of a SGR, according to a survey of Mediterranean Foundation. The sectorial cast is diverse: in June 2025, the 31% of the guarantees went to commerce, 25% to services, 21% to the industry, 18% to agriculture and 4% to constructionaccording to Sepyme.

SGR 3

“If they eliminate the exemption, the system disappears,” said Rafael Galante, of growing SGR

“This system not only gives financing: it transforms a non -subject of credit into a credit subject. We tried it with 100,000 SMEs over 30 years. The cost is minimal against the spill it generates in employment, investment and taxes,” he said Rafael GalantePresident of Grow sgrwho had a talk with Scope in which he deepened why eliminating exemption means, in fact, The end of a system that has been promoting the financial inclusion of Argentine SMEs for three decades.

Journalist: This Wednesday Congress discusses whether he validates or eliminates fiscal exemption to the SGR. Why do you think this instance was reached?

Rafael Galante: What is resolved is of enormous gravity. We are talking about destroying a public policy that has been operating for almost 30 years. This system was born in the ’90s to solve a structural problem: to give credit to the smallest and most risky SMEs, those who do not have enough assets to offer as a guarantee. In these three decades he showed that he meets that role. I have trouble understanding why the idea is installed that “it does not work” when it is proven. In fact, neighboring countries that do not have SGR have visited us to learn from our experience. Instead of eliminating it, we should be discussing how to enhance it.

Q.: What do you feel behind the decision to repeal the exemption: ignorance or a deliberate plan to end the system?

RG: What we see, mainly, is a lot of ignorance. Some legislators said that SGRs do not pay taxes, which is false. We pay profits, VAT, gross income, social loads, like any company. The only thing that exists is the possibility of deducting from the income tax the contribution to the Risk Fund, which is what originates the guarantees. That is not a privilege, it is an incentive for protective partners to risk their capital for the benefit of SMEs. When one warns that level of ignorance in Congress, concern is even greater.

Q.: If the veto is rejected and the exemption falls, does the system stop working?

RG: Yes, without that benefit the system directly disappears. The protective partner leaves its capital immobilized for two years, assumes losses in case of default and tax for returns. If you also lose the fiscal incentive, you will not have reason to stay. He retires, and with him the financing goes to SMEs. And Remarco: it is not a fiscal spending problem. The Congress Budget Office has already demonstrated that the cost is minimal, just 0.027% of GDP. But the benefit is enormous: each guarantee has a multiplier effect throughout the chain -the SME that buys a machine, the company that manufactures it, suppliers, the taxes that are generated. The cost is insignificant against spill.

Q.: How does the impact of elimination dimension in specific numbers?

RG: The worst scenario is the disappearance of the system. Today a third of the PyME credit stock is endorsed by SGR. If the incentive is eliminated, that percentage will fall as the current operations are canceled. But there will be no new guarantees. That means that thousands of SMEs will be out of the long -term credit and reasonable rates. To give an example: before the July rates jump, an SME with endorsement could be financed at 30% or 32% per year. Without guarantee, that rate doubled and in some cases, such as current account agreements, exceeded the 65%. No company can sustain a 5 -year credit at 60% or 70%. The result is clear: less investment, less employment and less collection.

gallant

Rafael Galante, President of Grow Sgr.

Q.: Is there a plan B in case the veto is confirmed?

RG: No, there is no plan B. If the exemption is eliminated, the 46 SGR that operate in the country would have to close. That implies the loss of 2,000 direct jobs And, above all, the disappearance of more than $ 3 billion in productive financing. The impact would immediately feel on the real economy. Not only are thousands of SMEs run out of credit, the collection also falls, because each guarantee generates a tax spill that greatly exceeds the fiscal cost of the exemption. In short, it would be more expensive to close than sustain us.

Q.: What sectors concentrate more guarantees and would be the most beaten?

RG: We are present in almost all. Agro represents near the 18%trade a 31%the industry more than 20% And there is also participation in services and construction. Maybe where we have less is in mining. But the most important thing is that the 83% of our operations are aimed at micro and small businessesthose that have the most difficulties to access credit. That was always the reason for being of the system: transforming a “non -credit subject” into a “credit subject.” We have seen SMEs who received a guarantee ten years ago, paid their credit and then no longer needed because the bank considered them reliable customers. That is our real success.

Q.: How many SMEs have been benefited and benefited from the system?

RG: More than 100,000 at the system peak. Today there are some 43,000 with valid endorsementwhich support around 500,000 jobs. And we speak especially of micro and small, who represent more of the 40% coverage within the segment. They are not large companies, but family businesses with few assets, a rented place and a owner who does everything. They are the most vulnerable, but also the most important to generate employment in Argentina.

Q.: How did the Argentine SGR model originate?

RG: It is inspired by the European postwar period, particularly in Spain. There the SGR can be leveraged up to 8 times the risk fund. In Argentina the limit is 4. Today, with risk funds by $ 900,000 millionwe are endorsing credits for almost $ 3 billionwhich demonstrates the efficiency of the system. The difference is that in Spain the SGRs are cooperatives and do not pay taxes. Here we pay all taxes; The only thing that exists is the deduction of the contribution to the Risk Fund. In addition, all resources are invested in local instruments: ON, actions, public titles. We cannot buy foreign bonds. Everything is in the local market, which is small and needs financing.

Q.: Who are the main protective partners that contribute to the system?

RG: They are large companies, banks, stock market societies, multinationals and companies in Oil & Gas. There are also natural persons. An wage earner that charges a bonus can contribute, for example, $ 5 million to lower its load on profits. It is savings that is channeled in two directions: towards local financial instruments and towards guarantees that finance the real economy. It is a virtuous circle: the protective partner wins, the SME wins, the state wins.

Q.: If I had a minute to talk to legislators before the vote, what would I say?

RG: I would ask you not to destroy a system that works. It is perfectible, like everything else, but in 30 years it proved to be a valuable tool. The guarantees that we issue generate employment, investment and collection. Far from eliminating it, we should encourage it, as they do throughout the world. And if we talk about retirement, the only way to improve them is to create more work. For that we need SMEs that grow and risk capital. Every great company was once a small SME. And those are, precisely, the ones we help finance.

Source: Ambito