The Quantum consultant estimated the competitiveness gain for some sectors after the rise in the July dollar, taking into account the disposal of taxes.

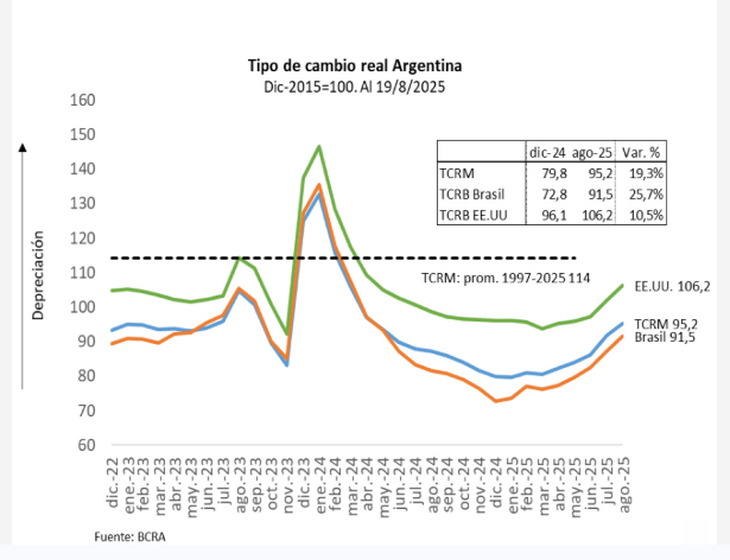

The real multilateral exchange rate 19% depreciated So far this year, a process that would mark that the dollar would have ceased to be “delayed.” But the reality is that if it compares to the previous situation that was to the partial exit of the stocks, This competitiveness improvement is different for each sector.

The content you want to access is exclusive to subscribers.

This is warned in your last report QUANTUM Consultant, who runs the economist Daniel Marx. There it is proposed that “the official actual multilateral exchange rate (TCRM) depreciated 19% so far from 2025, Bilateral with Brazil 26% and bilateral with USA 10%. ”

The report shows that “most of the movement in the multilateral It was verified in the period July – August 2025, with a real devaluation of 9%”.

TDCRM

“In the case of bilateral with Brazil, LA real depreciation in this last period is 11% (and 26% in the accumulated of 2025) and with the dollar the real depreciation is 9% in the period July – August 2025 (and 10% in the accumulated of 2025) ”, Expresses the study.

In real terms, the movements of the dollar and the instability of the financial markets raised as a collateral effect an improvement of the ability to compete of the local economy, when liquefy part of the costs.

“Looking from the perspective of competitiveness, It is observed that these variations at a general level are not homogeneous for all activities, ”says Quantum.

The consultant points out that it is necessary “Take into account the levels of comparative costs between the different jurisdictions and the effective exchange rates applicable in each case ”.

“When there were multiple exchange rates and different taxes for different transactions, The effective exchange rate was very different from the current one although this depends on the type of transaction in question, ”adds the report.

In this sense, he adds that the effect of exchange simplification on competitiveness for different types of transactions is different by comparing the current situation with that of the late 2024.

Dollar: Those who earn and those who lose

Quantum raises the situation of different economic actors and how the variation of the real exchange rate for each has influenced:

- Professional Services Exporter (CCL): The real appreciation leads to a loss of competitiveness of 7% in the comparison.

- Goods exporter (without retentions, dollar blend): Face a real depreciation of the Arsd/USD bilateral exchange rate of 4%.

- Soy exporter (with retentions, dollar blend): It has a 15% exchange competitiveness gain in the period.

- Importer (country tax, official dollar): The elimination of the country tax – it implies appreciation of the exchange rate for the importer – practically compensated the real depreciation of the official exchange rate (real variation of 1% in the comparison).

Source: Ambito