A recent report warned that Argentina “loses relevance” for foreign investments and American and European multinational companies, Despite exchange restrictions that generated “artificial” investment flows. In this scenario, the study warns that the loss of attractive investor is observed “Even within the regional plane.”

In detail, the study was prepared by professionals from the Interdisciplinary Institute of Political Economy (IIEP), under the Faculty of Economic Sciences of the UBA. The work analyzed the periods of 1999-2000, 2009-2011, 2020-2022 and the current situation.

Loss of attractiveness for foreign investors

As reported from the IIEP, the report analyzes the sales variables, added value, employment, investments and assets. In that sense, the first conclusion issued by the study to review different stages of modern history is that the country “It has lost attractive for foreign investments.”

The report, led by researcher Dr. Andréz López, explains that the balance of payments showed, since 2006, “great fluctuations in the flow of foreign investment, with peaks in 2012 and 2023, and minimum values in 2009 and 2016”.

WhatsApp Image 2025-08-23 at 15.08.07_668ae95c

IED income to Argentina, between 2006 and 2024.

“The Capital contributions averaged just US $ 2440 millionand observe a maximum in 2012 (US $ 4860 million) and a minimum in 2014 with an output of US $110 million. The reinvestment of profits, meanwhile, contributed on average US $ 5 billion annually, with a maximum of US $ 8000 million in 2015 and a minimum in 2008 (US $ 400 million) “details the analysis.

On the other hand, he adds: “The most striking evolution is that of Debt instruments, that on average contribute US $2330 million, and They show a maximum of US $ 153 billion in 2023 and a minimum with a negative of US $ 4730 million in 2016 (the result of the greatest normality in access to the change market in that year, which allowed the cancellation of accumulated debts by the EMNs). “

WhatsApp Image 2025-08-23 at 15.08.12_84c1e4b5

In this scenario, the report ensures that it would be difficult to “explain these fluctuations only from the evolution of the country’s macroeconomic situation.” Thus, the response you offer is that the changes are “intimately linked to the introduction of exchange regulations (generically known as” CEPO “) that affected the access to currencies by EMNs at different times, both to send profits to their matrices houses and to pay imports made by their subsidiaries in Argentina.”

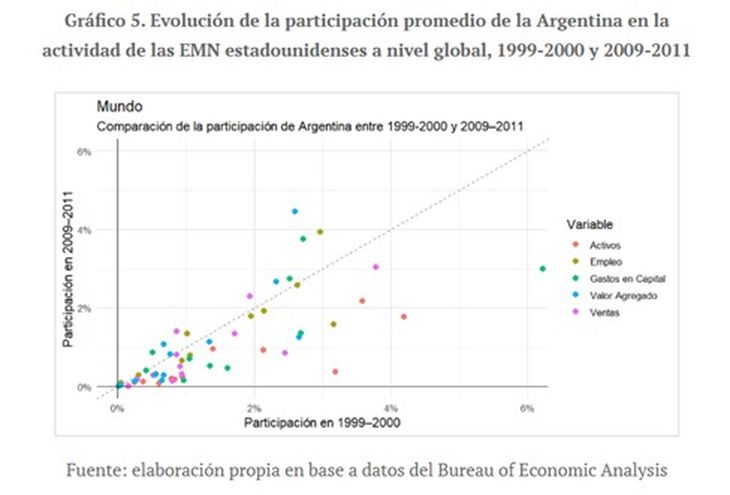

On the other hand, from the IIEP they detailed that the percentage of investments that our country received in the 90 fell dramatically in the following decade, from 1.71% to 0.48%, Raise to 0.6% in 2010 and return to the well -following biennium to the 2000 values.

Foreign direct investment in the country is currently low, if compared to the relative weight of the country in the world population (0.56%) and global GDP measured in purchasing power parity (0.7%).

Finally, the report concludes that loss of interest does not respond to a “Regional phenomenon“, but is mostly explained by the loss of” relative weight “of our country, during the analyzed period.

Foreign direct investment fell in Argentina during 2024, despite growth in the region

Little more than a month ago, a report by the Economic Commission for Latin America and the Caribbean (ECLAC) also warned that Foreign direct investment (FDI) in Argentina registered a strong fall during the last year. While in the Regional average a growth of 7.1% year -on -yearthe agency alerted due to the lack of dynamism in the arrival of new capitals, an indicator of the little attraction that the region represents today for international companies.

In the ranking of main ied receptors, Brazil led again with 38% of the total, followed by Mexico with 24%. Further back Colombia, Chile and Argentina were located, although in these three cases the income was lower than those of 2023.

Despite this general setback, Argentina stood out in the natural resources sector. In a context of lower weight of that area at the regional level, the country was the exception: investments in this segment grew 44% year -on -year, the greatest increase in Latin America, motorized by the expansion of hydrocarbons exploitation.

According to ECLAC, the advance was mainly driven by transnational firms already installed in the region, which increased the reinvestment of profits. In contrast, fresh capital contributions remain stagnant, a reflection of “the low interest of new companies to be located in the region.”

The statistics of the Central Bank confirm the trend: In 2024 the net flows were reduced 54% compared to the previous year, as it descended from US $ 23,866 million au $ 10,996 million.

Source: Ambito