Nielseniq’s report shows that, despite the reactivation in traditional supermarkets and channels, Argentine consumption does not yet rebuild the lost terrain and remains in historical minimums compared to 2017.

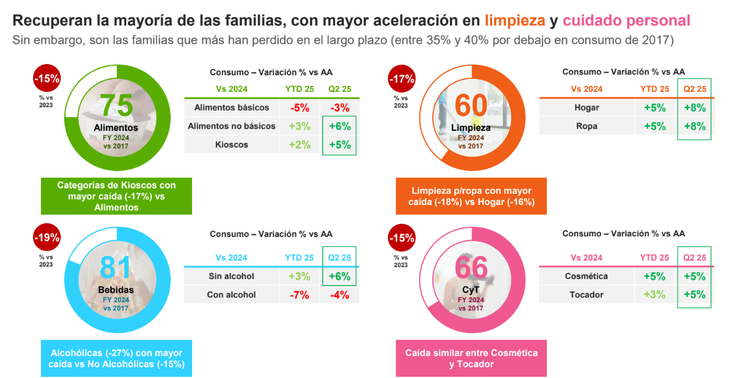

After the historical 2024 contractionhe Mass consumption He showed a slight recovery in the first semester. According to a private report, the basket of mass consumption goods (FMCG) grew 1.2% between January and June and could close with a rise in 3% in 2025. However, the consumption of several key categories remains between 35% and 40% below the 2017 records.

The content you want to access is exclusive to subscribers.

The report belongs to “Arg H1 2025” trends ”by Nielseniq (NIQ) and reveals, among other data, that the interior of the country explains most of the rebound: in the second quarter of 2025, 85% of the categories grew, compared to 48% in the GBA. Among the most dynamic, non -basic foods, alcohol without alcohol, cleaning products and cosmetics appear. But the long -term comparison shows that recovery barely covers part of the lost terrain.

“We are seeing a rebound, but still with a very depressed consumption in historical terms,” they warn in NiQ.

Channels and Consumer Strategies

The Supermarkets They were reactivated thanks to the aggressive promotions policy And upon return of the First brands (Tier 1). Today, almost a 30% of FMCG billing comes from products on offer. The categories that intensified promotions grew 7% in interannual volume, while those that did not fall 6%.

The own brands stabilized their participation in 14% of the totalwith presence in the 76% of the categories. In parallel, the Traditional channel (Warehouses, kiosks, pharmacies and perfumeries) supports its growth supported by Price brands (Tier 3) and in assorted adjusted to the consumer pocket.

The panorama is less encouraging for self -servicewho continue to lose competitiveness and accumulate more than 1,700 closures since 2019. Instead, the wholesaler Keep growing, especially in Cleaning and cosmeticsand the e-commerce maintains leadership in rhythm of expansion.

Screen capture 2025-08-26 112655

The supermarkets were reactivated thanks to the aggressive promotions policy

The projections for 2026

“The 2025 Argentine consumer comforts his habits in search of value and opportunities,” he explained Solana Alvarez Fourcadedirector of Customer Success of NiQ Argentina. “The promotions are consolidated as a pillar of the modern channel, while the flexibility of the traditional channel and the growth of e-commerce mark the way forward.”

With the most stable inflation, NIQ provides that the promotional dynamics will remain decisivewhile the traditional and the wholesaler They will be key to sustaining recovery.

Source: Ambito