Due to the volatility of fees, the credit retraction and the stagnation/fall of wages, new lean data is expected for the September collection.

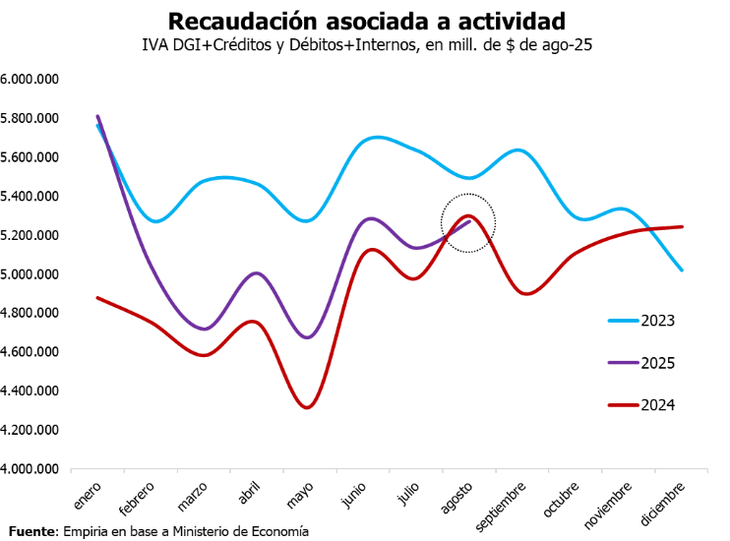

The collection associated with economic activity scored its first 2025 drop in August. In this way, the “monetary squeeze” implemented since July also yields its first impacts on the fiscal result, the main battle knight of the government.

The content you want to access is exclusive to subscribers.

This was reflected by the consultant Empiriadirected by Hernán Lacunza, who knew how to be the last Minister of Economy of the Government of Mauricio Macri, by grouping the income for VAT, the tax on credits and debits, and internal taxes. “The collection associated with the activity fell in August for the first time in 2025. The chosen strategy of nominal stability with high rates, at the expense of the activity, begins to hit the heart of the program: the fiscal anchor“He said Bautista SantamarinaEntity economist.

Image

Internal taxes fell 7.1% real in the accumulated 2025

According to the calculations of Nadin Argañaraz, director of the Argentine Institute of Fiscal Analysis (Iaraf), so far this year Collection for co -participated internal taxes contracted 7.1% compared to the same period of 2024. In parallel, VAT collection rose a slight 2.6% and in credits and debit an increase of 7.4% was observed.

It should be remembered that in July the government modified its monetary policy, which now has as its primary objective to control (and dry) the amount of pesos of the economy. The countercara is the Volatility generated in interest rates, which stops consumption and investment decisionsthus affecting an activity that already has a certain roof due to low wages.

The proceeds in a month usually reflect more what happened with the activity the previous month. Therefore, It is expected that this deterioration will be deepened in the next fiscal balance.

Lower retention income significantly affected the fiscal result of August

In aggregate terms, the National State raised 2.4% less than a year ago. This happened fundamentally by the elimination of the country tax and a collapse of 32% in retention income. “The advancement of exports between February and June 2025 to take advantage of the reduction of aliquots (at that time transitory) and the subsequent definitive reduction of the aliquots (Decree 38/2025) explain the fall in the collection of export rights,” they detailed from the LCG consultant.

Regarding the impact of economic activity, the LCG predicted for the coming months that “consumption -related taxes would remain stable without contributing too much to general collection.”

Source: Ambito