As of October and in two stages, Arba will apply retentions of gross income in virtual wallets, such as Mercado Pago and Uualá, to equate them with the banks.

The collection agency of the province of Buenos Aires (Arba) announced that As of October 1, gross income will begin to be discounted on virtual wallets. The measure will impact applications widely used as Mercado Pago, Ulá and other digital payment platforms. The change was established by regulatory resolution 25/2025 and will be implemented Through the SIRUPA SYSTEMa scheme that already operates in about twenty jurisdictions of the country. The decision seeks unify criteria and give a similar treatment to all means of payment.

The content you want to access is exclusive to subscribers.

However, the announcement generates doubts among users of virtual walletstaxpayers and specialists, who warn about possible complications for small and medium enterprises that could accumulate balances in favor to recover.

A new Arba taxes?

The official answer is clear: It is not an additional taxbut the application of retentions of gross income to money movements in virtual accounts. That is, the same criteria that already governs for bank accounts, now moves to digital platforms.

Arba Expiration.jpg

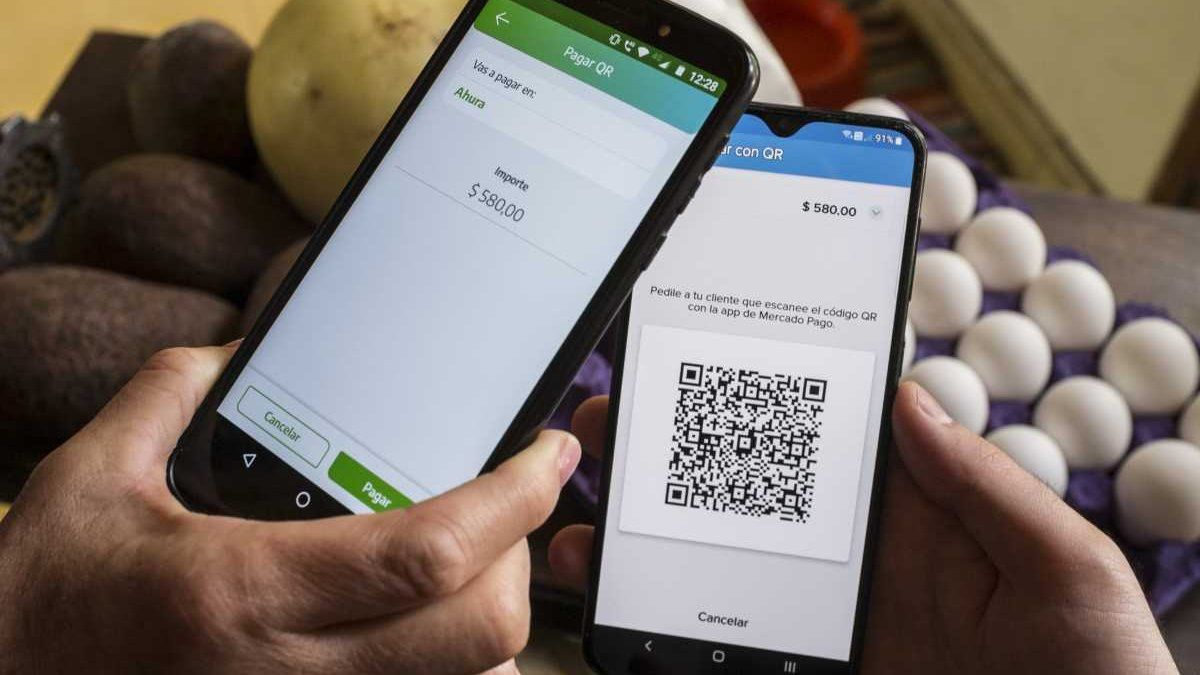

As of October, Arba will discount gross income in operations with virtual wallets.

The measure will enter into force in two stages. From the 1 of Octube must act as collection agents already registered PSPs in the arbitration commission of the multilateral agreement. Meanwhile, from November 1, those suppliers that meet the planned conditions will be addedeven if they do not appear in that initial list.

The scheme reaches deposits in pesos, foreign currencies (with the exception of the US dollar), as well as values or instruments with purchasing power similar to legal tender money. Not all activities are included: they are exempt, for example, operations related to authorized lotteries, tobacco or marketing of livestock products.

Payments with digital wallet.jpg

21% of the expenditure in electronic commerce in the region was made through payments with virtual wallets.

One of the most noise points is the possibility that companies accumulate balances in favor of recoveringsomething that already happens with the Sircreb bank regime. Faced with this concern, from the Buenos Aires administration they noticed that The maximum amount to access the express return was extended to $ 3.5 million of fiscal credits via online, a relief that would benefit more than 95% of taxpayers with balances in favor.

In practice, the announcement means that The movements in digital wallets will be under the magnifying glass of Arba, in the same way as banks.

Source: Ambito