After the electoral setback of the Government in the legislative elections of the province of Buenos Aires, The dollar accelerated the bullish dynamics Started in July. While this can negatively impact inflation, it will contrast it is that corrected part of the exchange delay accumulated during the management of Javier Milei, although it is still below the historical average of the post -convertibility.

This Tuesday, September 10, The official wholesale exchange rate closed at $ 1,423.50. Thus, the actual multilateral exchange rate (ITCRM), which compares the price of the dollar in Argentina with that of its main shopping partners, culminated the day in its higher level since March 2024.

Thus, according to the calculations made by Scopethe “green ticket” value reversed about 60% of the appreciation which had accumulated between January last year, Pico de la eraii ($ 1,877 at today’s prices), and January of this year ($ 127).

“Until a few months ago many economists argued that the exchange rate was late and was unsustainable. We thought the Argentine economy needed a higher level. Today it is no longer evident that you need a higher level“He said in dialogue with this media Joaquín Waldmaneconomist and researcher at the Center for Economy and Society Studies (CEDES).

For its part, the economist Andrés Salinas He argued that the exchange delay ceased to be a problem of great magnitude, but warned that the proximity of the October national elections can lead to the government to dedicate greater efforts to contain the price, thus producing new setbacks.

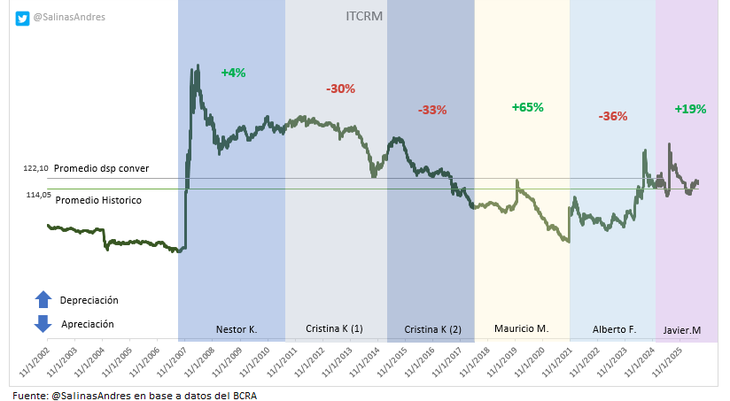

Despite correction, the official dollar remains below the average post convertibility

However, the dollar today remains 17.4% below the average post convertibility That, at current prices, is approximately $ 1,724. From the end of “one by one”, two periods of some months can be identified with a price of the dollar similar to today: the one from May 2012 to May 2013 ($ 1,437), and the one from December from 2021 to April 2022 ($ 1,435).

Image

“With this level, in 2013 we had current account deficit, so something more correction may be missing“Waldman remarked. Indeed, in the first period mentioned, the accumulated current account of current account was -U $ 2,473 million. Subsequently, the negative result grew AU $ S13.211 million between June 2013 and January 2014, compared to the progressive exchange delay, partially corrected with the depreciation implemented by the then Minister of Economy and today Bonaerense governor, Axel Kicillof.

In the second period of time cited, the currency deficit was -U $ S229 million, although it is worth remembering that it was an atypical moment due to the exit of the Covid -19 pandemic (which implied less exit of dollars per tourism), which joined a good export performance for the price rise unleashed with the war in Ukraine.

In addition, Compared to the average of all governments from 2003 onwards, the dollar today is only higher than the second term of Cristina Fernández (+1.9%). On the contrary, there is 37.2% behind Néstor Kirchner’s average, -26.2% versus Cristina’s first government, -4.8% in relation to Alberto Fernández and -1.7% compared to Mauricio Macri.

Image

Dollar today: Is the price for the Argentine economy appropriate?

In this context, economists discuss whether the exchange rate is at the level that the economy needs to avoid deepening the strangulation that external accounts have been suffering since the middle of last year. In this regard, Salinas stressed as positive the little transfer to inflation that the dollar increases are having, which helps to avoid a rapid loss of competitivenessas happened at the beginning of libertarian management.

However, he clarified that the debate about whether the currency is late or not, “depends on whoever you ask.” “If you are looking for price stability, you may see this level as reasonable, but if you are part of a productive sector that competes globally, you may feel that it lacks an adjustment“He deepened.

More taxative was the economist Federico Glustein. “I consider that the price is cheap if the demand still with stocks for companies is greater than $ 1,400 and thinking about the low fire of the BCRA and the Treasury, which cancels any efficient intervention that allows to sustain for an extensive time that desired value. Going to the most technical point, It should be at a value closer to $ 1,480, although the productive sectors demand a value of $ 1,700“He said.

Within this framework, it remains to see if the government chooses to insist on its strategy of using exchange anchor as a fundamental tool to contain inflation, or if you choose to validate controlled adjustments, more taking into account the little “Pass-Through”. In any case, the accumulation of reserves (or at least their maintenance) and the effect of the official discourse on expectations will be fundamental to avoid a run that generates an over reaction of the exchange rate, bringing it to an excessively high level that, as history marks, always negatively impacts real wages and poverty.

Source: Ambito