Menu

Political long -term crisis: Rating agency FITCH classifies France’s creditworthiness

Categories

Most Read

The Government declared the emergency for frost and hail in productions of Entre Ríos

October 3, 2025

No Comments

Buenos Aires monotributistas enter the single tax system since 2026

October 3, 2025

No Comments

Pension at the age of 63: Who can retire earlier?

October 3, 2025

No Comments

Retired attention! This supermarket offers exclusive discounts to save in October 2025

October 3, 2025

No Comments

Climate protests: Survey: Support for climate protection actions decreases easily

October 3, 2025

No Comments

Latest Posts

This is the bank that pays more interests this Friday, October 3

October 3, 2025

No Comments

October 3, 2025 – 10:56 The banks adjusted the rates of the fixed deadlines in the middle of the new measures of the Central Bank

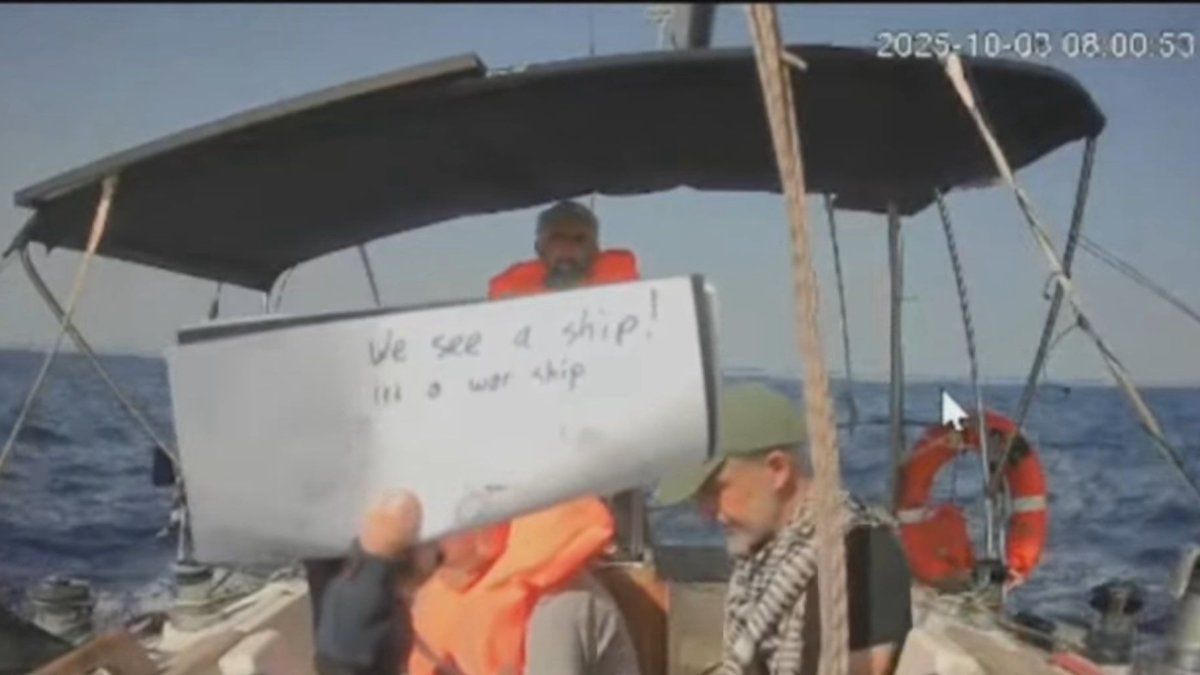

Israel intercepts a new vessel of the humanitarian flotilla and begins to deport its occupants

October 3, 2025

No Comments

The Israeli army intercepted the last ship of the Global Sumud flotilla, an international mission that sought to break the Maritime block over Gaza To

Bitcoin exceeded US $120,000 and cryptocurrencies bet on a “uptober”

October 3, 2025

No Comments

October 3, 2025 – 10:08 The crypto market started with strength and the leading digital currency reached its highest peak since August. The operators trust

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.