Expert forecast

Private individuals buy more real estate – but interest rates are increasing

Copy the current link

Add to the memorial list

Movement on the real estate market: More and more private buyers dare to dream of their own four walls again. But the loan rates are going up.

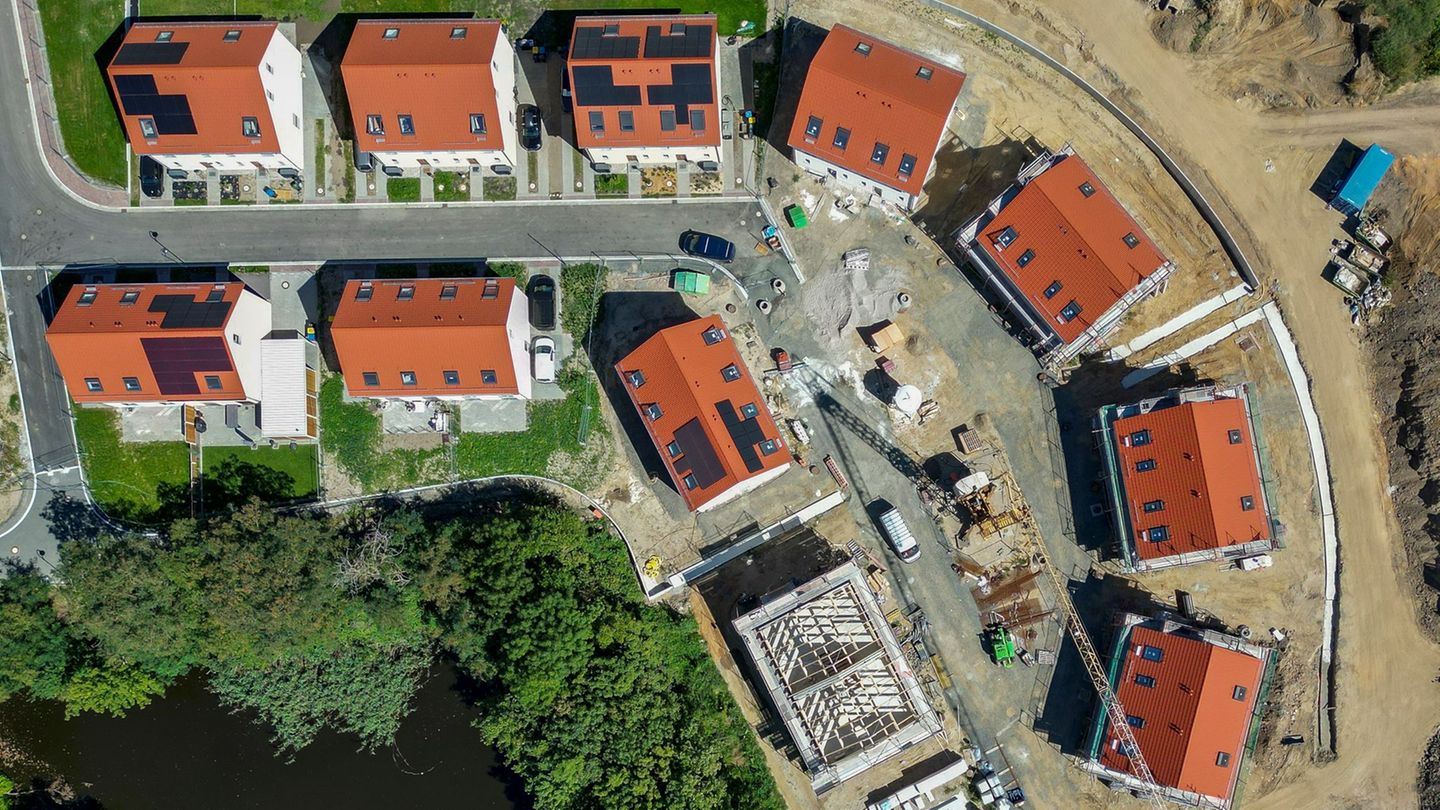

Rising prices, more transactions, more brave buyers: the real estate market in Germany is getting going again. But higher building interest rates put a strain on buyers. Experts expect the four percent mark to be reached soon.

The Hamburg Gewos Institute for City, Regional and Living Research expects significant more purchases of apartments, homes and building land in 2025. “The retention of buying on the German real estate market gradually dissolves, especially private buyers return to the market,” writes Gewos-Immobilien expert Sebastian Wunsch.

Trust in buyers grows

Specifically, the institute expects the number of residential real estate to be purchased to around 656,000 this year-an increase of a good 14 percent compared to 2024. This is shown by a study that is available to the German Press Agency and is based on an analysis of completed purchase contracts.

Sales with homes, condominiums, multi -family houses and residential lands are likely to increase by 18 percent to around 221 billion euros, after around 188 billion euros last year. The real estate market will continue to recover from its setback from 2022 when rising interest rates ended the boom and fell prices.

In potential buyers, trust is growing to be able to manage real estate financing, says Wünder. In addition, some people gave way to residential property because of their high rents.

At least in the case of homes and for condominiums in the inventory, the pre -crisis level of 2021 should be exceeded, according to the forecast. The first half of the year was severe, so that in 2025 it was expected to increase around 13 percent with an increase in purchases. In the case of building land and new apartments, on the other hand, there are even more than 40 percent below the pre -crisis level.

Soon four percent of Bauzin?

However, buyers tend to be increasing loan interest. According to the FMH financial advice, around 3.7 percent have recently been due for ten years of real estate loans. It was only 3.3 percent twelve months ago.

FMH founder Max Herbst believes an increase to 4 percent by the end of the year. He points out that the construction interest is not dependent on the sunken key interest rates of the ECB, but on the return of ten -year -old federal bonds. And because of the economic and increasing public debt, this could increase: “It depends on whether investors Germany are trusting the economic turn that the Federal Republic demands trust or increasing risk premiums.”

Prices for real estate still moderate

Since buyers often finance high sums by loan, even small interest rates can be expensive. Autumn does not believe that relaxation on the real estate market ends so quickly. “In 2022, construction interest rates rose from one to 3.3 percent in six months.” There is no such increase now.

Potential buyers also have more selection again and benefited from somewhat lower prices, says Gewos expert wish. The current price level for existing apartments is 6 percent below the record from the last real estate boom, at home, 7 percent.

Dpa

EPP

Source: Stern