Amid the financial tension and the cooling of the product economy, consumers continue without recovering trust. So far this year accumulates a 13.5%drop.

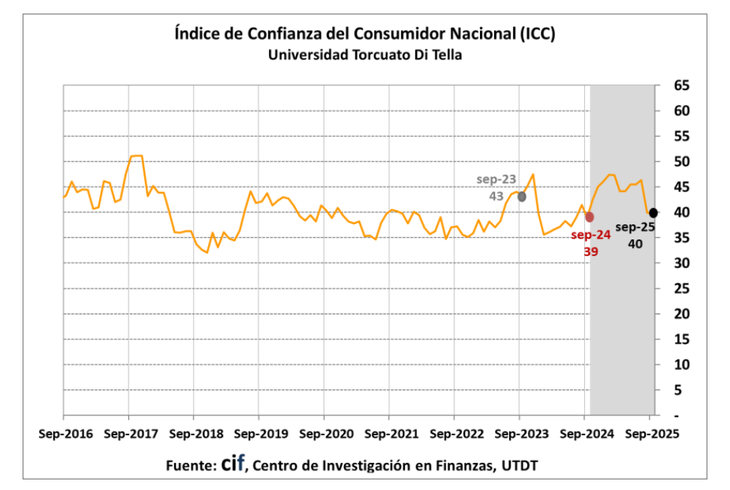

Amid the exchange tension and the cooling of the economy, the consumer trust its skid continues: another 0.33% fell in September in the monthly measurement and is located in the 39.81, 2.08% above the value of September 2024 and accumulates a decline of the 13.5% Since December 2024. It is worth remembering that in August the index scored its greatest monthly fall since December 2023 and after this setback in GBA, the decline continued, while CABA recovered and inside the country there was a more pronounced decrease.

The content you want to access is exclusive to subscribers.

During August, the private consumption presented a monthly fall of 3.2%according to the measurement of the Business Faculty of the University of Palermo (UP). For its part, in comparison with the value of the same month of the previous year, the indicator remains in positive terrain, although it showed a slowdown in the growth rate (+5.5% interannual).

Amid the financial tension and the cooling of the product economy, among others, of the increase of interest rates, the consultants forward They cut their economic growth projections For this 2025, warning that the high point of the activity was in February: they provide an increase in GDP between 3.6% and 4%continuing as the most optimistic of the REM, which was located in the 4.4% In your latest report.

The salary level continues on a very low threshold, with the registered private falling a 0.6% real from the assumption of Javier Milei, while the Average public salaries lost 14.3% from November 2023 to June 2025. In this way, income still does not observe improvements during the libertarian administration.

“Despite the strong slowdown in inflation, the acceptance of a very demanding salary pattern – between 1% and 1.5% – prevents the recovery of real salary”highlight from CP Consultants.

Consumer trust

In regional terms, the consumer confidence index (ICC) showed disparate results: in CABA there was a 9.58% increase compared to August and 4.74% year -on -year; In the GBA, on the other hand, the index fell 0.84% in the month and is 1.93% below September 2024; And inside it presented a decrease of 3.73% monthly, although in the year -on comparison there is a rise of 7.07%.

Analyzing by income level, in the Low income homes The ICC increased 6.65% In September and is 10.67% above the level of a year ago. On the other hand, among the High income homes The index fell 5.20% compared to August and is 4.02% below in the interannual comparison.

consumer trust

Future expectations rose 6.59% in the month, although 3.34% are maintained below in the interannual comparison. The conditions present retreated 9.83% in the month, but 12.30% are maintained above in the interannual comparison.

Source: Ambito