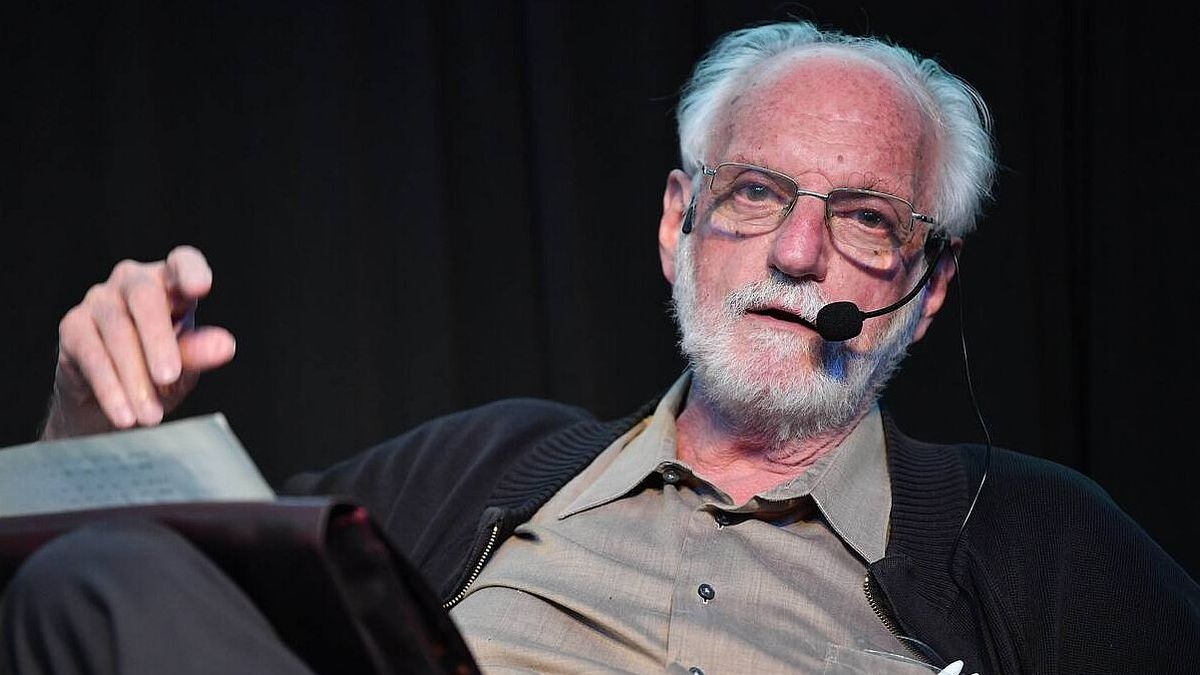

The economic referent Juan Carlos de Pablo again marked agenda with statements that mixed support for exchange policy and harsh warnings on debt and official communication. Amid the financial tension, it was categorical: “God knows,” he said about whether they reach the reserves of the Central Bank to the elections.

The Central Bank sold on Thursday US $ 379 million to try to calm the pressure in the market, in a context of the dollar, bonds in fall and country risk near the 1,500 points. Asked about the effectiveness of that strategy, the economist Juan Carlos de Pablo, one of the most heard by President Javier Milei, questioned that they reach the dollars to contain the foreign currency.

The content you want to access is exclusive to subscribers.

“God knows. I am not a specialist in that. The important thing is that the government said that if the dollar reached the roof, he sold, and sold. Can you imagine that Bausili suddenly says he does not want to sell? When they put it to the test, he sold,” he sold. “he said in dialogue with Radio el Unapape.

Along the same lines, he referred to the official promise to use reservations to defend the exchange band, remembering Luis Caputo’s phrase in the Carajo streaming channel: “We are going to sell to the last dollar on the band’s roof.” “The important thing is that there is a rule and it was fulfilled in the two days when he was tested. I would have surprised me if they had not sold, ”he said.

Darts to Caputo: “It seems foolish”

The economist, however, was lapidary with the Posture of Caputo against the debt maturities of January. While the minister assured that his team works to “guarantee the payment”, by Paul questioned the lack of clear definitions: “I think it’s foolishness, but put a whiskey in the morning. If you don’t know [cómo se va a pagar]he doesn’t have to say it. It is one thing to pay interest and another is to pay the maturities. Ask for efforts to Argentines so that from our pocket we pay the maturities it is not to think. ”

In addition, he recommended concrete alternatives: “You will have to try to put fresh money, fresh bonds or convince the main holders to change some titles; if not, declare the default.”

Nor did he coincide with Javier Milei, who in the national chain said that “the worst has already happened.” For De Pablo, that phrase lacks weight: “The presidents always say that the worst is already happening and the Ministers of Economics say that they will not devalue. That has no value. If the worst is already happening or not, historians will say in 50 years.”

Source: Ambito