Private estimates indicate that they could cost 0.14% of GDP. Although the primary fiscal surplus is not compromised, the sum of expenses imposed by the Congress can affect goals agreed with the IMF after the July Waiver.

The government returned to a kind of “Soy dollar” to hurry the income of up to US $ 7,000 million here as of October 31 with the announcement of zero withholdings to the grains. This tries to ensure the necessary currencies to reassure The rise of the quotation that tests the roof of the bandand see if you can rebuild the currency position to pay in 2026 about US $ 9,000 million maturities.

The content you want to access is exclusive to subscribers.

The cTotal prosecutor of the new government measure will be of the order of 0.23% of the Gross Domestic Product (GDP). What is attributable to 2025 is 0.14% of GDP, A figure that does not put at risk the fiscal result of the national state, but that added to other costs not provided for such as money for universities, funds for the claw or the emergency in disability increases the need for greater cutting cuts.

Beyond that, it’s every time more likely that the Government is directed towards a breach of objectives with the International Monetary Fund (IMF). The goal was that this year the government of Javier Milei Buy about US $ 8,000 million for reservations. That was not achieved, although in reality he did not want to arrive deliberately, they recognize in the Palacio de Finance itself.

In the waiver granted by the agency to Argentina, precisely for not fulfilling the accumulation goal in the July review, It went to a fiscal surplus objective for the 2026 period of 1.6% from 1.3%. AND then in the projections of the Budget sent on Monday, September 15, dropped to 1.5% in the primary and 0.3% in El Financiero. With the expenses and loss of unforeseen collection for the remainder of the year, the fiscal objective cannot be achieved. The measure of removal of retentions will take almost half of the financial surplus planned for this year.

According to data from ARK In the first 8 months of the year the withholdings raised $ 5.8 billion, which gives an average of $ 720,000 million per month, although with marked differences. In August, just from $ 400,000, while in June there were $ 1.2 billion and in July $ 1.1 billion.

How much does the Government cost the elimination of withholdings

Iaraf

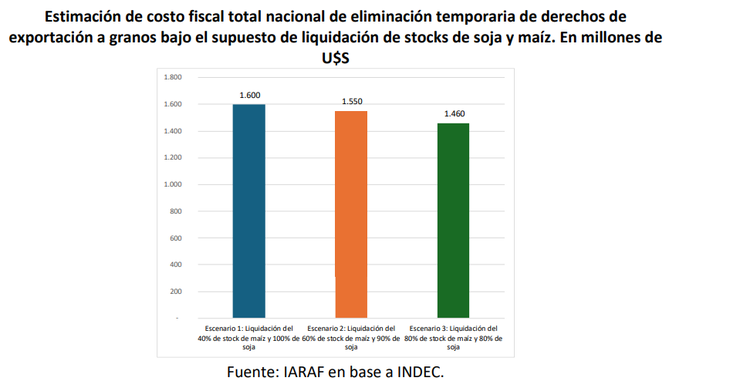

The Iaraf imagined three possible scenarios:

- 40% settlement of the corn stock and 100% of the soy stock

- 60% corn and 90% soybeans

- 80% of the corn stock and 80% of soybeans.

“In terms of GDP, the direct cost ranges from 0.25% of GDP to 0.28% of GDP,” The report says. The study indicates that “for the national government, if the possible increase in collection of the income tax and its distribution after co -participation to nation (approximately 8% of the reduction of export rights) is considered, it is reduced and reducedl Direct fiscal cost to 0.26% of GDP in scenario 1, at 0.24% on stage 2 and 0.23% in scenario 3 ”.

“Obviously there is a lag, taking into account that the income tax is taxed the following year,” the study clarifies.

On the other hand, it emphasizes that “according to the analysis of the export rights collection flow of the last four months of the 2026 budget, the forecast was lower than the total loss, therefore, andl Net fiscal cost attributable to 2025 is lower. ”

“Specifically, According to our calculations, the direct fiscal cost attributable to the year 2025 would be 0.15% of GDP (approximately US $ 1 billion) and the net of collection of the income tax of 0.14% of GDP. That is, the loss of collection would be equivalent to 46% of the 2025 fiscal surplus that arises from the 2026 budget of 0.3% of GDP, ”says the report.

Source: Ambito