Menu

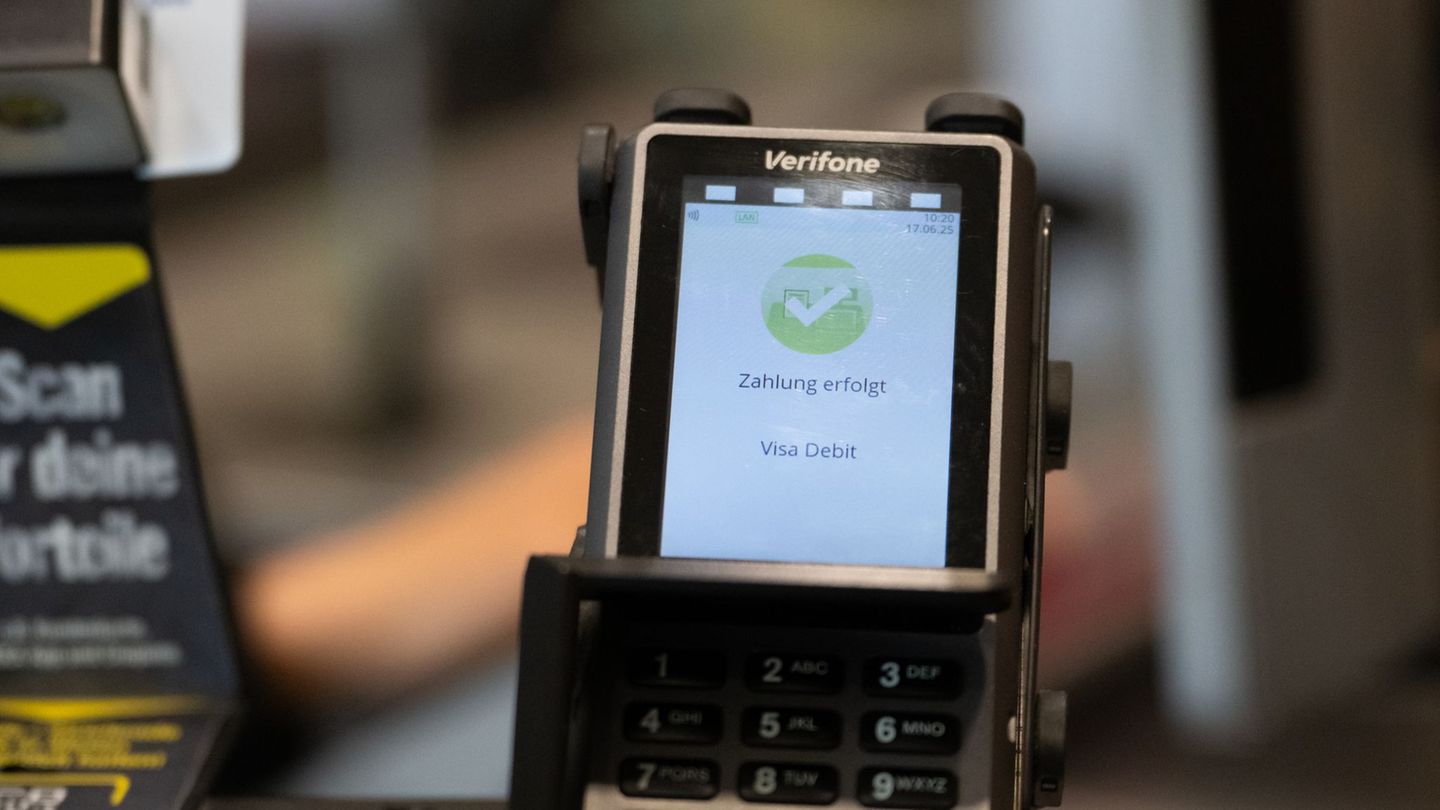

Numbers without cash: growth in electronic payment weakens

Categories

Most Read

Meat increased less than inflation in the last four months: the reasons

October 19, 2025

No Comments

Economist warns of real wage increases at the expense of competitiveness

October 19, 2025

No Comments

Bahn: New boss Evelyn Palla announces major renovations

October 19, 2025

No Comments

Remuneration at stock exchange companies: “No longer a rare species”: female managers earn less

October 19, 2025

No Comments

businessmen distrust that it will reactivate the real economy

October 19, 2025

No Comments

Latest Posts

They will do everything possible to generate panic with the dollar

October 19, 2025

No Comments

The president Javier Mileitrue to his style, was active on social networks in the last few hours. This time he positioned himself on two central

Meat increased less than inflation in the last four months: the reasons

October 19, 2025

No Comments

October 19, 2025 – 1:18 p.m. Meat prices have remained stable in recent months, but consumption remains historically low. Reuters In the last four months,

Selena Gomez and Benny Blanco: First appearance as a married couple in pure elegance

October 19, 2025

No Comments

Lisa HarrisI am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.