This Tuesday the US $ 6,300 million were completed that the agro -exporters were obliged to liquidate in the free market -free market (MLC) for US $ 7,000 million exports without retentions. Since this currency flow was going to be ephemeral, the market expected the government at least to take advantage of its reserves.

However, The treasure barely bought about US $ 2,300 million During this period. On this last day the net acquisition was just US $ 30 million as transcended.

This happened since, despite the extraordinary supply, the demand remained at very high levels because the expectations of devaluation and change of exchange regime are far from dissipating. In that framethe official wholesale exchange rate came to flirt with the $ 1,450, until an alleged official intervention decreased the price to $ 1,380.

“Today was the last day of liquidation of the field and as expected, all the dollars were demanded. However, The most striking thing was that sales orders for US $ 2,200 million in $ 1,380 appeared in the MLC. By volume we estimate that it is the treasure. Although little was operated at that level, the truth is that it is worrying that it has appeared there. We do not find an explanation to make so much effort to buy dollars at $ 1,350 and then sell them at $ 1,380, “he said Nicolás CappellaIEB financial analyst.

Market sources highlighted that today the dollar expectations are disagree in the same way that they were in March. That means that Since the expected devaluation is greater than the rate, all tend to dollarize. “When the dollar floats, the demand for dollars makes it upload until the expected devaluation falls and is arbitrated with the rate, which regains the demand for weights,” said a specialist.

Those who did not go to the MLC, went to the futures or the dollar bonds Linked

In the same tuning, the LCG consultant embodied in a report that “Those who did not hurt in the MLC, demanded coverage via future dollar contracts or the subscription of Linked dollar bonds in the tender last Friday. “

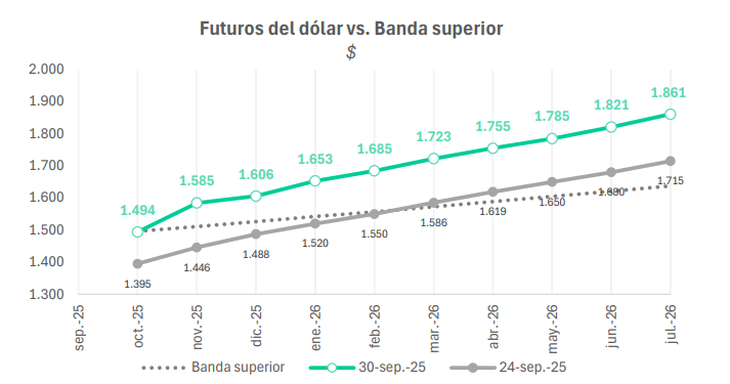

As for futures, open interest grew strong in the last three days. Therefore, as analyzed in a graphic, The expected exchange rate for the last three months of the year is already much more similar to the one that was “held” before the statements of the US Treasury Secretary, Scott Besentthat to the values that were observed in the days after the overwhelming support that the Trump official gave to the libertarian government.

Image

“Besent’s ads last week had collapsed devaluation expectations, assuming a dollar inside the bands until February. Today the market again considers a disarmament of the scheme of exchange bands at the end of October. The expectation of implicit devaluation at one month seen climbed to 7% monthly and exceeds 5% monthly average for the next three months, “LCG said.

Image

Although it is estimated that the BCRA would have taken a profit for the position sold in the September contract at low prices, said surplus is insufficient compared, for example, with the fiscal “red” that meant for the public sector the fleeting elimination of export rights.

“It gives the feeling that this new adventure for visiting low exchange values has not been very beneficial; on the contrary, it could have incorporated noise after the positive messages from the US,” LCG warned.

Regarding the dollar Linked segment, Cappella estimated significant sales of the BCRA in title D31o5. “The treasure posture of US $ 2,200 million in $ 1,380 together with the sale of D31O5. If it was only to influence the price of the September contract of A3, we found too high price to pay. We will see if tomorrow, without the expiration of A3 and with the banks again buying dollars (by regulations they cannot increase their position in hard currency on the last business day of the month), the wall reappears again or if it was something specific for this day and to “cover liquidity potholes”/influence future, “he deepened.

While the expectation of devaluation grows, the government prays Trump

On the other hand, distrust in the exchange scheme is also being reflected in the Jump of the gap between the official wholesale exchange rate and the CCL, which went from 3.4% to 11.7% in just one week. This increase was fed by the restoration of the cross restriction for “human people”, a measure taken with the aim of curbing a “rulo” that was transforming into a relevant factor of the currency demand in the MLC.

The ruling announced a new meeting with Trump for October 14 with the aim of calming expectations, although at the moment it did not take effect. Meanwhile, far from insinuating the end of the band scheme, the government ratifies it day by day and hardens exchange restrictions. It will subtract to see if it is something temporary to the October legislative elections or if the American support allows the useful life of the exchange policy to be extended.

Source: Ambito