At this point, work “Impact of municipal fees on credit” points out that one of the factors “Particularly important is the level and type of tax pressure that tax financial intermediation.” The evidence shows that in a majority of municipalities they apply the tax without legal support.

Table 1

“In practice, many municipal ordinances do not meet these requirements. The more than 2 thousand municipalities regulate the methodology to calculate the rate with total autonomy,” reads work. Situation that “It derives in a huge dispersion of rules that exponentially raise administrative costs and legal insecurity. ”

This anarchic regulatory network forces to oversize the administrative areas of banks, which must invest many resources in interpreting and complying with highly heterogeneous local standards.

To calculate the additional cost of these taxes, information provided by a set of banks was taken, for 51 municipalities in 10 provinces. “These municipalities represent about 30% of the country’s population, ”they indicate.

According to this analysis, it is observed that “The weighted average aliquot, for the municipalities included in the study, is 5.9% of its gross income. ”

This tax pressure “By its magnitude, not only exceeds the limits of a rate and operate as an undercover tax, but sensitively impacts the cost of credit. ”

The other problem is that the “average hides huge differences between jurisdictions. Even similar municipalities apply a very different tax pressure on financial intermediation.”

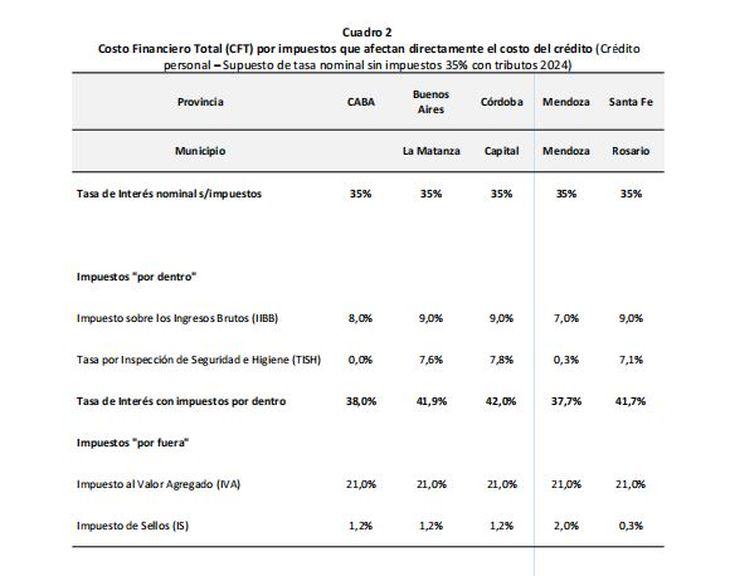

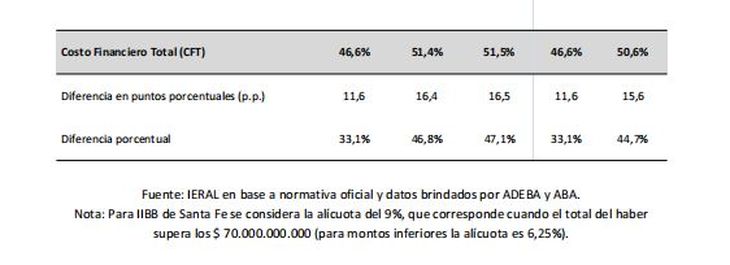

Table 2

Table 3

More pressure

When joining Provincial and municipal taxes that directly tax the creditand under the assumption that each bank charges local taxes at the cost of financing in each locality, “The current rate already exceeds 42%, that is, around 7.5 extra percentage points, or an increase of more than 20% derived from the application of local taxes ”.

The impact On the cost of the most moderate credit, with an increase in the order of 10%, it is in CABA and Mendoza, Because there is no municipal rate in the first case since the municipal rate in Mendoza is much lower than in other cities.

If this situation is incorporated the incidence of VAT, The load is even greater since it is added to local taxes. Under this hypothesis “The increase in the cost of credit as a consequence of the application of taxes in some cities reaches just less than 50%”.

At the other end, locations appear with effective aliquots above average. More significant it turns out that in larger cities located in Buenos Aires, Córdoba and Santa Fe, Effective rates greater than 7% of the gross income of the banks were estimated.

Sectors

Another remarkable feature “are the arbitrary differences in tax pressure between economic sectors.”

In general, The tax pressure on financial intermediation is several times higher than that applied to the rest of the sectors, even great taxpayers with similar contributory capacity to banks.

In many municipalities to The financed activity will apply a tax burden equivalent to more than 7% of gross incomein the rest of the economic activities, which rarely exceed 1%.

An example of how the financing cost is expensive: a loan at an interest rate of 35% by incorporating provincial and municipal taxes that directly tax the credit, the credit, the credit directly, the credit, the credit directly, The active rate exceeds 42%, that is to say, Around 7.5 extra percentage points, or an increase of more than 20% derived from the application of local taxes.

Rates

As an example, rates applications in different jurisdictions, showing the lack of tax equity:

- La Plata: Inspection services aimed at preserving health, safety and hygiene

- San Fernando del Valle de Catamarca, Santa Rosa, Viedma: Enabling, safety, health and hygiene services

- Endurance: Registration and control services of premises; Verify safety, health and hygiene; Control the faithfulness of weights and measures; Inspect and control electrical installations and biosafety conditions; Supervise the exhibition of own advertising; Commercial loyalty and consumer defense

- Rawson, Córdoba: Registration services, qualification, inspection, comptroller, health, safety and hygiene, and any other not paid for a special tax (Rawson, Córdoba).

- Corrientes, Posadas: Registration and control services of activities, preservation Health, safety and hygiene. The supervision of stained glass, advertising and propaganda; Inspection and control of public space occupation. In addition to planning and urban planning, weight and measures control and consumer defense loyalty (

- Paraná, Formosa, Santiago del Estero: Pecuniary benefit corresponding to the registration and control of activities, preservation of health, morality, safety and hygiene, and other services for which special taxes are not foreseen.

- San Salvador de Jujuy, Mendoza, La Rioja, Neuquén. Municipal Comptroller Services to preserve safety, health, hygiene, environmental conditions and any other, not paid by a special tax, which tend to the common good and general well -being of the population

- Salta: Inspection services to preserve safety, health and hygiene, shops, establishments, local and offices, totally or partially affected to the economic exploitation of the taxpayer

- San Luis: Municipal Services of the Comptroller of Health, Safety and Hygiene, Conservation, Maintenance, and other services for the urban system and the conservation of its infrastructure, as well as any other, not paid by a special tax, which tends to the general well -being of the population.

- Santa Fe: Services for: register and control commercial, industrial, scientific, research activities and all lucrative activity; Preserve health, safety and hygiene; Control the faithfulness of weights and measures; Inspect and control electrical installations, engines, machines in general and steam and electric generators; Own stained glass and advertising

- Ushuaia: Control of compliance with the safety and hygiene standards in the premises and/or establishments, in which activities of a commercial and industrial nature, producer of goods and/or services in the jurisdiction of the municipality of Ushuaia are carried out

- San Miguel de Tucumán: For the purposes of the municipality

The work indicates that “the ambiguity and wide variety of services that are argued as consideration for the collection of these municipal rates reveals a disconnection between what the municipality really contributes and the tax burden imposed. This takes legitimacy and legality to the tribute and aggravates the competitive disadvantage of businesses with physical presence.”

Reform

For the objective of generating A tax context that allows credit expansion, there are several reasons why It must be considered urgent and essential to review and rethink the way in which the municipalities tax the financial activity.

The ultimate goal should be to a simpler and more homogeneous scheme between municipalities and that the amount of the framing rate within the legal limits that impose that the rate is the counterpart of a service provided by the municipality and that is clearly identified.

Recent litigation confirms these tensions: The National Bank, and then other entities, have promoted judicial actions in the federal justice questioning the validity of municipal fees.

Although there are still no firm sentences, precautionary and reached agreements that reduce the tax burden in several municipalities have already been issued.

An additional issue is not less important is that under such a scheme the asymmetry that currently generate municipal fees between those who operate with a physical headquarters and those who offer digital financial services would also be corrected.

While those who operate with a physical headquarters support the tax burden that the municipality applies, who operate digitally, by not having a physical headquarters, they completely avoid this tribute, concludes the work of Ieral.

Source: Ambito