This is the understanding signed by the Argentine government and that of the United States on exchange of bank information agreed during the previous management.

The Customs Collection and Control Agency (ARCA) informed the 145,000 Argentines that have bank accounts abroad that it already has the data that He provided the IRS of the United States, The agency that deals with taxes in this country.

The content you want to access is exclusive to subscribers.

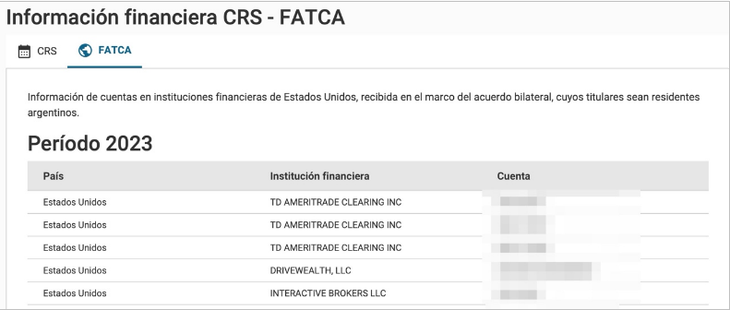

Taxpayers can enter the Arca site with their fiscal code and address the service “OUR PART” where the agency informs the data available to the person.

“The United States completed, last year, with shipment of automatic information of 2023 based on the IgA 1 model agreement signed with Argentina and Arca We have just published part of that information in the service our part that is accessed with fiscal code, “said the CEO of SDC Tax Advisors, Sebastián Domínguez.

Fatca

Domínguez said that “the United States sends certain deposit accounts informationto the extent that the holder of the account is a human person resident in Argentina and have been paid in that more than US $ interest at any time of the year.

In that case, the information offered by IRS is:

-

Name and surname, address and cuit of the Argentine resident holder of the deposit account.

-

Deposit account number.

-

Name and identification number of the US financial institution subject to declare.

-

The gross amount of interest paid in the deposit account.

The information sent by the United States is from January 1, 2023 onwards. This, because the IGA 1 model agreement was not retroactive to previous years.

In the case of other countries, the United States has signed the exchange of information retroactively. You must have sent The information of the year 2024 and Arca should process it to put it available as has made with that of 2023.

Source: Ambito